Currency Forecast - January 2025

Market Outlook (GBP, EUR & USD) – January 2024

GBP

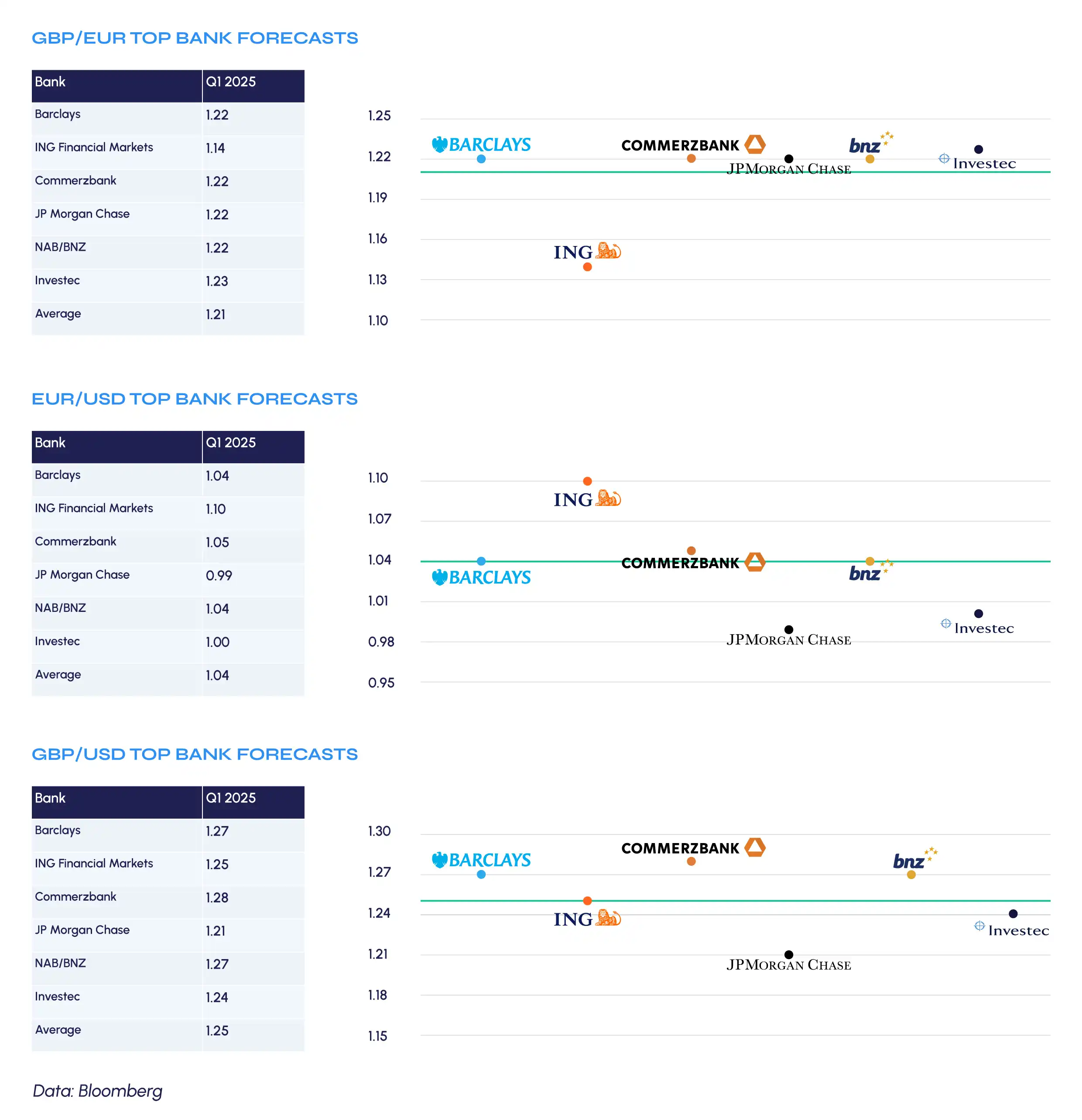

The pound traded softer as 2024 drew to a close, notching a third straight losing month against the dollar, cable’s worst run since April, with spot sinking back towards the $1.25 handle, erasing the rebound seen towards the tail end of November, and equalling the lows printed that month.

