Currency Forecast - January 2023

December Review & January Risk Events & Themes

Pound Sterling

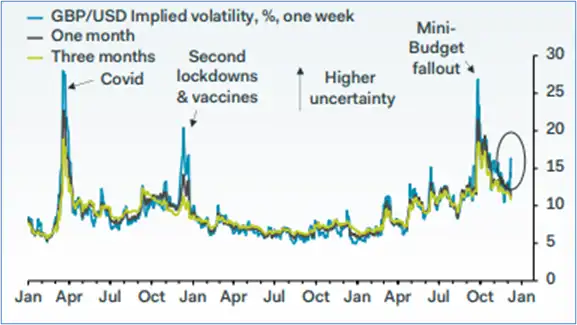

It was far from quiet on the Cable front this December. Quite the contrary in fact. Going by a data assessment from Pantheon Macroeconomics, one-week implied volatility for the first half of the month was much higher than usual.

Don’t get us wrong, GBP/USD volatility was nothing like what we saw following Truss and Kwarteng’s (remember them?) harmful mini-budget, but regardless, the week leading up to the Monetary Policy Committee (MPC)’s interest rate announcement on December 15 was the most volatile pre-rate announcement week for two years.

GBP/USD hit a volatile streak leading up to the MPC’s interest rate decision – Source: Pantheon Macroeconomics

GBP/USD hit a volatile streak leading up to the MPC’s interest rate decision – Source: Pantheon Macroeconomics

Cable ended up gaining around 1.7% leading up to the widely expected 50 bps decision by the Bank of England (BoE), only to close 1.8% lower at 1.219 on the day- the biggest daily dip on the pair since November 3.

Why the dip if the 50 bps hike was expected? It had more to do with the tenuous 6-3 majority, with two MPC members voting to leave rates unchanged despite double-digit inflation.

The pound also contended with a surge on the dollar following a pretty hawkish tone emerging from the US Federal Reserve, even though its own 50 bps rate hike yielded no surprises there.

BoE doves had some justifications on their side, the most obvious being a soft-than-expected inflation reading the day prior. Furthermore, the Nationwide house price index reading on December 1 increased 4.4% year on year (YoY) compared to 7.2% in the previous reading and below market expectations of 5.8%.

But that was little comfort for the hawks. Yes, inflation came in a few notches lower than the market had pencilled in, but 10.7% is still eye-watering no matter which way you cut it.

Cable’s drastic dip in the middle of the month coincided with BoE indecision on interest rate policy – Source: capital.com

Cable’s drastic dip in the middle of the month coincided with BoE indecision on interest rate policy – Source: capital.com

Sterling generally fell out of favour for the rest of the month as investors saw greater value in riskier equities positions (the FTSE 100 rallied hard after the 16th).

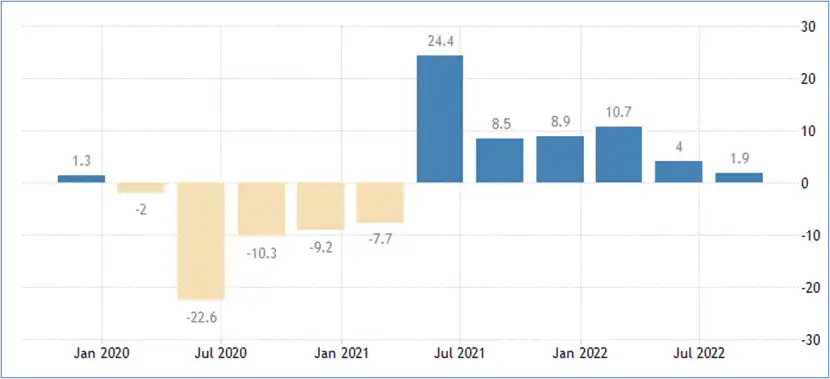

Propelling negative pound sentiment was the gross domestic product (GDP) reading on December 22, with the YoY growth rate coming in at 1.9% compared to a 2.4% forecast and 4% reading in the prior month.

