Currency Forecast - November 2024

OCTOBER REVIEW & NOVEMBER OUTLOOK

GBP

Sterling traded poorly in October, with cable tumbling over 3.5% during the month, not only the biggest such decline this year, but the pound’s worst month since September 2023. The move came amid broad-based USD strength on the month, though nonetheless saw cable retrace rapidly from the 1.34 figure, surrendering the 1.30 handle as the month drew to a close, to trade at the lowest levels since mid-August.

The pound also lost ground against the common currency, with GBP/EUR notching its first monthly decline since February, and the biggest one-month loss since December 2022. Most of these declines, it must be said, came towards the back end of the month, which saw spot move back below both the 50- and 100-day moving averages.

These late-October GBP losses came amid increasing market concern over the proposals laid out by Chancellor Reeves in her first Budget. The Budget, which saw around £40bln of tax increases, though spending was increased by almost double this amount. This, coupled with the narrow headroom of just £16bln against the new PSNFL metric used to gauge progress against the ‘fiscal rules’, has led to a high degree of concern among market participants, that Reeves will be back for either more tax rises, more borrowing, or both, at some point during the remainder of this Parliament.

Gilts reflect this sentiment most obviously, having sold-off aggressively across the curve since the Budget, and with 10-year yields now at their highest level in a year. This can be interpreted as pure concern over the UK’s potential fiscal instability, particularly considering that the GBP is moving in the opposite direction, contrary to the ‘typical’ relationship whereby higher yields are rewarded with a stronger currency.

Somewhat more hawkish monetary policy expectations, after the Budget loosened fiscal policy by over 1% of GDP, are also behind some of the pressure at the front-end of the Gilt curve, however.