Against the EUR, however, the pound held it’s own a little better, ending December with a modest monthly gain, marking the 10th positive month for GBP/EUR in 2024, the pound’s most monthly advances against the common currency in over a decade. This saw GBP/EUR spot end the year just shy of the 1.21 handle.

December proved to be an interesting month for the UK economy, though one where festive cheer was in relatively short supply.

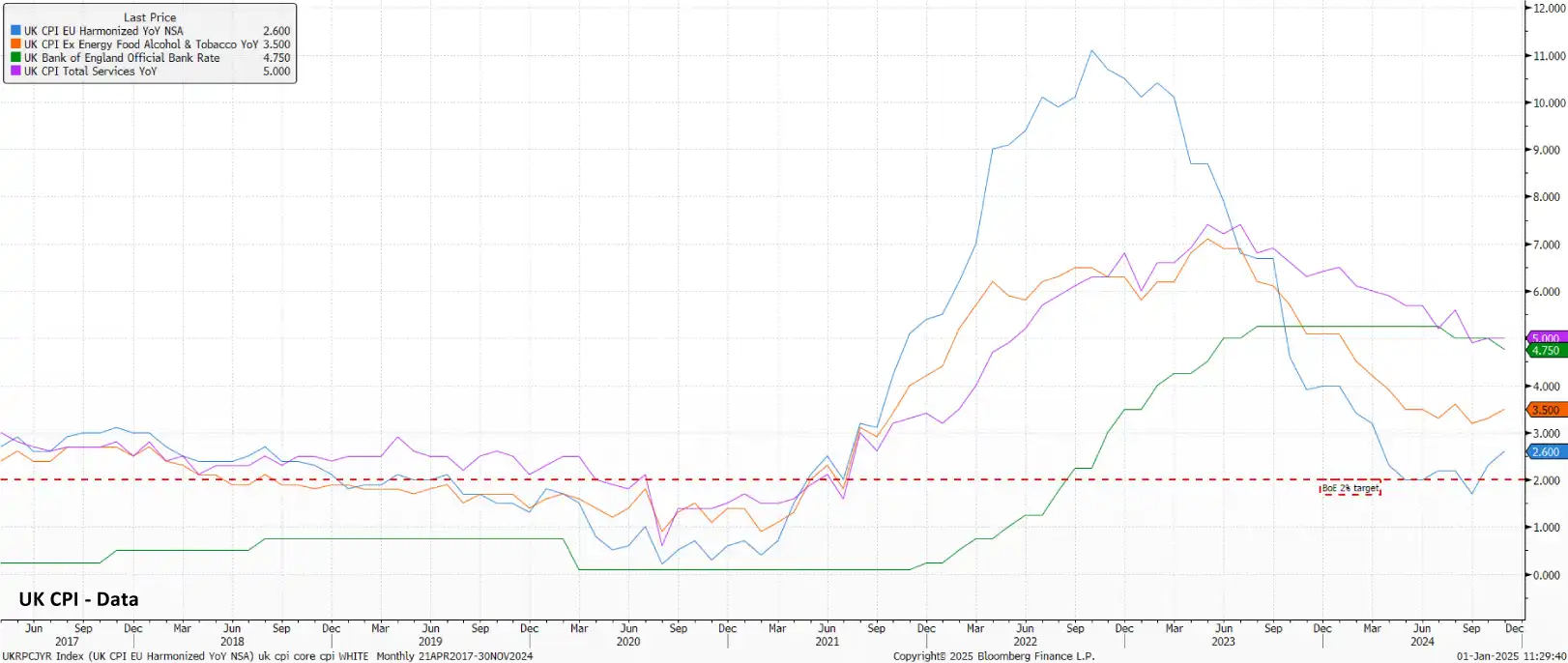

Data pointed to price pressures remaining stubborn, with headline inflation having risen by 2.6% YoY in November, and underlying metrics also pointing to persistent price pressures, as core prices climbed at their fastest rate since the summer, and as services inflation held north of 5%, well above the Bank of England’s expectations. Furthermore, upside inflation risks persist, particularly as the impacts of above-inflation public sector pay rises, and Chancellor Reeves’ inflationary October Budget, begin to be felt. Rising commodity prices, particularly towards the back end of December 2024, will also be on the Bank’s radar.

