Currency Forecast - February 2024

January 2023 Review & Themes

Pound

The British pound largely trod water against the dollar in January 2024, while becoming more buoyant versus the euro. The final three months of 2023 for the GBP/USD pair were characterised mainly by the weakening of the dollar as the case seemed stronger for the Federal Reserve to cut rates sooner than the Bank of England. A four-month high of 1.28 was momentarily breached just before the new year, but 2024 has yet to see a return to these levels, starting with a slide to 1.26 as UK manufacturing PMI data came in weaker than expected before sterling found support following better services data.

A pushback above 1.277 was seen in the first half of the month, following strong US jobs at the end of the first week and US consumer price inflation picking up faster than forecast. These developments tempered the previously optimistic hopes of an early US rate cut. A slide to test 1.26 followed stronger-than-expected UK CPI, but despite adding to the case for the Bank of England's continued hawkish stance, lending support to the pound, this proved short lived and the pair crept higher.

GBP/USD closed flat in January – Source: tradingview.com

Moving towards the end of January, the trend has been within a channel of 1.268 and 1.272, with the last day of the month seeing a Federal Reserve decision that only slightly shifted the currency pair out of that band.

Meanwhile, EUR/GBP, having risen from below 0.86 to a peak above 0.87 just after Christmas, has completely reversed the December rally over the last month, passing below 0.86 by the second week, and last week breaking below 0.855 for the first time since early September. This level has proved the bottom of all valleys for the currency pair over the past year, with the 0.84 last experienced in the summer of 2022.

Currency strategists at UBS observed that both Eurozone and UK data have disappointed lately, but contrary to that, PMI data “suggests a divergence in the relative outlook” from businesses, while consumer demand has been noticeably weaker in the UK than Europe.

Euro

Analysts noted that despite Germany’s economic and budget woes, the EUR has been the fourth best-performing G10 currency in the year to date after the USD, GBP and CAD.

That reflects a near 2% gain versus the JPY, with 1%-plus against AUD, NZD and NOK, and not far off that with SEK.

However, as mentioned, versus USD and GBP, the EUR has given back all December’s gains.

The US Dollar Index (DXY) added 1.7% in January – Source: tradingview.com

Furthermore, analysts have noted that in recent sessions EUR/USD has broken below the 200-day simple moving average.

At last week’s European Central Bank meeting, the governing council kept interest rates unchanged. It said "tight financing conditions are dampening demand, and this is helping to push down inflation", with ECB president Christine Lagarde telling reporters that the consensus around the table was that it was premature to discuss rate cuts. "Consensus around the table was that we had to continue to be data dependent," she said.

Dollar

After a chastening month for the US dollar following the Fed’s dovish pivot in December, the greenback has been back in the green in January as hopes for an early cut have dissipated slightly. The dollar index (DXY). having fallen below 101 at the end of the year for the first time in almost six months, regained form and the 103.5 level by mid-month, remaining there since.

The Fed pivot, as policymakers acknowledged economic growth had slowed and inflation eased over the past year, was interpreted by markets as a signal that rate cuts were imminent. At one point, the market was predicting seven rate cuts of 25 basis points each this year, with the first coming in March. However, there has been a steady reversal over the month, with the market’s initial 70% pricing of the chances for a March move falling to 50% last week and roughly 36% on the last day of the month, after the Fed meeting.

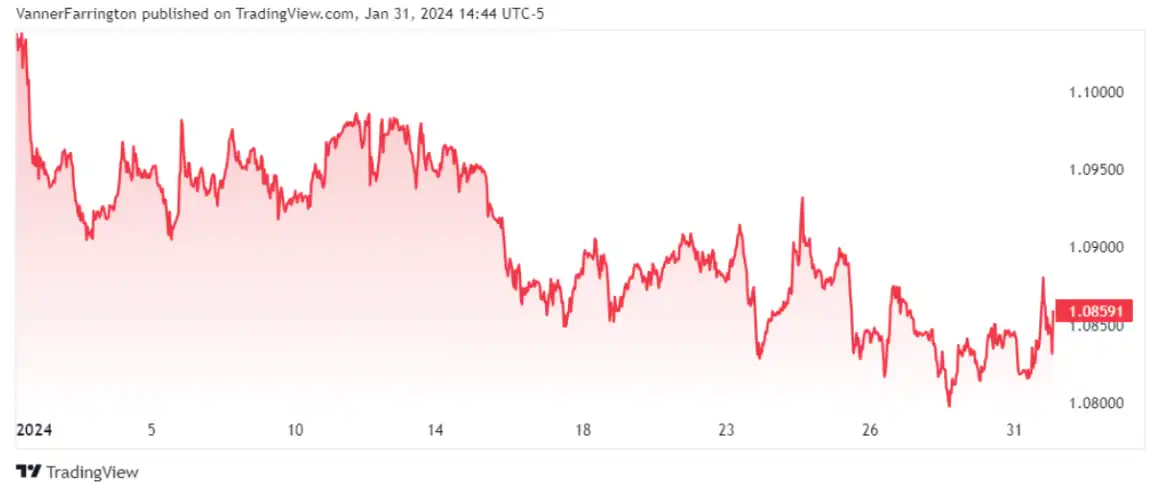

EUR/USD fell 1.6% in January – Source: tradingview.com

EUR/USD touched a five-month high of 1.113 in the post-Christmas week and since then has slowly tumbled 2% over the month and broke below 1.085 in the past week, breaching the 1.080 level on Monday afternoon and Wednesday evening this week. USD made bigger gains, adding over 4% against the Japanese yen, and 3% versus the Aussie and Kiwi dollars and the Norwegian and Swedish krona.

