Buying Property Abroad in 2024

Buying Property Abroad in 2024: Your Comprehensive Guide to Global Real Estate Opportunities

The international property market in 2024 presents an unprecedented opportunity for investors and lifestyle seekers. Gone are the days when buying property abroad was a distant dream reserved for the wealthy. Today, a combination of technological advancements, flexible international policies, and diverse global markets has democratised international real estate investment.

Best Places to Buy Property in 2024

Comprehensive Market Insights

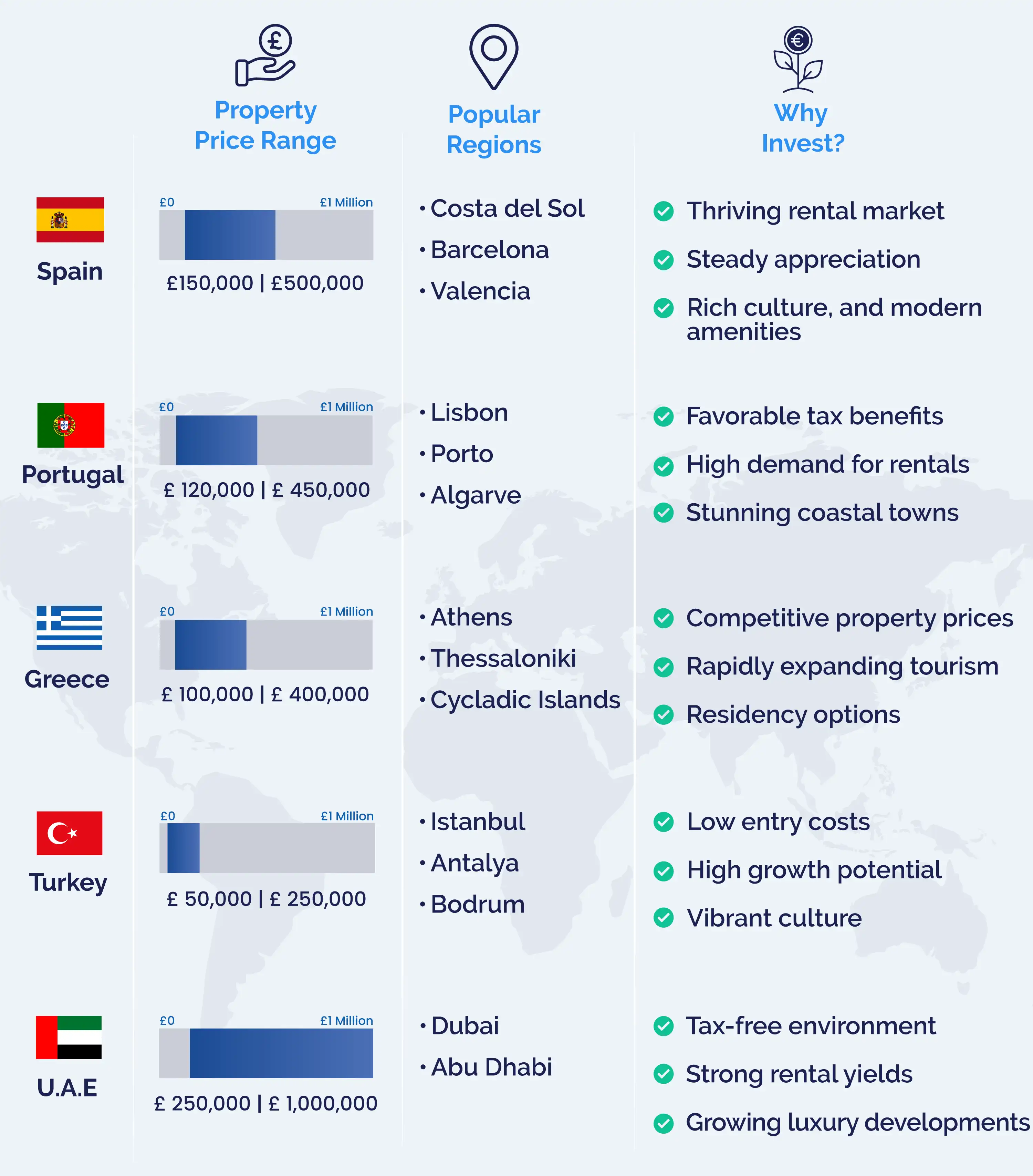

1. Spain: The Mediterranean Dream

- Property Price Range: €150,000 - €500,000

- Popular Regions: Costa del Sol, Barcelona, Valencia

- Why Invest in Spain?

- A thriving rental market fueled by year-round tourism.

- A recovering real estate sector with steady appreciation in key areas.

- An unbeatable combination of warm climate, rich culture, and modern amenities.

- Investment Tip: Focus on properties with sea views or proximity to city centers for higher rental yields.

