Currency Forecast - November 2023

October Review & Themes

Pound

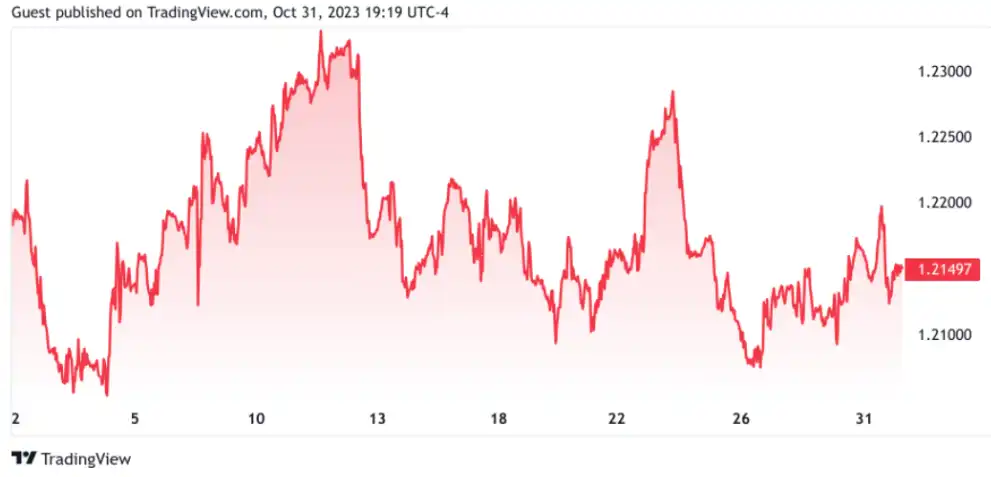

During October, the pound thudded to its lowest levels against the US dollar since March, and struggled to pull away, finishing lower than where it started.

Versus the euro, the latter half of the month saw the lowest levels breached since May.

The currency market month opened amid volatile trading in bond markets. GBP/USD started moving downward from 1.22 and early in the first week was dragged below 1.207, around seven-month lows, with disappointing manufacturing PMI data combined with multi-decade highs in US Treasury yields in the background.

As well as drawing money out of stock markets, higher bond yields tend to result in more buyers, even though UK Gilts are also at long-term highs. However, some analysts cited caution around the dollar at the start of the month, which helped sterling, which quickly bounced back and by the week after had topped 1.232 on the 11th and 12th, the latter the day of GDP release.

It was a similar story versus the euro, with the month’s peak on the same days. However, GBP was not able to hold this momentum.

There was a spike in Cable on the night of the 23rd and into the 24th after a bond rally that halted US yields, but UK economic data continued to indicate another interest rate was not imminent soon.

Against EUR, GBP was on the slide from the middle of the month, and began to test six-month lows after the inflation data on the 17th, despite being stronger than expected.

Looking at the yield curve, FX strategists at Rabobank said the movements suggested that “the market judged that this data was not enough to noticeably change the odds of a BoE rate hike at the November 2 policy meeting… viewing the stickiness of UK inflation as a reason for BoE rates to remain higher for longer”.

