Currency Forecast - November 2022

October Review & November Risk Events & Themes

Pound Sterling

Gilts and volatility are not usually uttered in the same breath, but these aren’t usual times on the markets. One week yields dipped as low as 3.74%, only to jump as high as 4.55%, before diving down and up again…

Fun fact: Throughout October, bitcoin saw less price volatility than 10-year bonds!

What drove these price swings though? Parliamentary chaos no doubt played a role. Ex-chancellor Kwasi Kwarteng’s reckless mini-budget send yields soaring; Incoming chancellor Jeremy Hunt’s tearing up of his comically short-lived predecessor’s mini-budget, coupled with the Bank of England (BoE)’s emergency bond-buying programme, brought them down again.

An end to the BoE’s bond-buying intervention sent them up again but ultimately Rishi Sunak’s appointment beat some sense into the market and yields came down to 3.57%.

But speculation over interest rates also has to take some of the blame.

On that note, the consensus forecast is 75 bps for the next decision, but a full percentage point is not off the table- we’ll find out on Thursday, November 3. The latter would hardly be a surprise, given that at 10.1%, inflation came in even hotter than expected in October and now sits at 40-year highs.

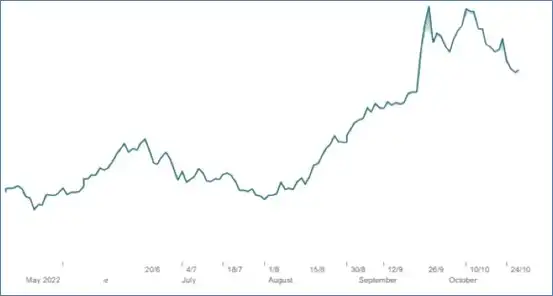

Gilts have both risen and acted erratically in 2022 so far – Source: Financial Times

Gilts have both risen and acted erratically in 2022 so far – Source: Financial Times

Core inflation – which excludes prices for energy, food, alcohol, and tobacco – also rose to a record high of 6.5%, beating estimates of 6.4%.

Against this backdrop, the British pound came scarily close to parity with the US dollar, with the GBP/USD pair heading as low as US$1.09 on October 11.

The pound was actually rallying on the BoE’s intervention prior to that, with late-September gains continuing until reaching October highs of US$1.149 on the 4th, before the sharp reversal.

Sterling went through the ringer in October, but came out stronger as the dollar weakened – Source: capital.com

Sterling went through the ringer in October, but came out stronger as the dollar weakened – Source: capital.com

But the tail end of the month saw a softening of the US dollar, causing cable to shoot up to six-week highs of US$1.164.

A technical case could be made for the pound’s increasing stability against the dollar, given the higher lows observed on the daily chart above. But that will be contingent both on what the BoE decides on next, and how the US economy moves.

Euro

Europe is far from economically stable, although consumer confidence in the Euro Area did edge up by 1.2 points to -27.6 in October from September’s record low of -28.8, beating market expectations of -30.

Inflation may have been revised down by 0.1%, but at 9.9%, it remains the highest since records began in 1991.

The energy crisis is unsurprisingly the main driver behind inflation, followed by food, alcohol tobacco and services.

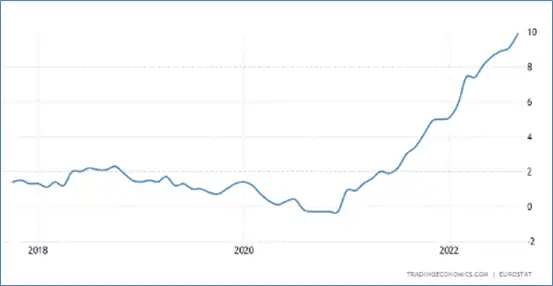

Inflation’s steady takeover of the Eurozone – Source: radingeconomics.com

Inflation’s steady takeover of the Eurozone – Source: radingeconomics.com

Record inflation has brought with it record interest rate hikes from the European Central Bank (ECB) as policymakers battle to get prices under control. Rates were jacked up another 75 bps on the 27th, bringing the total to 200 bps since July. the Eurozone base rate is now at a 14-year high.

Recession fears are unlikely to stem the pace of policy tightening, given that inflation is running at five times the ECB’s target, and may not have peaked.

Put together, the multitude of economic woes blanketing the continent meant that the euro remained below parity with the US dollar for the better part of October, having broken below the barrier in September for the first time in 20 years.

The EUR/USD pair did come close to regaining parity on October 4, having touched US$0.99 on a 1.5% rally, but a reversal swiftly followed as the dollar provided too strong.

EUR/USD is still in a downward trend – Source: capital.com

EUR/USD is still in a downward trend – Source: capital.com

While EUR/USD gained again in the latter half of the month due to a slight relief on energy prices and a soft US dollar environment, long-tail trends point to a continual downwards channel.

When softer economic data from the US saw a slide on the greenback, the euro briefly broke above parity on Friday October 28; it was a short-lived affair.