Against this backdrop and having seen little evidence of persistent price pressures fading, it was little surprise to see the MPC maintain Bank Rate at 4.75% at the final meeting of the year. The vote split, however, was considerably tighter than anticipated, with three of the nine member Committee, including Deputy Governor Ramsden, dissenting in favour of a 25bp cut.

Against this backdrop and having seen little evidence of persistent price pressures fading, it was little surprise to see the MPC maintain Bank Rate at 4.75% at the final meeting of the year. The vote split, however, was considerably tighter than anticipated, with three of the nine member Committee, including Deputy Governor Ramsden, dissenting in favour of a 25bp cut.

Despite that, the MPC seem set to continue with a relatively gradual pace of policy normalisation over the year ahead, albeit with the next decision not coming until February. That meeting is likely to result in this cycle’s third 25bp cut, with said reductions being delivered at a regular quarterly cadence from then onwards the base case for now.

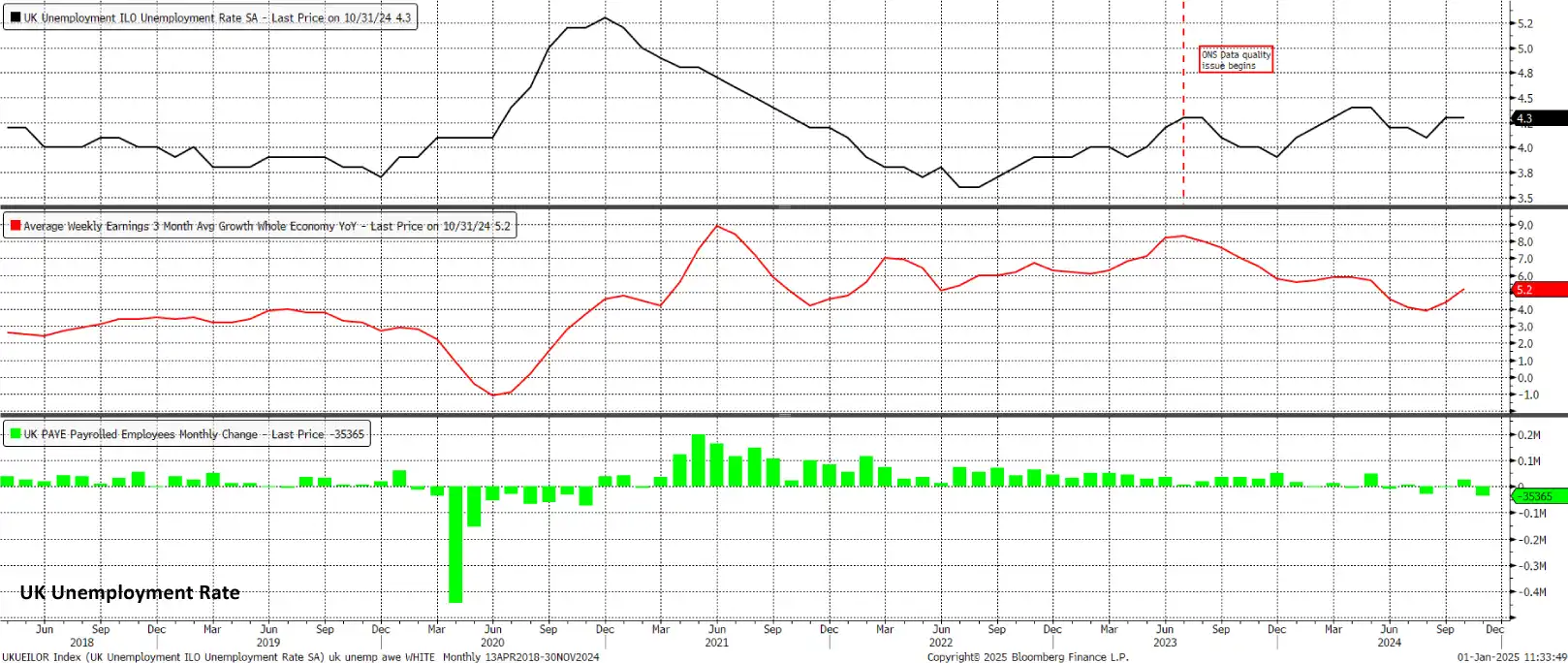

The labour market, however, presents a dovish risk to that outcome. While earnings growth, at 5.2% YoY, remains roughly double that which would be compatible with a sustainable return to the 2% inflation target, cracks are beginning to emerge. Headline unemployment held steady at 4.3% in the three months to October, though the more accurate, and up-to-date, PAYE employment metric pointed to November having seen the biggest one-month decline in employment since the tail end of 2020.

With the aforementioned Budget having dramatically increased the cost of employment for all businesses across the country, one would anticipate this trend of labour market softness to continue, and perhaps accelerate, in this new year. Further labour market cooling may dent services demand, which could in turn result in the alleviation of some degree of persistent price pressures – this, clearly, is the scenario on which the BoE’s doves are currently betting.

