BoE PREVIEW MARCH 2025 MEETING

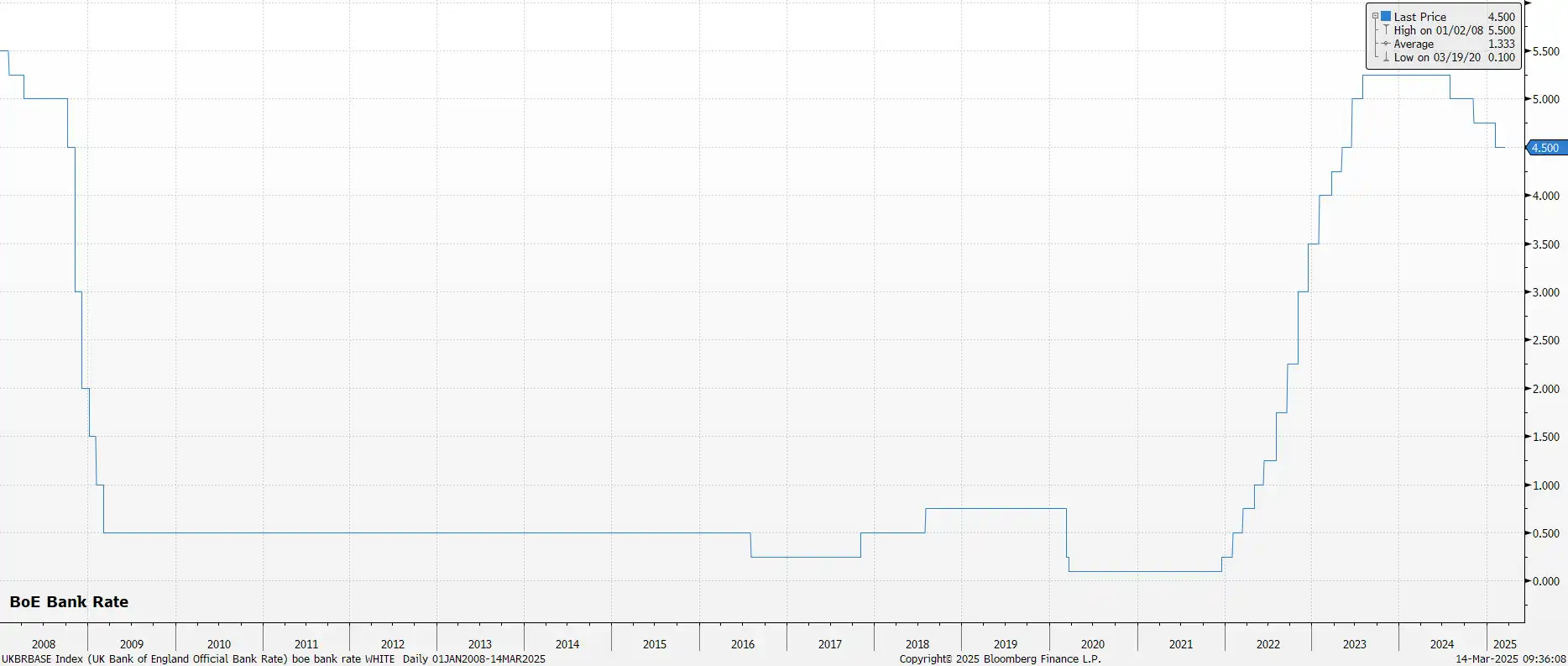

The Bank of England’s Monetary Policy Committee will hold all policy settings steady at the conclusion of the March meeting, maintaining Bank Rate at 4.50%, having delivered a 25bp cut last time out. Money markets, per the GBP OIS curve, price almost no chance of any action.

The decision to hold rates steady will likely come by virtue of an 8-1 vote split. External MPC member Dhingra remains the uber-dove on the Committee, and will likely dissent in favour of another 25bp cut. Despite dissenting for a 50bp cut in February, fellow external member Mann will probably align with the majority this time around. Her previous dissent primarily aimed to signal the need for forceful policy transmission rather than indicating her preferred future path.

Meanwhile, the accompanying policy statement should largely mirror February's, emphasising the "gradual and careful" approach to removing restriction. The MPC will likely reiterate that policy must "remain restrictive for sufficiently long" to mitigate persistent inflation risks, while maintaining a meeting-by-meeting approach to future decisions.

In fact, the MPC are likely to be relatively content with current market pricing, which foresees two further 25bp cuts this year, and are unlikely to want to ʻrock the boat’ too much in this regard.