Any meaningful revitalisation of the euro is contingent on two main factors: Peak European inflation and a long-tail cooling off of the US dollar. The former seems unlikely in the short term, given the higher-than-expected inflation data that emerged from Germany, France and Italy at the end of the month.

After spending a good week making gains, EUR/GBP hit a wall at 87.6p following Rishi Sunak’s premiership win, though a case can be made for an upside return in the weeks ahead.

For all of the EU’s woes, investors are well and truly rattled by the UK’s political instability.

US Dollar

October for the greenback was a red-hot affair marked by a cooling off at the tail end. It felt like nothing could put a plug on the dollar’s runaway growth, but what goes up must come down.

It’s too early to say that the dollar has peaked, but a softening of key economic figures certainly acted as a dampener.

House prices in the US rose 11.9% year-on-year, the lowest rate since December 2020, and consumer confidence came in lower than expected.

The US goods trade deficit widened more than expected to -US$92.22bn against a forecast of -US$86bn, likely because the dollar’s relative strength softened demand and weighed on exports.

While the overall trade deficit tightened, causing gross domestic product to increase 2.6% after two consecutive quarterly declines, domestic demand remains the weakest in two years.

This flurry of underwhelming data came thick and fast at the end of the month, thus creating headwinds that saw the greenback fall against the G10 set.

The Fed is now looking less hawkish, and the resultant loosening of economic policy could spell further losses against the pound and euro.

Most observers see the dollar as overvalued right now. Some speculated on an October GBP/USD recovery. That didn’t quite happen, but the case is definitely stronger heading into November.

That should be taken into context though, according to Chris Turner, global head of markets at ING. “The move looks less like any kind of de-rating of the US economy or the Fed cycle and more an issue of investors looking for bargains in bombed-out bond and equity markets,” said Turner.