Dollar

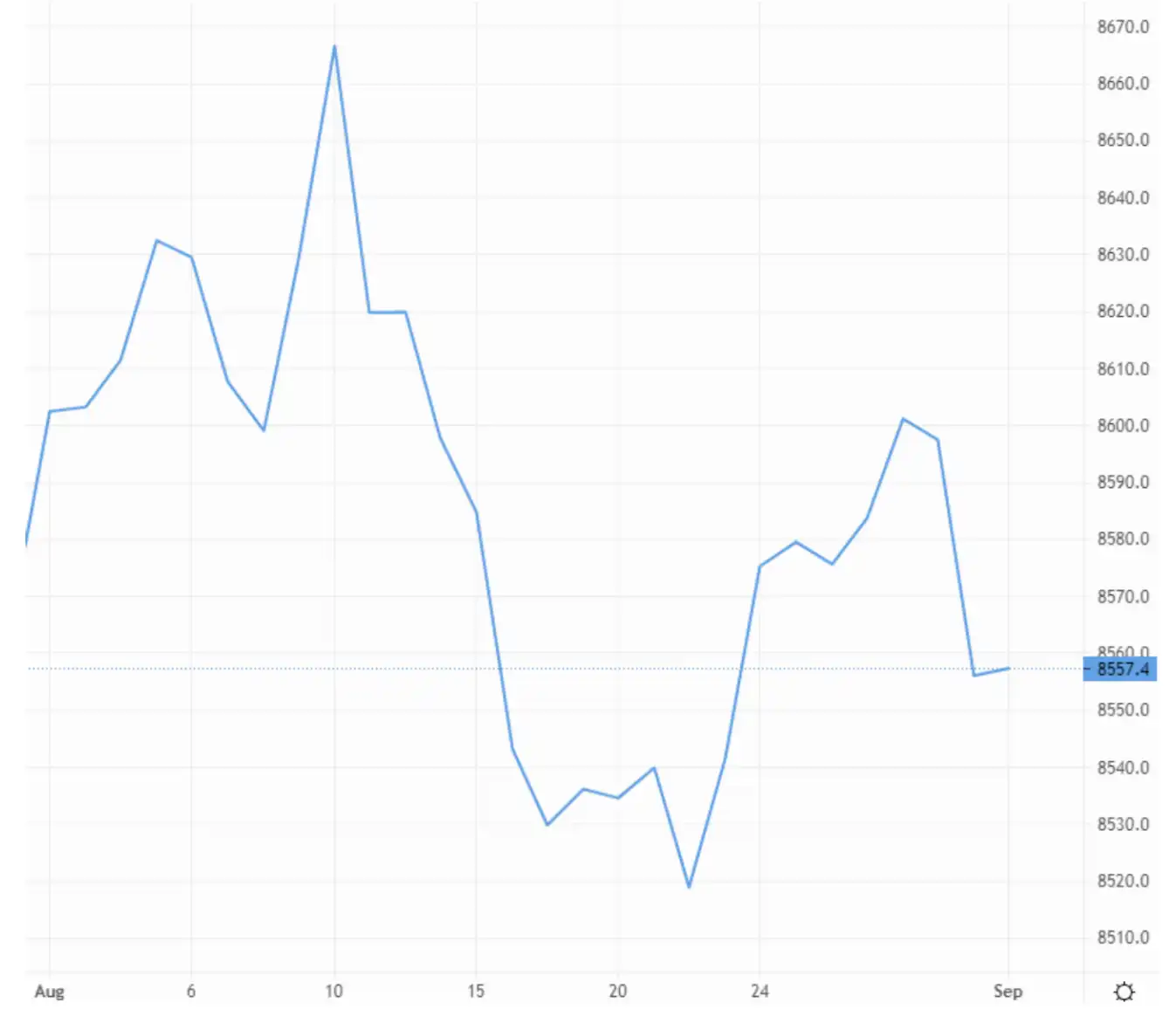

The US Dollar Index (DXY) regained the 107 level at the start of the month, last seen almost a year ago.

However, the dollar rally then lost steam, though it remains near its highs for the year against currencies from both developed and emerging economies.

Higher US Treasury yields have been a dominant force driving the dollar higher over recent months as long-term bond yields rose more in the US than elsewhere. On top of that, there have been flows to the greenback from rising geopolitical uncertainty, notably in Israel and Palestine.

Mid-month, UBS strategists noted that currency markets “breathed a sigh of relief” as US 10-year yields pulled back, having been “in the driver’s seat for FX moves, alongside geopolitical factors”.

Economists at ING said the support for the greenback was especially apparent when the yield moves were driven by strong US macro data, justifying the Fed keeping rates higher for longer.

“However, unless we start to see some sharply weaker US data coming through, it is hard to see the long end coming a lot lower,” they said.

Emerging market currencies traded broadly sideways against USD in the second half of the month.

Euro

Following several months of downtrends, October marked a recovery for EUR in its major trading pairs.

Against the USD, having fallen from 1.25 since July, the euro hit 1.045 at the start of the month before testing 1.065 a few more times before October’s close.