With the aforementioned Budget having dramatically increased the cost of employment for all businesses across the country, one would anticipate this trend of labour market softness to continue, and perhaps accelerate, in this new year. Further labour market cooling may dent services demand, which could in turn result in the alleviation of some degree of persistent price pressures – this, clearly, is the scenario on which the BoE’s doves are currently betting.

On that note, though, the UK economy comes into 2025 with little by way of positive momentum. GDP contracted by 0.1% MoM in both September, and October, with leading indicators pointing to slim prospects of a significant recovery in the early part of the new year. Something of a ʻstagflation-esque’ backdrop hence presents itself, likely posing stiff headwinds to the GBP over the short-term, even if the BoE remain a hawkish outlier among G10 peers.

EUR

The common currency ended December around 2% lower against the greenback, notching a third straight monthly decline, and a first December loss since 2016. This decline, in turn, saw the EUR revisit the 2-year lows around 1.0350 printed towards the middle of November, with spot ending 2024 perilously close to this key support level.

The tail end of 2024 saw the long, and familiar, laundry list of issues facing the eurozone persist, although none seemed to become materially more of a negative catalyst as the year drew to a close.

Political uncertainty of course persists, with Germany remaining on course for elections in mid-February, and likely drawn out coalition negotiations after polling day, while a new French PM has been appointed, though must grapple with the same issues which brought down Barnier in record quick time. Meanwhile, geopolitical risks persist, both in Ukraine and the Middle East, and while a resolution to either remains some way off, neither appears to have had a significantly increased detrimental impact on the bloc over the last month or so.

