BoE Preview – February 2025 Meeting

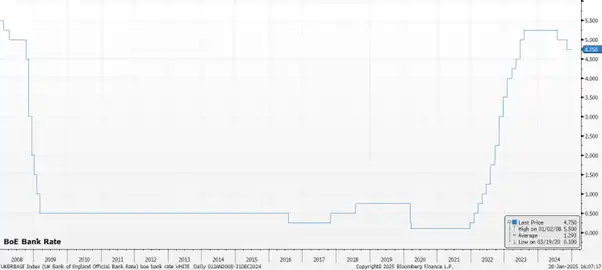

The Bank of England’s Monetary Policy Committee are set to deliver this cycle’s third 25bp Bank Rate cut at the conclusion of the February meeting, lowering the key policy rate to 4.50%, as the gradual policy normalisation process that begun last summer continues.

Money markets, per the GBP OIS curve, assign around a 95% probability to such action, while also fully pricing another 25bp cut in June, and around 72bp of easing in total by the end of the year.

The decision to deliver another rate cut, though, is unlikely to be a unanimous one. While three policymakers – Ramsden, Dhingra, and Taylor – dissented in favour of a 25bp cut in December, when Bank Rate was held steady, they are likely to be joined by Governor Bailey, Deputies Breeden and Lombardelli, as well as Chief Economist Pill, in that dovish view this time around. Uncertainty around the vote split comes from the MPC’s hawks, external members Greene and Mann, whose votes will determine whether the February cut is delivered via a 7-2 or an 8-1 margin. A unanimous decision seems highly unlikely.

Accompanying the 25bp cut is likely to be policy guidance that, by and large, should reflect that used since the easing cycle begun last summer. As such, the statement should repeat a focus on signs of inflation persistence when determining the timing of future rate cuts, while maintaining that a “gradual” approach to removing policy restriction remains an appropriate one.

Meanwhile, as is typical, the February MPC meeting will bring with it an update to the Bank’s economic forecasts. Significant revisions, though, to those issued last November seem unlikely, as the impact of October’s Budget remains highly uncertain.

In any case, recent data paints a mixed picture. While services CPI slowed to 4.4% YoY in December, below the Bank’s forecast, this was largely driven by statistical quirks, with higher energy prices, and unfavourable base effects likely to push headline inflation back towards 3% YoY by the middle of the year, before price pressures fade once more.

The labour market also continues to send rather mixed signals, though does appear to slowly but surely be loosening. Unemployment rose to 4.4% in the three months to November, a 6-month high, though concerns over the accuracy of the ONS’ Labour Force Survey persist and likely leave policymakers placing relatively little weight on this information.

Concurrently, average weekly earnings rose 5.6% YoY, both including and excluding bonuses, a pace that – clearly – is incompatible with a sustained return to the 2% inflation target over the medium-term.

At the post-meeting press conference, Governor Bailey is unlikely to explicitly pre-commit to further policy moves, or the timing of the Bank’s next rate cut. That said, Bailey has previously hinted at the MPC delivering 100bp of cuts this year under their ‘central scenario’.

Such a pace of policy normalisation is broadly consistent with the base case, for the MPC to continue to bring rates back to a neutral level at a predictable pace of 25bp per quarter, for the time being. Risks though, to this view are tilted in a dovish direction, with the possibility of faster rate reductions on the table should prolonged labour market weakness materially impact demand, and accelerate services disinflation.