Currency Forecast - December 2024

Market Outlook (GBP, EUR & USD) – December 2024

GBP

Sterling lost ground in November, as cable fell just over 1% to notch a second straight monthly decline. During the month, the spot slipped marginally below the $1.25 figure, briefly trading to the lowest levels since May, before recovering some of the inter-month declines towards the tail end of November.

Against the EUR, though, sterling proved somewhat more resilient, gaining around 1.6%, as spot rose as high as €1.21, the best levels for the cross since mid-2022, as market participants continue to take a rather dim view of the economic outlook across the channel.

UK-specific developments were somewhat lacking during the last month, as the focus fell more broadly upon President Trump's election and plans for a second term in the White House. Nevertheless, November did see the Bank of England's Monetary Policy Committee deliver this cycle's second 25bp Bank Rate cut, lowering benchmark rates to 4.75%.

That said, the statement accompanying said decision stressed that, while policymakers remain 'date-dependent', a 'gradual' approach to removing policy accommodation will continue to be followed. This has significantly dented the chances of another such cut being delivered before year-end, with the GBP OIS curve discounting a negligible 13% chance of a second straight cut at the December MPC meeting.

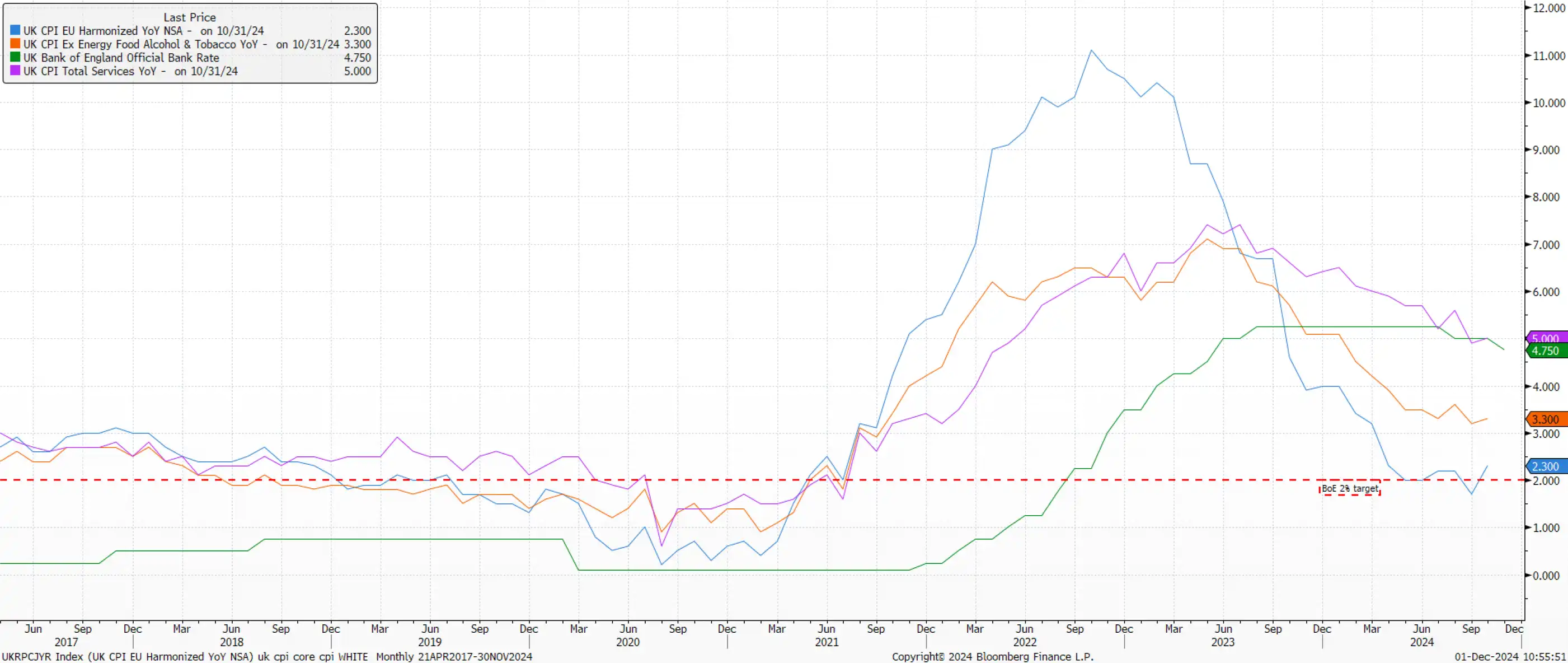