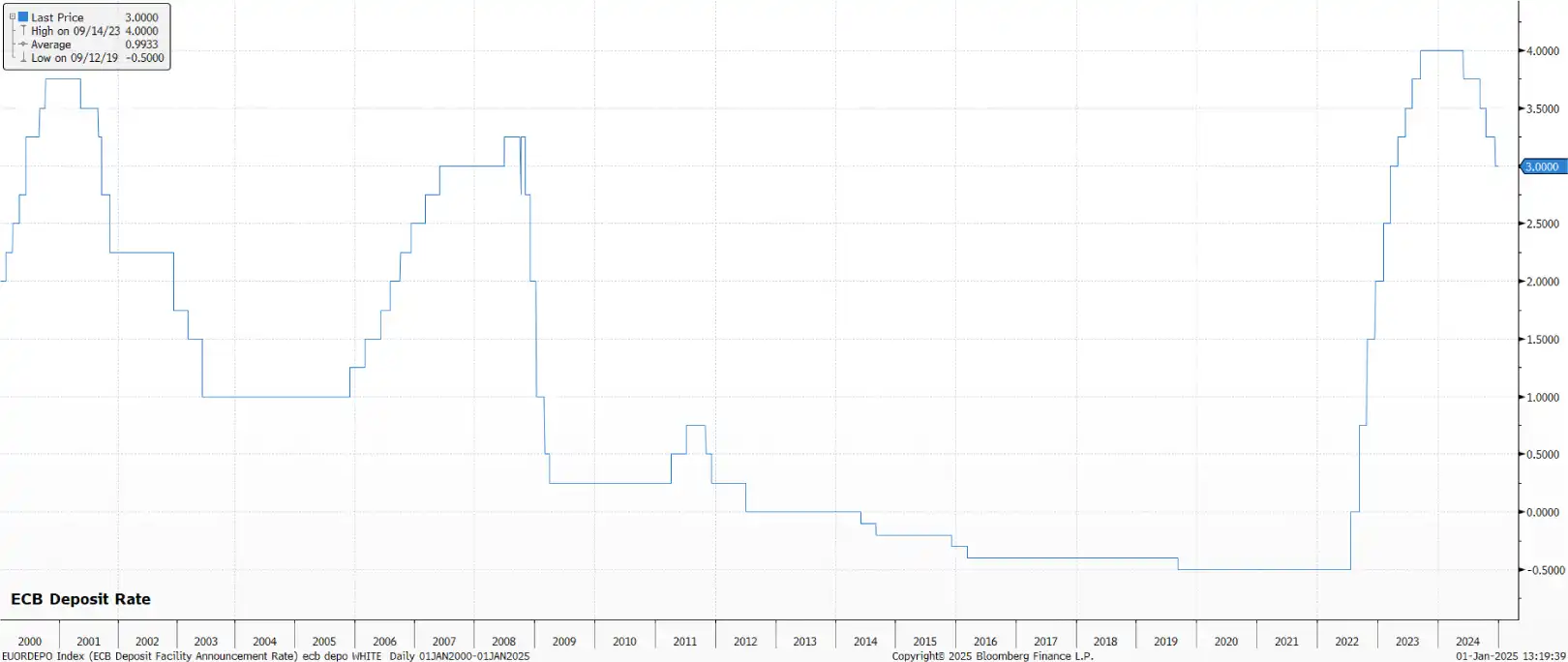

Nevertheless, monetary policy normalisation continues apace, with the ECB having delivered another 25bp cut at the December meeting, while having also seriously discussed the possibility of a larger 50bp move at the time. A 25bp cut at every meeting, for at least the next four decisions, is the base case for now, though the prospect of a 'jumbo' cut could well be on the table, were downside risks to increase, particularly in light of a likely tit-for-tat EU-US trade war.

The bigger question for policymakers, however, is whether rates must head below neutral, and into outright 'easy' territory, in order to stimulate the economy. Such a move, below the 2% mark, seems plausible at this moment in time, with the ECB in fact being one of few G10 central banks – along with the SNB – who are likely to take rates below neutral during the year ahead.

While one could expect this to pose headwinds for the EUR, it is important to recognise that not only are a significant degree of negative catalysts already priced in, but that money markets, per the EUR OIS curve, are already fully discounting the deposit rate falling to 1.75% by the tail end of this year.

While one could expect this to pose headwinds for the EUR, it is important to recognise that not only are a significant degree of negative catalysts already priced in, but that money markets, per the EUR OIS curve, are already fully discounting the deposit rate falling to 1.75% by the tail end of this year.