Download full report here

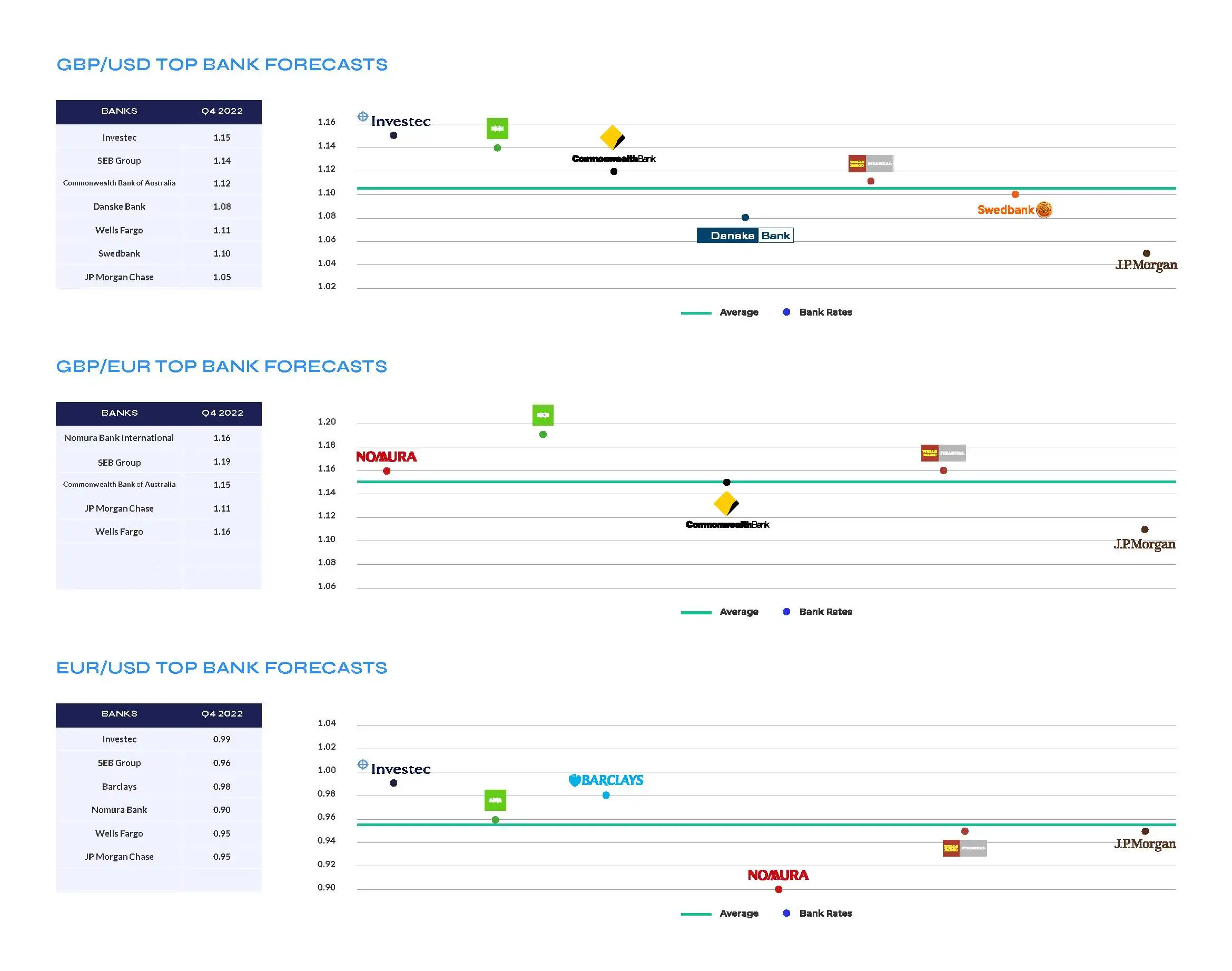

Top Bank Forecasts

NOVEMBER RISK EVENTS AND KEY THEMES

UNITED KINGDOM

Interest rate speculation: It’s all about rates in the months ahead, and the BoE will be going in blind when it has to make a decision on November 3. Sunak made the responsible choice to delay the fiscal plan until November 17. While that leaves the BoE in the dark, “it at least brings confidence that the end result will be well thought out and properly reviewed by the OBR,” said senior market analyst Joshua Mahony at online trading platform IG.

Falling house prices: First-time buyers are finding it increasingly difficult to get a mortgage. Data suggests that the number of low-deposit mortgages has dropped by half since the infamous mini-budget of September. The culprit is falling house prices, which increased 9.9% year-on-year in September, the lowest in eight months.

Sunak’s in-tray: Regardless of your political leaning, it’s hard not to quiver at the immense challenges facing Britain’s newest prime minister. Putting aside the fractured Tory party and infighting, Sunak and chancellor Jeremy Hunt need to get inflation under wraps while attempting to stem the cost-of-living crisis and a pending recession. Sterling has shown signs of stability, but it’s just a matter of for how long.

EUROZONE

Parity: The euro managed to break above parity with the US dollar towards the end of October; the challenge now is to keep it that way. A softening dollar will no doubt help, but the potential for a dovish pivot from the European Central Bank could test parity’s mettle in the weeks ahead.

Energy crisis: The energy crisis continues to rage across the continent. A gas price cap is on the way, but member states have conflicting views over its implementation so the maximum daily price cap level has yet to be decided on. According to a Euronews report, some states including Germany, Austria, Hungary and the Netherlands are reluctant to cap gas prices at the EU level while the likes of Belgium, Greece, Poland and Italy support even broader measures.

Quantitative easing: In addition to the ECB’s ongoing rate hikes, president Christine Lagarde vowed to keep printing money to buy bonds, signalling more quantitative easing on the way. This will cause downward pressure on the euro, particularly since the Bank of England and the Federal Reserve are taking the opposite approach.

UNITED STATES

Fiscal cooldown/recession?: As October draws to a close, we are most likely seeing evidence that the dollar is overvalued. Certain economic data has begun to soften, so this could cause a Federal Reserve pivot if inflation figures show some hope. The Fed’s interest rate decision and forward statements on November 2 are high stakes. However, recent data showed a tightening trade deficit, causing a 2.6% GDP climb. That will surely provide ammunition to the debate over whether the US is in a recession or not.

Bombed-out equities market: The latest round of tech earnings was a minor disaster, with Apple, Meta, Alphabet and Microsoft underperforming. As such, these blue-chip tech stocks all took a nosedive, even while the broader indexes saw some momentum. This could cause investors to seek out bargains as their risk appetite increases, at the expense of the US dollar

Mid-term elections: America’s fractured sides face off in the US mid-terms on November 8. Republicans were expected to retake control of the House of Representatives and the Senate, though recent policy wins by Joe Biden’s Democratic party has called that into question. The Senate is currently split 50-50 and vice president Kamala Harris holds the casting vote, so a swing of just one seat could see the Republicans triumph. Abortion rights are surely going to be the hot-button topic for voters.

Download full report here

KEY DATES IN NOVEMBER

United Kingdom

- November 3: Bank of England interest rate decision (75 bps exp); Monetary policy report

- November 4: New car sales

- November 7: Halifax house price index

- November 11: Yearly GDP (1.5% exp)

- November 15: Unemployment rate (3.6% exp)

- November 16: Inflation rate (10.4% exp)

- November 18: Retail sales (-5.6% exp)

- November 25: Yearly car production

Eurozone

- November 3: Unemployment rate (6.7% exp)

- November 4: Producer price inflation (45.7% exp)

- November 8: Retail sales

- November 15: Yearly GDP; Balance of trade (-€43.6bn exp)

- November 17: Consumer price index; Inflation rate

United States

- November 2: Federal Reserve interest rate decision/press conference (75 bps exp)

- November 3: Balance of trade (-US$68bn exp)

- November 4: Unemployment rate (3.5% exp); Total vehicle sales

- November 10: Inflation rate (8.1% exp)

- November 16: Retail sales

- November 29: Yearly house price index

- November 30: Goods trade balance

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our decicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.

Download full report here