2. Portugal: A Golden Visa Paradise

- Property Price Range: €120,000 - €450,000

- Popular Regions: Lisbon, Porto, Algarve

- Why Invest in Portugal?

- The Non-Habitual Resident (NHR) tax regime offers favourable tax benefits.

- Stable property market with high demand for rentals.

- Exceptional lifestyle options, from historic cities to stunning coastal towns.

- Investment Tip: Explore properties in secondary cities like Braga or Aveiro for lower prices and strong appreciation potential.

3. Greece: Affordable Luxury in the Aegean

- Property Price Range: €100,000 - €400,000

- Popular Regions: Athens, Thessaloniki, Cycladic Islands

- Why Invest in Greece?

- Competitive property prices compared to other European destinations.

- Rapidly expanding tourism sector boosting rental demand.

- Residency options through property investment programs.

- Investment Tip: Opt for properties in popular tourist islands like Santorini or Mykonos for strong short-term rental income.

4. Turkey: Affordable and Strategic

- Property Price Range: €50,000 - €250,000

- Popular Regions: Istanbul, Antalya, Bodrum

- Why Invest in Turkey?

- Low entry costs and a favourable currency exchange rate.

- Istanbul remains a hub for luxury real estate with high growth potential.

- Vibrant culture and emerging real estate infrastructure.

- Investment Tip: Look for new developments in Istanbul's suburbs for long-term capital appreciation.

5. United Arab Emirates: Modern Luxury Redefined

- Property Price Range: €250,000 - €1,000,000

- Popular Regions: Dubai, Abu Dhabi

- Why Invest in the UAE?

- Tax-free environment and investor-friendly policies.

- Strong rental yields in high-demand areas.

- State-of-the-art infrastructure and growing luxury developments.

- Investment Tip: Focus on properties near Expo City Dubai and other emerging hotspots for future gains.

Financial Planning and Budgeting

Comprehensive Cost Analysis

Total Cost of Ownership Breakdown

Purchase Costs (Initial Investment)

- Property price

- Legal fees (3-5% of property value)

- Property transfer taxes

- Notary and registration expenses

Recurring Expenses

- Annual property taxes

- Maintenance costs

- Insurance

- Potential community or management fees

Currency-Related Costs

- Transaction fees

- Exchange rate margins

- Transfer fees

- Potential hedging costs

Currency Transfer Considerations

Recommended Action: Should get a detailed quote for international property transaction to understand:

- Exact conversion fees

- Transfer fees

- Potential hidden charges

- Comparative exchange rates from multiple providers

Legal and Regulatory Landscape

Key Compliance Areas

Foreign Ownership Regulations

- Country-specific ownership restrictions

- Required documentation

- Potential investment limitations

Tax Implications

- Resident vs. non-resident tax treatments

- Double taxation treaties

- Reporting requirements for foreign property ownership

Professional Support Recommendations

- Bilingual legal representation

- Local real estate experts

- International tax consultants

Currency Exchange and Risk Management Strategies

Advanced Financial Protection Techniques

Investing in international property is an exciting opportunity, but it comes with its own set of risks. Successful investors adopt a well-rounded approach to risk management, ensuring their investments are protected from financial fluctuations, market volatility, and unforeseen challenges. Below, we break down key strategies to safeguard your international property investment.

Currency Risk Mitigation

Currency exchange rate fluctuations can significantly impact your purchase price, ongoing expenses, and overall investment returns. To avoid unnecessary losses, follow these proven strategies:

• Use Forward Contracts:

Forward contracts let you lock in an exchange rate for a future date, protecting you from unfavourable currency fluctuations. If you’re unsure how forward contracts work, get in touch with a reputed currency broker for expert guidance and tailored solutions.

• Maintain Diversified Currency Holdings:

Keeping funds in multiple currencies minimises the risks associated with any single currency's volatility. For seamless transactions, consider opening a multi-currency account with a trusted provider. Get a free quote now to explore the best options for your currency needs.

• Work with Specialist Forex Providers:

Partnering with a forex specialist can save you money on exchange rates and fees compared to traditional banks. They can also provide valuable insights into market trends. Contact us today to discover how a dedicated forex broker can enhance your international property investment.

Market Research

A deep understanding of local property markets and economic conditions is crucial for managing investment risks. Staying informed helps you anticipate changes and adapt your strategy accordingly.

• Continuously Monitor Local Property Markets:

Keep track of property value trends, rental demand, and the competitive landscape in your chosen location. This helps you identify opportunities and avoid overvalued markets.

• Understand Economic and Political Factors:

Stability is key when investing abroad. Assess the country's economic health, political climate, and regulatory environment to ensure your investment is safe and viable in the long term.

• Stay Informed About Regional Development Plans:

Areas with planned infrastructure projects or economic development initiatives often see a surge in property values. Research these plans to capitalise on potential growth hotspots.

Diversification

Avoid putting all your eggs in one basket. Diversifying your investment portfolio across multiple regions and property types can help balance risks and enhance potential returns.