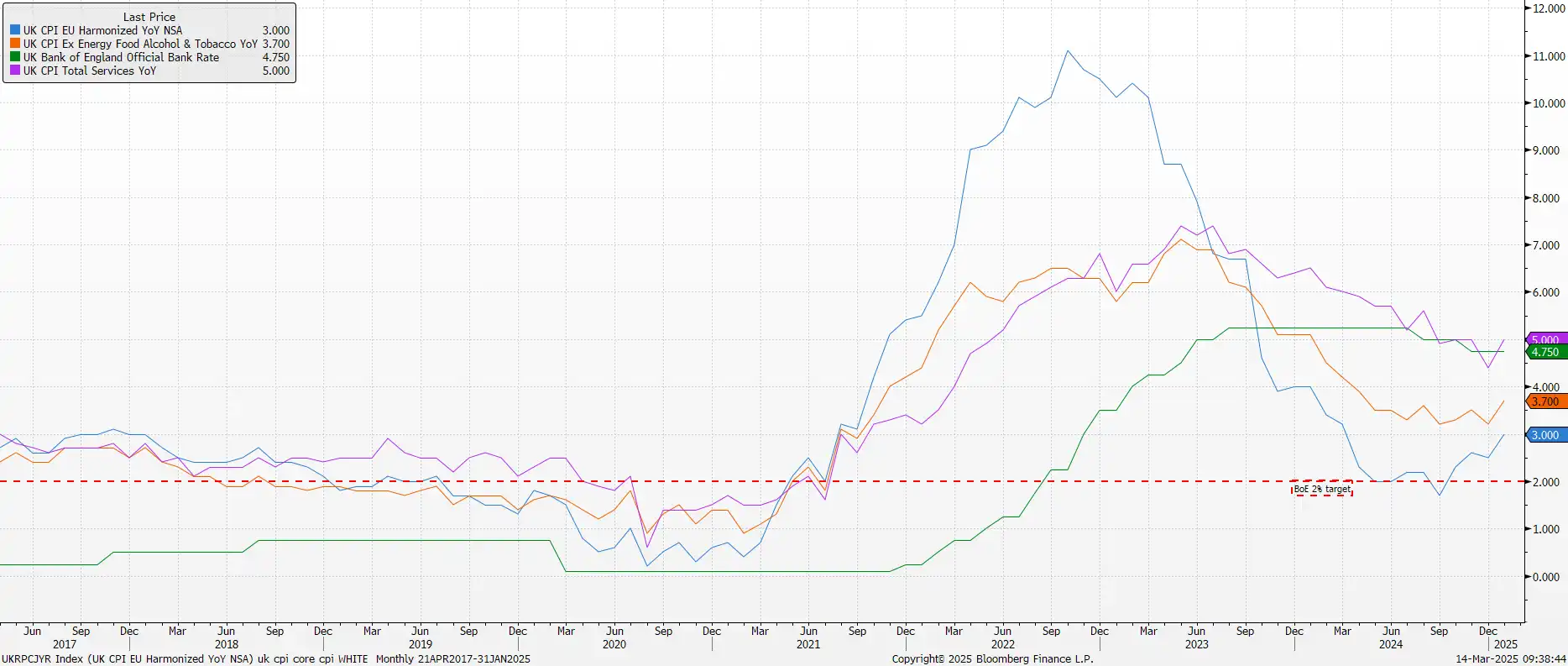

In any case, January's inflation data disappointed policymakers, with headline CPI at 3.0% YoY—the fastest since March 2024 and 0.2pp above the Bank's February forecast. Though services CPI was marginally below expectations, at 5.0% YoY, such a pace is hardly worth celebrating, and clearly points to underlying price pressures remaining persistent.

The labour market, meanwhile, remains something of a mixed bag, even accounting for ongoing data quality issues at the ONS. Headline unemployment held steady at 4.4% in the three months to December, though sentiment surveys have indicated weakening employment conditions since then, particularly as hiring plans are scaled back ahead of April’s National Insurance hike.

Earnings growth, however, continues to run at around 6% YoY, both including and excluding bonuses. Such a pace is, obviously, incompatible with a sustainable return to the 2% inflation target over the medium-term.

That said, the most notable shift in the broader economic outlook since the prior meeting has been the rise in protectionist rhetoric, and measures, from the White House. While the UK's services-centric economy may be less affected than other developed markets, these tariffs still pose downside growth risks that policymakers must consider. The uncertainty surrounding US trade policy may be referenced in the MPC statement, though a full impact assessment awaits May's Monetary Policy Report.

Overall, the base case remains three additional 25bp cuts being delivered by year-end, bringing Bank Rate to 3.75%, with those cuts likely coming in conjunction with the release of updated economic forecasts. Risks, though, tilt in a dovish direction, particularly if significant labour market weakening accelerates services disinflation, and reduces the risks of inflation persistence.