British GDP fell for the third straight quarter – Source: tradingeconomics.com

British GDP fell for the third straight quarter – Source: tradingeconomics.com

For the second half of the month, Sterling lost 3% of ground to the dollar to close the month at 1.205.

During the same period, the pound fell 3.5% against the euro to close at 88.44p and nearly 5% against the Japanese yen to close at 160.52. The latter was largely due to a surprising announcement from the Bank of Japan in which governor Haruhiko Kuroda widened the allowance band around its long-term yield target.

As for UK yields, the 10-year gilt yield increased 19% over the month, from 3.105% to 3.697%. Certainly below the 4.5%+ seen in the September/October mini-budget meltdown, but still historically high.

EURO

The first minor surprise on the Eurozone calendar came on December 7, when GDP figures came in slightly higher than expected. Third-quarter growth of 0.3% beat out 0.2% forecasts, with the most vigorous growth (2.3%) recorded in Ireland. Malta and Cyprus expanded at 1.3%, while contractions in Estonia, Latvia and Slovenia weighed the average down. On a YoY basis, GDP grew 2.3% against market expectations of 2.1%.

Coming as no surprise was the European Central Bank’s decision on December 15 to hike rates by 50 bps, marking a fourth rate increase following two consecutive 75 bps hikes, thus bringing the base rate to 2.5%. The following day brought an inflation reading of 10.1%, slightly hotter than the flat 10% forecasted.

While the UK and US seem to be weighing up the chances of peak inflation, energy costs in the euro area were, and are, an ongoing concern. On top of that, unemployment data showed record lows and accelerated wages.

The euro rallied hard against the pound in response, jumping over 1.5% on the day to close the session at 87.26p. EUR/GBP continued to gain for the rest of the month, eventually closing at 88.46p- a more than 10-week high.

While the pair mellowed out towards the end of the month as traders checked out for the year, further euro upside should be expected when trading volumes pick up, given the inflationary burdens hitting the Eurozone.

EUR/GBP rallies on a consistently hot Eurozone economy – Source: capital.com

EUR/GBP rallies on a consistently hot Eurozone economy – Source: capital.com

Price action against the greenback was substantially more muted given the surge on the US Dollar Index (DXY). Having initially dipped half a percent to 1.056 on the 16th, the EUR/USD pair traded in a sideways fashion for the rest of the month. It was not until the 29th that the pair broke above the 1.060 to 1.061 range to close the year at 1.070.

US Dollar

Considering that the US dollar was one of the few solid investment bets for the better half of 2022, having outperformed against most major indexes and commodity classes, it shouldn’t have come as a surprise when the US Dollar Index (DXY) cooled off quite substantially as the year came to a close.

For the month of December, DXY lost close to 1.2% to end the year at 103.083, but make no mistake- in the wider picture, it was a bumper year for the greenback. Aggressive Federal Reserve rate hikes and associated interest rate differentials meant DXY finished the year over 7% higher, while Cable ended up around 10.5% lower.

Strong euro performance at the tail end of the year helped to cut EUR/USD losses, but ultimately the dollar closed nearly 6% higher for the whole of 2022 to close at 1.070.

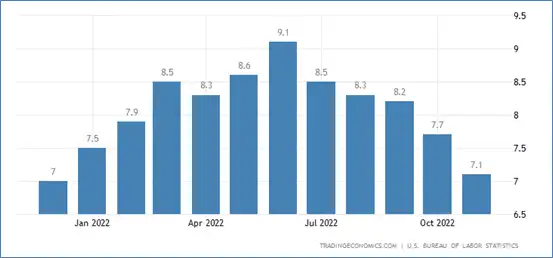

One of the main reasons behind the softening of the dollar was proof that inflation was continuing to ebb. As read on December 13, the annual inflation rate in the US slowed for a fifth straight month to 7.1% in November of 2022, the lowest since December 2021, and below forecasts of 7.3%.