The Bank has good cause to remain cautious, particularly taking into account recent inflationary developments. Headline inflation rose by 2.3% YoY in October, a substantial rise from the 1.7% YoY pace seen a month prior, though an increase that was driven almost entirely by higher consumer energy prices. Of more concern to policymakers is likely to be continued signs of inflation persistence, as shown by core CPI (ex-food & energy) rising by 3.3% YoY and by services CPI rising 5.0% YoY, both metrics that are clearly incompatible with a sustainable return to the 2% inflation aim.

Consequently, it seems unlikely that the MPC will deliver another Bank Rate cut until next February, a meeting which coincides with the release of updated economic projections. Unless significant progress in stamping out persistent price pressures is made over the winter, however, the chances of the 'Old Lady' quickening the pace of policy easing in H1 25 are relatively slim.

Consequently, it seems unlikely that the MPC will deliver another Bank Rate cut until next February, a meeting which coincides with the release of updated economic projections. Unless significant progress in stamping out persistent price pressures is made over the winter, however, the chances of the 'Old Lady' quickening the pace of policy easing in H1 25 are relatively slim.

Consequently, it seems unlikely that the MPC will deliver another Bank Rate cut until next February, a meeting which coincides with the release of updated economic projections. Unless significant progress in stamping out persistent price pressures is made over the winter, however, the chances of the 'Old Lady' quickening the pace of policy easing in H1 25 are relatively slim.

Ordinarily, one would argue this to be a positive influence on the GBP. However, the BoE's relative hawkishness, compared to the stances adopted by G10 peers, comes as economic growth continues to stumble.