Hence, further significant EUR downside is likely to require the emergence of a fresh negative catalyst, potentially via a 'black swan’ event, or if the ECB were to plump for a larger cut during the first quarter. In many ways, we are likely near a point of peak pessimism when it comes to the common currency, especially if President-elect Trump’s bark proves worse than his bite in terms of potential tariffs and other protectionist trade measures.

GBP/USD TOP BANK FORECASTS

USD

The greenback continued its solid recent run in December, gaining ground against a basket of peers for the third consecutive month, and notching its first monthly gain in December since 2016. That advance, in turn, took the DXY north of the 108 figure into year-end, seeing the index finish 2024 at more than two-year highs.

Those dollar gains continued to be fuelled by a broad theme of 'US exceptionalism', which drove the G10 FX market for much of the final quarter of the year, with Donald Trump’s victory in the November election seeing expectations ratchet higher that the US econ- omy would continue to vastly outperform that of DM peers.

Those dollar gains continued to be fuelled by a broad theme of 'US exceptionalism', which drove the G10 FX market for much of the final quarter of the year, with Donald Trump’s victory in the November election seeing expectations ratchet higher that the US econ- omy would continue to vastly outperform that of DM peers.

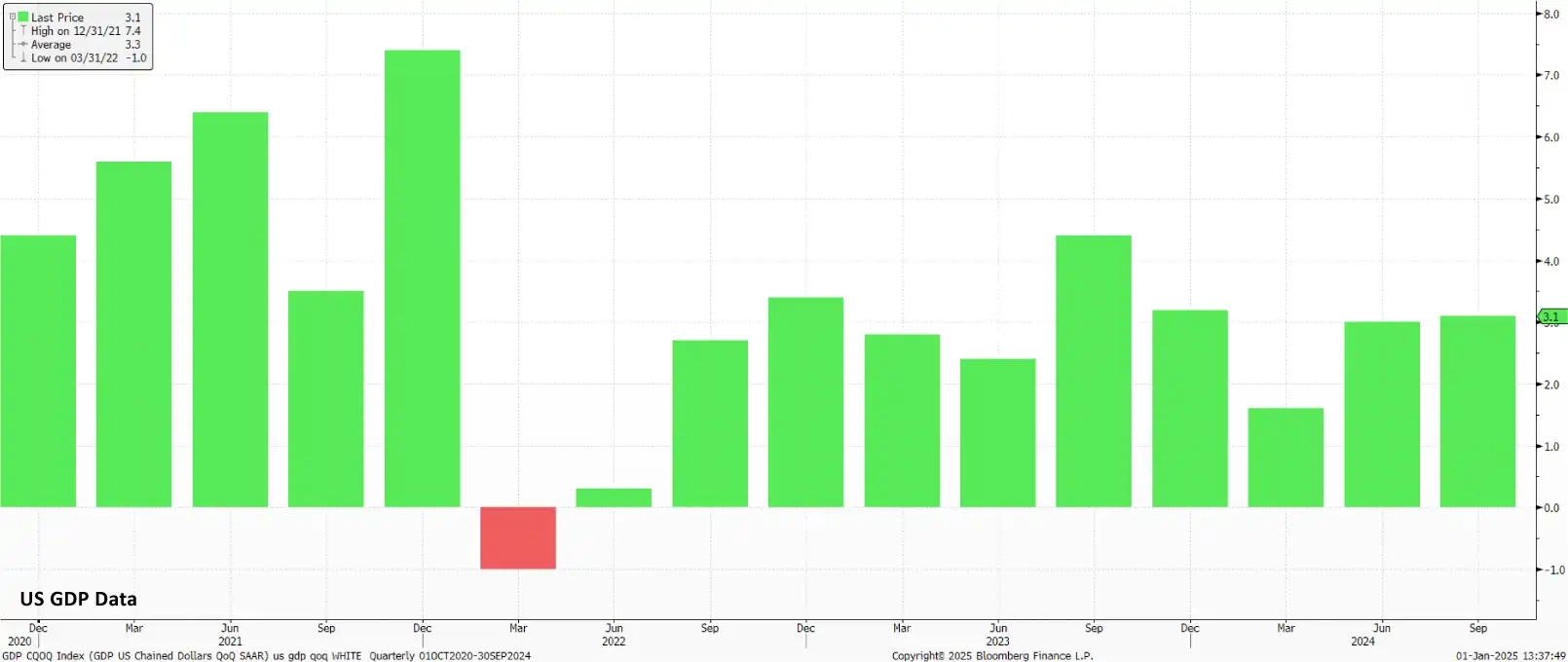

This theme was reinforced by a positive revision to third quarter GDP, with figures now pointing to the economy having grown by 3.1% on an annualised QoQ basis over that period, the fastest pace in a year. Leading indicators, such as retail sales data, point to that solid pace having continued into the final three months of 2024, while expectations for broad-based fiscal stimulus in the form of substantial tax cuts are likely to underpin a solid growth backdrop during the early part of 2024.

That said, the early days of the incoming Trump Administration will also be closely watched for initial policies on trade, particularly with the President having the ability to unilaterally impose tariffs by executive order, and not requiring Congressional approval for such action. While the imposition of tariffs on key trading partners such as China, Mexico, and the EU has likely been priced in by financial markets, the macroeconomic fallout of such action remains to be seen, with participants likely to pay particular attention to the potential upside inflation risks brought about by said policies.

That said, the early days of the incoming Trump Administration will also be closely watched for initial policies on trade, particularly with the President having the ability to unilaterally impose tariffs by executive order, and not requiring Congressional approval for such action. While the imposition of tariffs on key trading partners such as China, Mexico, and the EU has likely been priced in by financial markets, the macroeconomic fallout of such action remains to be seen, with participants likely to pay particular attention to the potential upside inflation risks brought about by said policies.