Source: tradingeconomics.com

Source: tradingeconomics.com

As the dollar continued to fall, US treasury bond yield continued to climb as investors demanded a better price for notes, capping the year at 3.88% or 156% higher year on year.

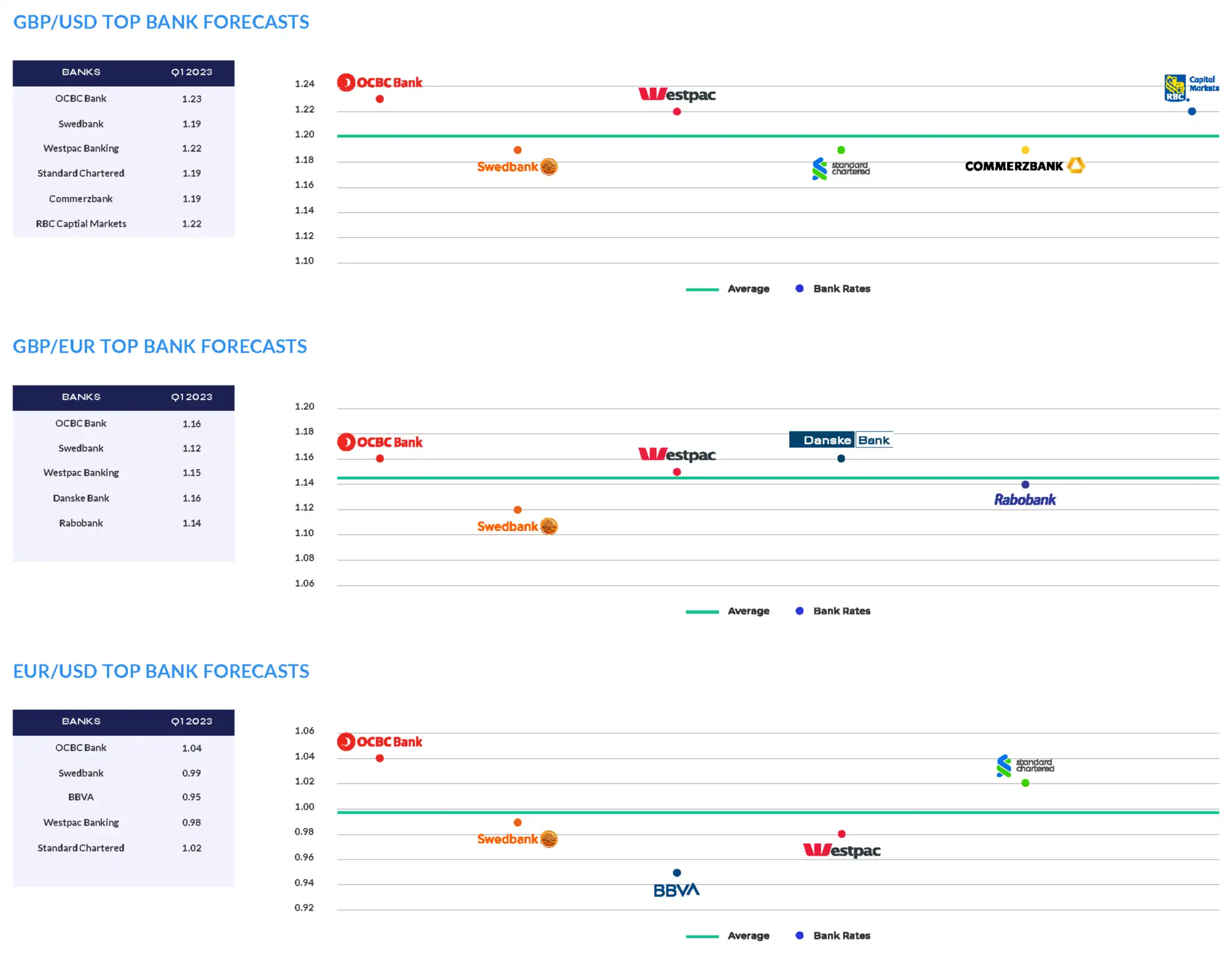

TOP BANK FORECASTS

Download report here

JANUARY RISK EVENTS AND KEY THEMES

UNITED KINGDOM

Rising yields:

While UK gilts cooled off significantly from the September/October rout, they have risen once again throughout December. The question for the bond market is: Who’s going to buy? With equities seeing a surge in investor interest, the government bond market could be under pressure for a while to come.

