Bank of Canada interest rate rise spills over into USD

Daily Forex Market Report 26-Jan-2023: Bank of Canada (BoC) interest rate rise spills over into USD

Matching expectations, the Bank of Canada (BoC) raised interest rates by another 25 bps on Wednesday, while announcing the continuation of its quantitative tightening programme to complement an aggressive monetary policy that saw rates rise to 4.5% over the past year.

“If economic developments evolve broadly in line with the (monetary policy report) outlook, Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases,” said the bank, in an indication that the peak rate may now be in.

GBP/CAD rallied 0.7% to 1.660 in response, while EUR/CAD gained 0.35% to 1.461.

Analysts at ING surmised that the loonie’s negative reaction “spilled over into USD, which weakened as markets saw a higher risk that the Fed will follow the BoC with a dovish hike next week”. This staved off any substantial gains on the USD/CAD pair, which remains just below 1.340 for the time being.

Dollar losses have the potential to extend further today- gross domestic product growth for the final quarter of 2022 is expected to come in at 2.6% in this afternoon’s reading, “although with signs in recent months that consumer spending is slowing you might think that there could be considerable downside risks to that estimate”, said chief market analyst Michael Hewson at CMC Markets.

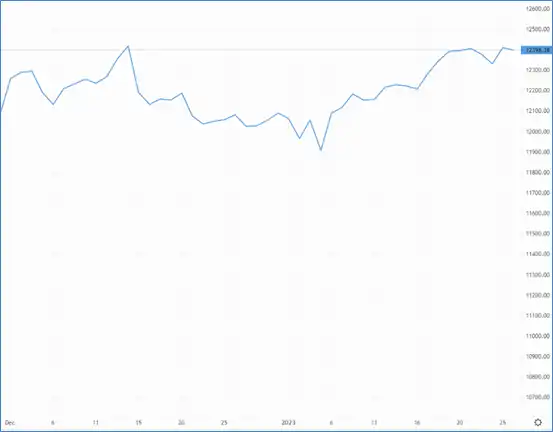

Cable headed lower this morning, but will a soft GDP read cause a reversal? – Source: capital.com

Cable headed lower this morning, but will a soft GDP read cause a reversal? – Source: capital.com

Looking at the major pairs, GBP/USD bounced higher on a weaker dollar, adding 80 pips to 1.241 on Wednesday, but has inched back to 1.239 this morning.

EUR/USD hit another fresh nine-month high of 1.092 as the markets continue to price in another two consecutive 50 bps interest rate hikes by the European Central Bank (ECB).

EUR/GBP was seen higher this morning after dipping 0.35% on Wednesday. The pair was changing hands at 88.04p in this morning’s Asia trading window.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.