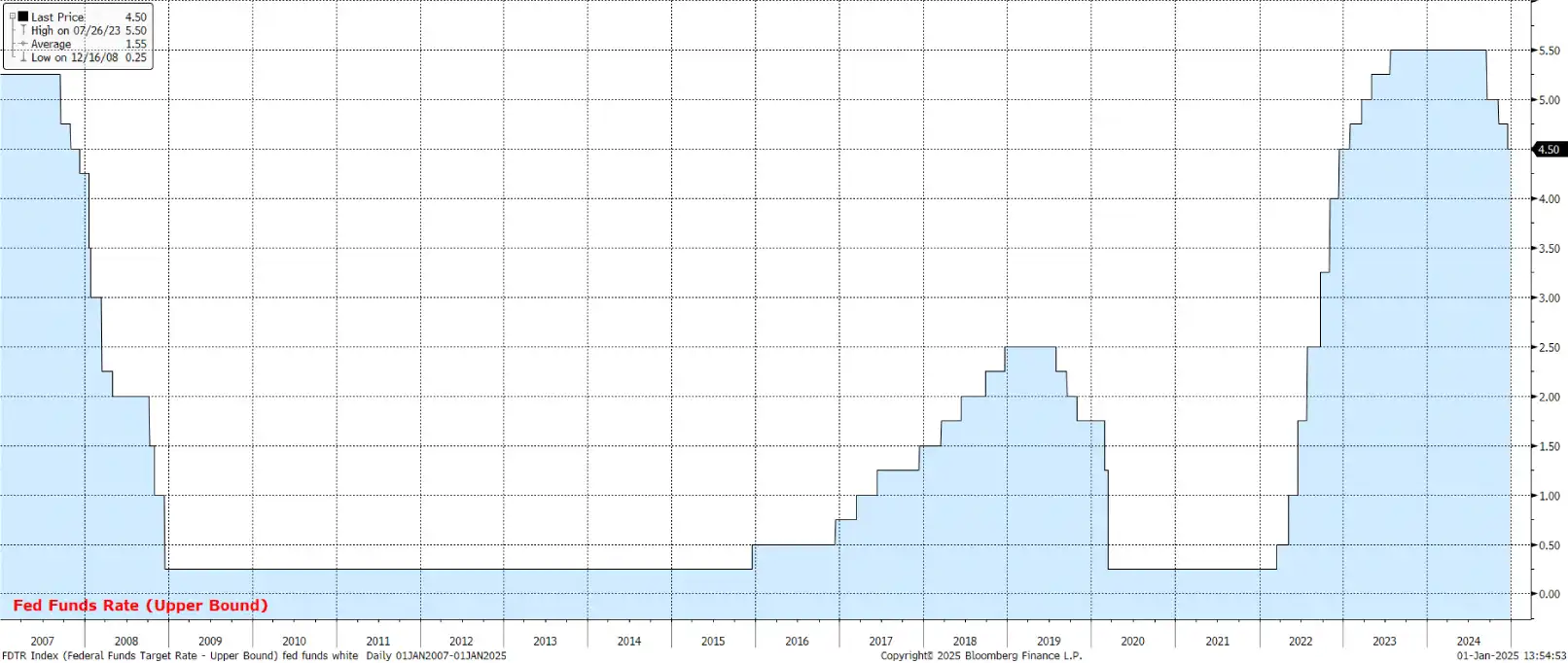

In light of this, the FOMC are set to take a much more cautious approach to removing policy restriction over the coming year. Having delivered a 25bp reduction, as expected, at the December meeting, the Committee’s latest projections, via the 'dot plot', point to a median expectation of just 50bp of further easing in 2025. It seems likely that the January meeting will be 'skipped', with the FOMC standing pat after three consecutive rate cuts, choosing to wait for hard evidence of the impact of the aforementioned Trump fiscal policies, before pulling the trigger on further steps back towards a more neutral level of the fed funds rate.

The FOMC have been afforded such flexibility not only by the aforementioned solid pace of economic growth, which seems set to continue, but also due to risks to each side of the dual mandate – achieving both price stability and maximum employment – being roughly in balance.

The FOMC have been afforded such flexibility not only by the aforementioned solid pace of economic growth, which seems set to continue, but also due to risks to each side of the dual mandate – achieving both price stability and maximum employment – being roughly in balance.