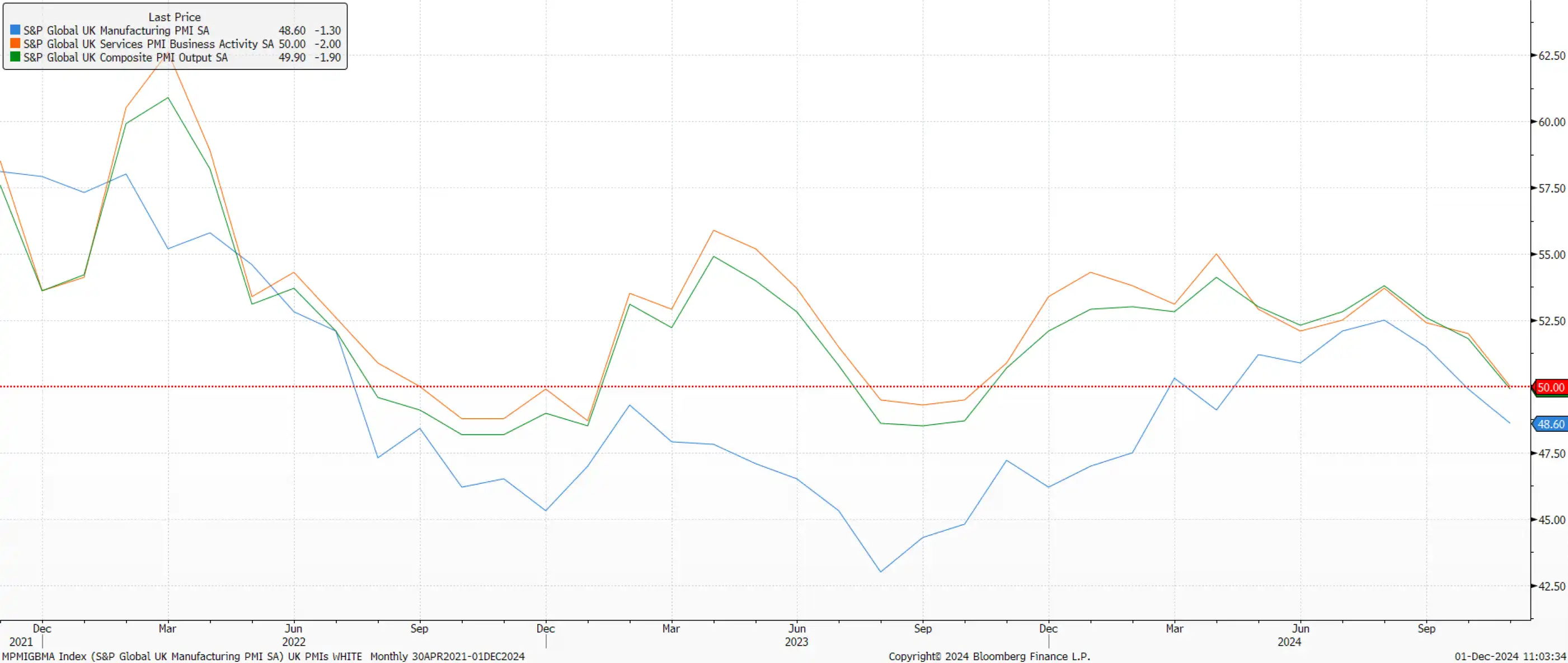

Per the latest PMI surveys, overall economic output contracted for the first time in over a year in November, as the composite PMI gauge fell to 49.9. While the manufacturing sector has been in the doldrums for some time, the services sector now also appears to be facing headwinds, having stagnated last month. Consumer spending also appears to be in rather poor health after retail sales fell by a chunky 0.7% MoM in October.

It would hence appear that the UK economy is on the verge of a 'stagflation-lite' scenario as we move into the winter months while, beyond then, the spring may bring little further by way of good news, as the full impact of the Budget's national insurance hike is felt, and as the threat of a renewed global trade war looms large on the horizon. As a result, the GBP is likely to face continued headwinds over the next couple of quarters despite cable having notched a monthly advance in the last 6 Decembers running.

EUR

The common currency traded poorly in November, losing almost 3% against the greenback, the EUR's biggest one-month decline since last May. Those losses, in turn, took EUR/USD as low as 1.0335, the EUR's weakest point in just over two years.

There remains an incredibly long list of bearish EUR factors for market participants to digest, though a handful stand out more than others as both being major contributors to last month's losses, and as being likely to pose further short-term headwinds.

The domestic political backdrop is perhaps the most important of these, with the bloc's two largest economies – Germany and France – on the verge of political tumult.

In the former, the government has collapsed, after the SPD's coalition partners pulled the plug on their governing agreement, triggering early elections for next February. While the likely result of said elections is unclear, it seems difficult to imagine any party winning an outright majority, meaning that a period of protracted coalition negotiations is on the cards, resulting in effective legislative stasis for the next couple of quarters.

Meanwhile, in France, the government also appears on the verge of collapse, with the National Rally, led by Marine Le Pen, threatening to collapse the government in objection to PM Barnier's plans which include a total €60bln fiscal tightening, in an attempt to tackle a budget deficit on track to balloon north of 6% of GDP, double the EU's supposed limit. Market participants have taken a particularly dim view of this latter situation, with the OAT-Bund spread hitting its widest levels in 12 years.

Of course, this all comes at a time when the bloc's economy remains in dismal shape. Domestically, the manufacturing sector is in what can now only be called a structural depression, while the services sector is faring a little better, with the PMI having fallen to a 10-month low in November.

At the same time, external risks persist. There remains a distinct lack of a significant economic recovery in China, likely to particularly harm the European luxury sector, while there is also a lack of desire from Chinese authorities to provide stimulus that may lift the economy, instead focusing on an approach that serves to prop up financial markets instead. Meanwhile, geopolitical tensions rumble on, both in Ukraine and in the Middle East, with neither situation showing any sign of reaching a resolution in short order.