Easing of rate hikes:

A slowing of inflation encouraged by lower commodities prices and inventory build-up should prove a catalyst for an easing of the Bank of England’s monetary policy. The next MPC meeting isn’t actually scheduled until February, allowing the committee to weigh up a month’s worth of economic data before making a decision. Central bankers as a whole are determined to fight inflation, but don't want to overtighten and crash the economy more than necessary.

Return to risk:

As was witnessed at the tail end of 2022, investors seemed more willing to bet on riskier investments at the expense of the pound. This risk-on environment in the UK meant the FTSE 100 actually ended up being among the best-performing indexes globally. We could see a continuation of this trend in January, given the lack of appetite for government debt.

EURO ZONE

Recession:

DPolicymakers expect the Euro Area economy to contract in the first quarter of 2023, owing to the energy crisis, weakening global economic activity and tighter financing conditions. Overall, the central bank expects GDP growth of 0.5% in 2023 as a whole, followed by 1.9% in 2024 and 1.8% in 2025.

Inflation:

Expect the Eurozone to win the inflation Olympics, as dubious an honour as that is. "The core inflation rate is unlikely to peak until mid-2023 and will only fall slowly thereafter," Commerzbank economist Christoph Weil recently said. "Against this backdrop, the ECB's goal of pushing the inflation rate back to just under 2% on a sustainable basis seems a long way off."

USA

Gross domestic product:

Global GDP is expected to slow down dramatically in 2023, and the US economy will be no different. According to JPMorgan, the monetary policy tightening drag is building and “central banks remain on the march”.

Cooling dollar:

A pause in Federal Reserve tightening could throw cold water on the US dollar (even if dollar strength might be expected across the wider year). Yet according to Credit Suisse, the greenback could remain overvalued for some time to come. “The USD’s safe-haven characteristics proved attractive at a time of deteriorating risk sentiment globally. Both these factors will likely remain in place going into 2023, and we expect the USD to remain largely overvalued throughout 2023,” said the bank.

Yields:

US interest rate strategists reckon treasury bonds will extend their recent rally, resulting in lower yields, lower and a steeper yield curve as 2023 gets under way, though that will be contingent on soft employment data and lower inflation.

KEY DATES IN DECEMBER

United Kingdom

- January 4: Bank of England consumer credit monthly amount (£1bn exp)

- January 5: New car sales

- January 6: Halifax house price index

- January 9: Mortgage rate

- January 13: GDP YoY; Balance of trade

- January 17: Unemployment rate

- January 18: Inflation rate YoY

- January 20: Retail sales YoY

EUROZONE

- January 2: S&P global manufacturing PMI (47.8 exp)

- January 5: Producer price inflation YoY (27.8% exp)

- January 6: Inflation rate YoY (9.7% exp); Retail sales growth YoY (-3.2% exp)

- January 9: Unemployment rate

- January 13: Balance of trade

- January 18: Inflation rate YoY (final)

- January 31: GDP growth rate YoY

UNITED STATES

- January 4: Mortgage Bankers Association mortgage data; FOMC minutes

- January 5: Balance of trade (-US$76.8bn exp)

- January 6: Unemployment rate (3.7% exp)

- January 12: Inflation rate YoY

- January 13: Import/export prices

- January 18: Producer price index; Retail sales YoY

- January 26: GDP growth rate

DOWNLOAD THE REPORT HERE

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our decicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.

Download full report here