Versus GBP it climbed from 0.866 to 0.874. The gains were even more apparent against others including its Scandinavian, Antipodean, Mexico and Canada pairs.

Analysts were somewhat surprised that the single currency was displaying such fortitude in the wake of various softer-than-expected economic data, with Germany continuing to look mired in stagnation.

Rabobank said: “Since fundamentals do not appear to justify the current buoyancy of the EUR, we expect that it is a function of position adjustment related to the strong sell off in EUR/USD in recent months.”

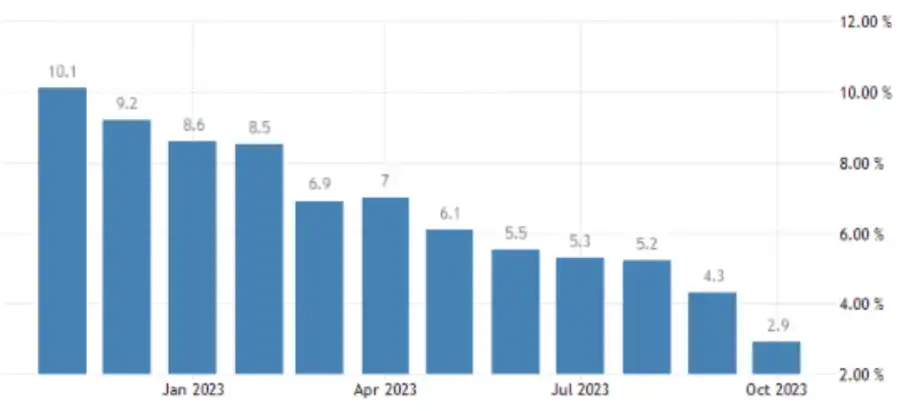

October saw eurozone CPI inflation ease below at 3% for the first time since July 2021 and the month ended with an ECB meeting, which pretty much delivered no surprises and did not move the single currency.

The decision for no policy change was unanimous, with the governing council reaffirming its data-dependent stance. President Lagarde said all options remain open, but another hike appears to be unlikely.

“Interestingly, a surprisingly strong US GDP print, which was released just as the ECB press conference started, also left markets unmoved,” said UBS. “This confirms our assessment that the euro has reached a point of weakness, where only very negative catalysts can trigger further depreciation.”

November Key Risk Events & Themes

Dollar

Interest rates and job openings: though this report comes on the cusp of the Federal Reserve’s next interest rate decision, there is a near-unanimous assumption that we’ll see a pause at 5.5%. If taking that at face value, the next question should be: what next? Super-high bond yields (see below) are expected to relieve the Fed’s monetary tightening responsibilities. However, there remains substantial resilience in the labour market, with the last job openings print flying well above market expectations by rising by 690,000 when a contraction was expected. Will job openings climb lower after last month’s surprise upside? We’ll find out on November 1.

Despite the resilient labour market, Pantheon’s chief economist Ian Shepherdson acknowledged that wage inflation is expected to slow over the coming quarters, potentially leading to core inflation undershooting future targets.

Treasury yields to take burden off Fed: soaring Treasury yields are bad news for all, but optimistic bargain hunters in the debt markets. Higher yields mean investors are either selling off or demanding better returns for providing long-term debt to the government, a sign of receding confidence in the US economy. They can also have a knock-on effect on the equities market, as high yields raise the prospect of a recession.

It came as a concern to see the 10-year Treasury flirt with 5% for the first time in 16 years at the end of October. But will the sell-off continue? That 10-year yield will be closely watched for an answer to this question. There is one other upside to higher yields. As explained by Monex researchers, they can effectively take the pressure off the Fed to raise rates, as they take on some of the burden of cooling the US economy. Monex expects the Fed chair to state that “ higher bond yields could substitute for a further rate hike this year”.

Euro

Inflation to fall, not thanks to energy prices: Eurozone headline inflation “will snap back in the coming months” and GDP is “going nowhere”, was the no-nonsense prediction from Claus Vistesen and Mel Debono, chief eurozone economist and senior European economist at Pantheon. The lower-than-expected GDP and inflation prints posted on October 31 supported this thesis.