Headline CPI rose 2.7% YoY in November, largely a result of higher energy prices, though core CPI remained relatively stubborn, at 3.3% YoY, over the same period. PCE inflation metrics, those preferred by policymakers, also remain somewhat elevated, with the FOMC’s hawks likely seeking further disinflationary progress back towards 2% before voting in favour of any further rate cuts.

At the same time, the labour market remains resilient, with headline nonfarm payrolls having rebounded by a solid +227k in Novem- ber, even as unemployment surprisingly rose towards cycle highs at 4.2%. Close attention will continue to be paid to the employment situation during this year, particularly if further signs of fragility were to emerge as may have been hinted at by the modest tick higher in joblessness.

Key Dates

GBP

- 2 – Manufacturing PMI (Dec F)

- 6 – Services PMI (Dec F)

- 15 – CPI (Dec)

- 16 – GDP (Nov)

- 17 – Retail Sales (Dec)

- 21 – Labour Market Report (Nov)

- 24 – ʻFlash’ PMIs (Jan)

EUR

- 2 – Manufacturing PMI (Dec F)

- 6 – Services PMI (Dec F)

- 7 – ʻFlash’ CPI (Dec), Unemployment Rate (Nov)

- 8 – PPI (Nov)

- 17 – CPI (Dec F)

- 24 – ʻFlash’ PMIs (Jan)

- 30 – GDP (Q4, 1st Est.), ECB Decision

USD

- 3 – ISM Manufacturing PMI (Dec)

- 7 – ISM Services PMI (Dec), JOLTS Job Openings (Nov)

- 8 – FOMC Minutes (Dec)

- 10 – Labour Market Report (Dec)

- 14 – PPI (Dec)

- 15 – CPI (Dec)

- 16 – Retail Sales (Dec)

- 20 – Inauguration Day

- 28 – Durable Goods Orders (Dec)

- 29 – FOMC Decision

- 31 – PCE (Dec)

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.