Furthermore, as if the above wasn't enough for the eurozone to be grappling with, a second Trump Administration is likely to bring a renewed round of tariffs on eurozone goods, posing a further substantial downside risk to growth. Already, Trump has announced tariffs on Mexico, China, and Canada, with the European Union rather conspicuously left off of that list. The bloc, though, is likely braced for significant trade barriers to be imposed in January.

Amid all that, perhaps the EUR's best hope for a recovery in the short-term is that the market reaches, or has already reached, a point of 'peak pessimism', where so much bad news is in the price that there is little fresh downside that can be triggered by new negative headlines. While we appear not to have reached that point just yet, stretched EUR short positioning suggests that we may not be too far away.

USD

The dollar gained ground broadly against most peers in November, notching back-to-back monthly gains for the first time since all the way back in April. Per the Dollar Index (DXY), the greenback last month touched its strongest levels in a couple of years, before profits were taken and the buck pulled back a little into month-end.

Of course, the month was dominated by President Trump's convincing election win, whereby Trump won not only the electoral college, but also all seven of the key swing states, and the national popular vote, something which was not achieved in his first election win back in 2016. Trump's win was met with knee-jerk USD demand, for two principal reasons.

Firstly, and predictably, participants have sought to rotate away from those currencies which are likely to be the target of trade tariffs under the incoming administration. This has caused notable weakness in the MXN, CAD, EUR, and CNH/Y, while also – obviously – sparking USD demand in the process.

Secondly, participants in the FX market have maintained a focus on 'buying growth', and Trump's victory has brought with it expectations that US economic growth will remain resilient, and continue to outperform that of DM peers, in the quarters ahead, as a result of Trump's tax cutting and fiscal stimulus plans.

Clearly, the theme of 'US exceptionalism' is still running true, with the economy having grown by 2.8% on an annualised QoQ basis in the three months to September, and with leading indicators – such as consumer confidence figures – pointing to activity having remained solid in the fourth quarter. A solid pace of consumer spending over the Black Friday and Cyber Monday events will likely also further help to underpin growth.

At the same time, the economy has continued to make further progress back towards the 2% inflation target, remaining on course for a 'soft landing'. Consequently, the FOMC has continued to normalise policy, having delivered a 25bp cut in November and looking set to deliver another such 25bp reduction at the December meeting.

Nevertheless, risks around the FOMC outlook do appear more two-sided heading into 2025. While the outlook this year has either been for easing or a more dovish case of rapid normalisation in the event of unexpected labour market weakness, the outlook for 2025 includes a more hawkish scenario, where Trump's tariffs reintroduce inflationary pressures, leading the FOMC to either pause or end, the easing cycle.

Such an outlook is in contrast to that of other G10 central banks, who seem likely to bring rates back to neutral as soon as possible, and should further help to underpin the greenback over the medium-term, particularly if the labour market remains tight, helping to maintain the current strong pace of consumer spending.

Key Dates

GBP

- 2 – Manufacturing PMI (Nov F)

- 4 – Services PMI (Nov F)

- 13 – GDP (Oct)

- 16 – ‘Flash’ PMIs (Dec)

- 17 – Labour Market Report (Oct)

- 18 – CPI (Nov)

- 19 – BoE Decision

- 20 – Retail Sales (Nov)

- 23 – GDP (Q3 F)

EUR

- 2 – Manufacturing PMI (Nov F), Unemployment Rate (Oct)

- 4 – Services PMI (Nov F), PPI (Oct)

- 5 – Retail Sales (Oct)

- 6 – GDP (Q3 F)

- 12 – ECB Decision

- 16 – ‘Flash’ PMIs (Dec)

- 18 – CPI (Nov F)

USD

- 2 – ISM Manufacturing PMI (Nov)

- 3 – JOLTS Job Openings (Oct)

- 4 – ISM Services PMI (Nov)

- 6 – Labour Market Report (Nov)

- 11 – CPI (Nov)

- 12 – PPI (Nov)

- 17 – Retail Sales (Nov)

- 18 – FOMC Decision

- 19 – GDP (Q3 F)

- 20 – Core PCE (Nov)

- 24 – Durable Goods Orders (Nov)

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.