• Consider Investments Across Multiple Regions:

Spreading your investments geographically minimises the impact of localized market downturns. For example, if one market experiences a slump, your other investments may still perform well.

• Balance Risks with Diverse Strategies:

Combine high-growth opportunities with stable, long-term investments to create a well-rounded portfolio. For instance, you might mix rental properties in tourist hotspots with commercial real estate in business districts. Need help crafting the perfect strategy?, get in touch with us for expert guidance and tailored solutions.

• Avoid Concentrating Resources in One Market:

Investing solely in one region or property type can leave you vulnerable to regional economic challenges. Diversification ensures you're not overly reliant on the success of a single market.

Frequently Asked Questions (FAQs)

What is the best way to transfer money for an international property purchase?

The best way to transfer money for an international property purchase is by using a specialist currency broker. Unlike traditional banks, currency brokers offer competitive exchange rates, lower transfer fees, and tools like forward contracts to lock in favourable rates. By avoiding costly exchange margins and ensuring your funds arrive securely and on time, you can save thousands on large transactions. To get the most accurate costs and compare rates, request a detailed quote from a trusted currency provider today.

How do I minimise the risks of fluctuating exchange rates?

Fluctuating exchange rates can significantly affect your property purchase budget. To minimise this risk, consider using tools such as forward contracts to lock in current exchange rates for a future date. Multi-currency accounts can also help you hold funds in different currencies and avoid frequent conversions. For a personalised risk management strategy, open an account with a forex specialist who can guide you through the process.

Are there hidden costs involved in buying property abroad?

Yes, hidden costs can arise when buying property abroad. These may include legal fees, property surveys, renovation expenses, and local taxes. Currency exchange margins can also inflate the cost if you don’t work with a specialist forex broker. Before committing, ensure you have a clear breakdown of all potential costs, including transfer fees and taxes. Reach out to us for a transparent currency transfer quote tailored to your property investment needs.

Can I negotiate property prices in a foreign market?

Negotiating property prices is common in many foreign markets, especially in regions where demand fluctuates seasonally. Understanding the local market dynamics and working with an experienced real estate agent can strengthen your bargaining position. If you’re serious about a property, ensure your funds are ready to transfer quickly to secure a deal. Get in touch to discuss how we can help you streamline your international payment process.

What documents are required to buy property abroad?

The documents required for purchasing property abroad vary by country but typically include proof of identity, tax identification numbers, proof of funds, and any necessary visas or residency permits. Some countries may also require local bank accounts or notary documentation. To avoid delays, consult with legal experts and a currency transfer specialist to ensure compliance and swift financial transactions. Request a free quote to learn more about specific requirements for your chosen location.

Is it better to finance an international property locally or through a foreign lender?

Financing options depend on your financial situation and the property location. Local lenders in the property’s country often provide competitive mortgage rates, but you’ll need to navigate language barriers and local laws. Some investors prefer using home equity loans in their home country for simplicity. Whichever route you choose, currency conversion will likely be a factor. Open an account with us to explore the most cost-effective way to manage international payments.

How do I find the best country to buy property abroad in 2024?

The best country for your investment depends on your goals—whether you’re seeking high rental yields, lifestyle benefits, or capital appreciation. Spain, Portugal, Greece, Turkey, and the UAE are among the top destinations for international property buyers in 2024. Conduct thorough research, visit the locations if possible, and consult with local experts. Don’t forget to secure favourable exchange rates for your funds.

How can I speed up the currency transfer process for an urgent property purchase?

For urgent transactions, choose a currency provider with a fast, efficient transfer system. Specialist brokers often process transfers more quickly than traditional banks while offering better rates. Ensure all documentation is prepared beforehand, and verify the receiving bank details to avoid delays. Open an account with a dedicated currency expert today to ensure your funds are transferred promptly and securely.

Do I need to pay taxes on foreign property investments?

Yes, most countries require property buyers to pay taxes, which may include purchase taxes, annual property taxes, and rental income taxes if you plan to rent out the property. Double taxation treaties between countries can sometimes reduce your tax burden. Always consult an international tax advisor and a currency broker to plan for these expenses effectively. Request a quote now to see how much you can save on tax-related transfers.

How can I ensure secure international property payments?

To ensure secure international property payments, work with a trusted and regulated currency provider. They offer security measures like encrypted transactions and verification protocols. Avoid using unverified platforms or third-party agents. For peace of mind, speak to our team of forex experts today and ensure every step of your property payment is handled with professionalism and care.

For further assistance with currency transfers, financial planning, get in touch with our team. Let us help you make your international property purchase a seamless and cost-effective experience.

Disclaimer: This guide is for informational purposes only and does not constitute financial or legal advice. Always consult professional advisors for guidance tailored to your specific circumstances. Currency Solutions does not endorse or guarantee any strategies or products mentioned and is not responsible for the completeness or accuracy of the information provided.