Key Risk Events & Themes

UK

Sterling skewed to the downside: if the UK or the whole world's economy starts to deteriorate, and people get more cautious about taking risks, it could mean bad news for the GBP/USD pair, in favour of the greenback’s safe-haven. At the same time, if the US economy keeps doing better than expected, the Federal Reserve might hold off on cutting rates. This delay could be another tough break for the pound, making it lose more ground against the dollar. This scenario will be scrutinised following the UK and US inflation prints, due on 13 and 14 February respectively.

Political resilience: political uncertainty, regardless of its stripes, is usually bad news for a country’s base currency. Yet hopes are high that instability among the British political class will have a limited downside impact on the pound. There is a sense that a Conservative loss is a foregone conclusion, so any further mayhem in parliament is akin to shouting into the void, with ongoing leadership squabbles being broadly shrugged off by the pound. Furthermore, as RaboBank’s senior FX strategist Jane Foley stated, “the latest rounds of infighting and divides in the Tory party have not undermined the view that Chancellor Hunt is a safe pair of hands.”

House prices: after a period of flux, house prices appear to have stabilised despite sales being down, not helped by persistently high mortgage rates, keeping the cost of buying a house high, even if their price tags are flat year on year. Attention has turned to selling pressure in the housing market, as refinancing starts to ramp up. But, as John Stepek at Bloomberg determined: “As long as the jobs market remains solid, we won’t get the forced sellers, and so we won’t get big falls in prices.” It’ll be worth keeping an eye on the Halifax house price index on the 7th followed by the unemployment print on the 13th.

Eurozone

Germany recession fears: Europe’s largest economy was the weak spot in the latest round of GDP data, falling 0.3% year on year. Unsurprising, this has raised fears of Germany entering a technical recession. It may as well already be, with economic growth seemingly not on the cards in the near term. “The best way to describe the state of the German economy is probably that it is in a shallow recession,” stated UBS analysts. “In fact, the economy remains stuck in the twilight zone between recession and stagnation.” The next round of GDP figures comes on 23 February, when Germany is expected to post another 0.3% quarter-on-quarter decline. In that case, the European powerhouse will, technically, be in recession.

Resolutely long: the recent drop in German inflation, coupled with similar trends in France, has stirred discussions about the European Central Bank (ECB) potentially cutting rates earlier than anticipated. However, the ECB is unlikely to be swayed by these headline figures, with the underlying inflationary pressures, evidenced by the monthly increase in consumer prices, encouraging caution against premature rate cuts. As Jane Foley at RaboBank stated: “It is our view that the ECB will keep policy on hold until it has greater certainty that wage inflation in the Eurozone has moderated.” The result? For now, the market remains “resolutely long” on the euro.

Dollar

Higher for longer: there are no rate decisions on the agenda this month, though the prospect of a ‘higher-for-longer’ rate policy will be a hot topic regardless. While economic and jobs data are trending towards the softer side, whether the trends are strong enough to justify a dovish realignment of the base rate is a matter of debate. Perhaps it’s best to quote Federal Reserve Governor Christopher Waller here: “With economic activity and labour markets in good shape and inflation coming down gradually to 2%, I see no reason to move as quickly or cut as rapidly as in the past.”

Jobs market: although inflation has significantly improved over the past year, the job market continues to be robust, even though, as mentioned above, there has been some softening. Historically, Fed chair Jerome Powell has emphasised the necessity of observing some softening in the labour market before contemplating a loosening of policy. While there's been some softening, it's important to remember that the central bank will likely continue to pay close attention to upcoming jobs data throughout the month.

KEY DATES IN FEBRUARY

United Kingdom

- February 1: Interest rate decision (exp hold at 5.25%)

- February 5: New car sales

- February 6: BRC retail sales monitor

- February 7: Halifax house price index YoY

- February 8: RICS house price balance

- February 13: Unemployment rate

- February 14: Inflation rate YoY

- February 15: GDP data

- February 16: Retail sales YoY

- February 23: Car production YoY; GfK consumer confidence

Eurozone

- February 1: Inflation rate YoY (flash)

- February 5: HCOB Services PMI; HCOB Composite PMI; PPI YoY

- February 6: HCOB Construction PMI; Retail sales YoY; Consumer inflation expectations

- February 14: GDP growth rate; Industrial production YoY

- February 15: Balance of trade

- February 20: Construction output

- February 22: Inflation rate YoY (final); CPI

- February 28: Consumer confidence

United States

- February 1: Initial jobless claims; Global manufacturing PMI

- February 2: Non-farm payrolls; Unemployment rate

- February 5: Global composite PMI; Global services PMI

- February 7: Balance of trade

- February 8: initial jobless claims

- February 12: Consumer inflation expectations

- February 13: Inflation rate YoY; CPI

- February 15: Retail sales YoY; Manufacturing production YoY

- February 16: PPI YoY

- February 21: FOMC minutes

- February 22: Initial jobless claims

- February 26: New home sales

- February 27: House price index YoY

- February 28: Goods price balance; GDP data

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our dedicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2024 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.