There is one caveat here in the form of energy prices. “Admittedly, energy price base effects will become less favourable from November on and we expect the headline rate to temporarily tick higher at the turn of the year,” said researchers at Daiwa Capital Markets. However, they noted that the food component, which accounts for roughly one fifth of the inflation basket and almost double the share of energy, will continue to fall steadily. They surmised: “With surveys and producer prices consistent with diminishing factory pipeline pressures, we expect core goods inflation to drop significantly further over coming months.”

Will Germany recover? Retail sales in Germany took an unexpected dip in September, concluding a lacklustre third quarter for Europe’s benchmark economy. According to government data, there was a 0.8% drop in sales. While this was an improvement compared to August's 1.2% decline, it still fell short of analysts' predictions, who had anticipated a 0.5% increase.

Germany has well and truly emerged as the sick man of Europe, with Daiwa noting that GDP remains the weakest of all the euro area member states, up just 0.3% post-Covid. Only the Czech Republic has fared worse bloc wide. November 6 sees German industrial production and construction PMI numbers, with inflation data coming the day after. These numbers will be closely watched.

Pound

Interest rates and economic cooling: falling retail sales (the joint worst October on record no less), tepid growth and weak PMIs are all pointing to a UK economy that is running out of steam. “The UK’s economic outlook therefore remains bleak, which should help bring inflation down without the need for further tightening,” said Fawad Razaqzada, market analyst at StoneX Group. In short, there is little to no chance of another Bank of England rate hike, which, in turn, has the potential to send the pound lower against other major currencies. In terms of the GBP/USD pair, it depends on what the Federal Open Market Committee in the US has to say when it convenes on the first of the month. Thus, cross pairs could be a better gauge of pound strength/weakness in the short term.

Mortgage lending: Pantheon analysts expect a continual decline in mortgage demand as the fourth quarter progresses, noting that net mortgage lending fell by £900 million in September, per the October print, compared to an average increase of £5.1 billion each month in 2022. “We think mortgage lending will remain weak over the coming months,” said Pantheon. This thesis is supported by recent Bank of England data suggesting a nine-month low in mortgage approvals, as higher interest rates continue to bite into the housing market.

Indicatively, net house purchase mortgage approvals dropped to 43,300 in September. “This was the lowest level since January when the jump in mortgage rates after the October mini-budget was still filtering through to demand,” said Pantheon. “We don’t see a pick-up in approvals any time soon.

KEY DATES IN NOVEMBER

United Kingdom

- November 1: Nationwide housing prices YoY

- November 2: BoE interest rate call (exp hold at 5.25%)

- November 6: New car sales

- November 7: Halifax house price index

- November 10: GDP YoY; Balance of trade; Industrial production; Manufacturing production

- November 14: Unemployment rate

- November 15: Inflation rate YoY; Retail price index YoY

- November 17: Retail sales YoY

- November 24: GfK consumer confidence

- November 30: Car production YoY; Nationwide housing prices YoY

Eurozone

- November 3: Unemployment rate (exp 6.4%)

- November 6: Services PMI (exp 47.8); Composite PMI (46.5)

- November 7: Construction PMI; PPI YoY

- November 8: Retail sales YoY

- November 14: GDP YoY

- November 15: Balance of Trade

- November 17: Inflation rate YoY; CPI

- November 30: Unemployment rate

United States

- November 1: Interest rate call (exp hold at 5.5%); JOLTS job openings (exp 9.2 million); S&P global manufacturing PMI

- November 2: Initial jobless claims

- November 3: Unemployment rate (exp 3.8%); S&P global composite PMI; S&P global services PMI

- November 7: Balance of trade

- November 14: Inflation rate YoY; CPI

- November 15: Retail sales YoY; PPI YoY

- November 22: Durable goods orders; FOMC minutes

- November 23: Initial jobless claims

- November 27: New home sales

- November 28: House price index YoY

- November 29: GDP QoQ

- November 30: Coer PE price index

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our dedicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.