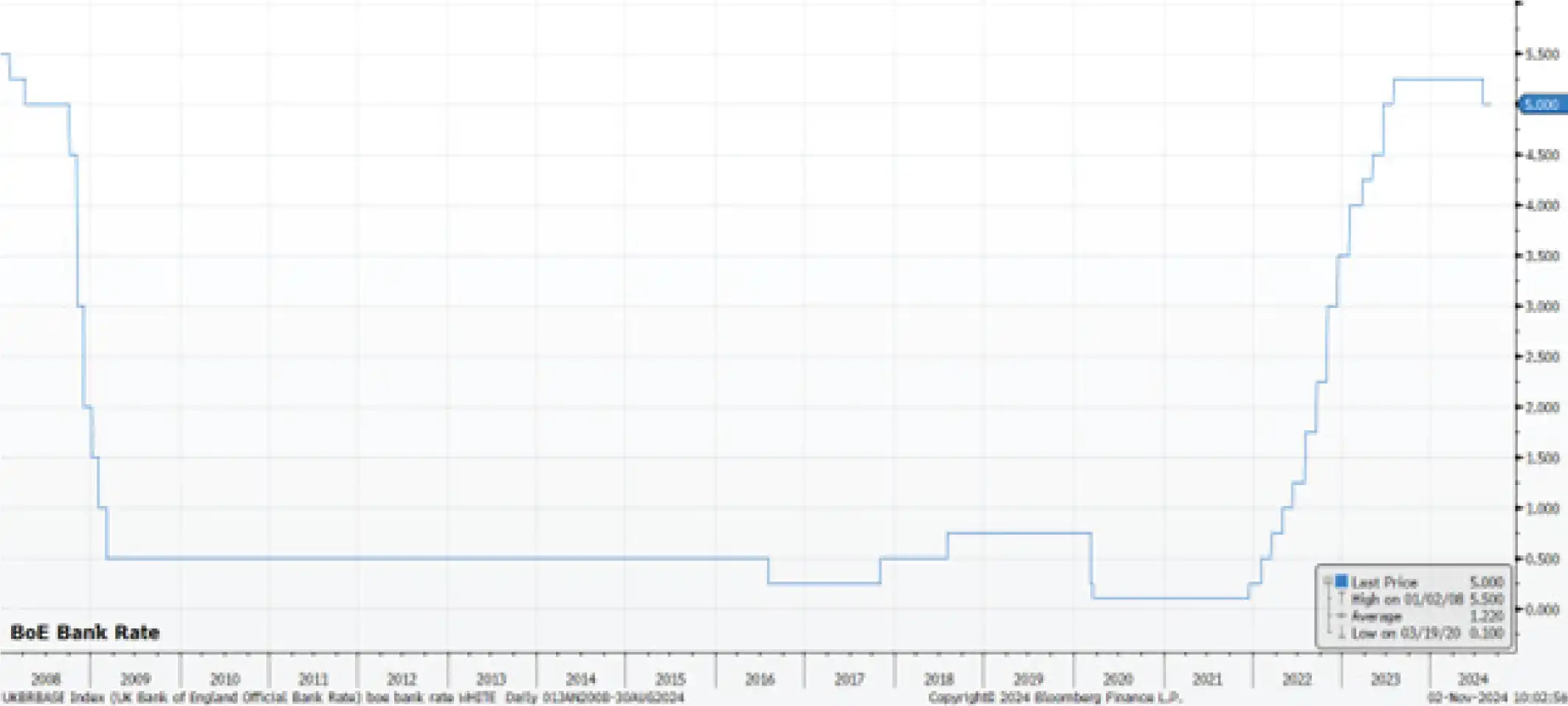

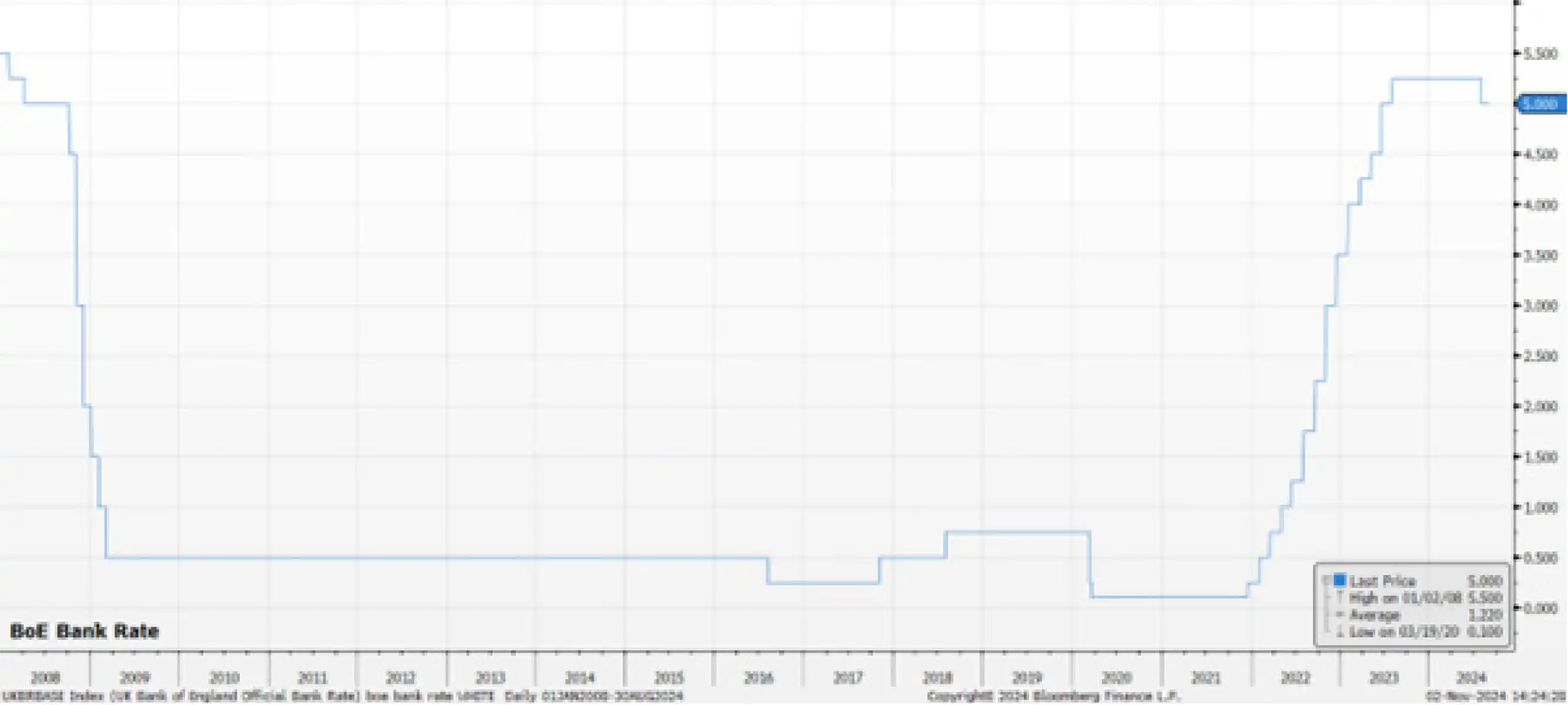

The BoE remain almost nailed-on to deliver another 25bp cut at the November meeting, in what is likely to be an 8-1 vote among MPC members. Beyond that, however, the GBP OIS curve now prices just 75bp of further easing by next summer, around half that discounted in the eurozone, and 30bp less than is priced Stateside.

While one may expect that this hawkish policy divergence could provide the GBP with some support, the FX market has not been particularly focused on the policy outlook of late, given that the journey towards neutral is taking place in relatively synchronised fashion across G10.

Instead, focus remains on the relative economic performance of the currency in question. Here, the GBP is likely to remain hobbled by the UK’s relatively anaemic course of economic growth.

Instead, focus remains on the relative economic performance of the currency in question. Here, the GBP is likely to remain hobbled by the UK’s relatively anaemic course of economic growth.

The most recent round of PMI surveys pointed to the economy having continued to lose momentum through summer, and into the autumn, particularly with the manufacturing output gauge having now dipped below the 50.0 breakeven mark for the first time since April. At the same time, retail sales growth has been sub-par, with sales having risen just 0.3% MoM in September, while concern ahead of the Budget caused a significant detrimental impact to both business and consumer confidence in the third quarter, which is likely to remain at depressed levels now that the Budgetary measures are known.

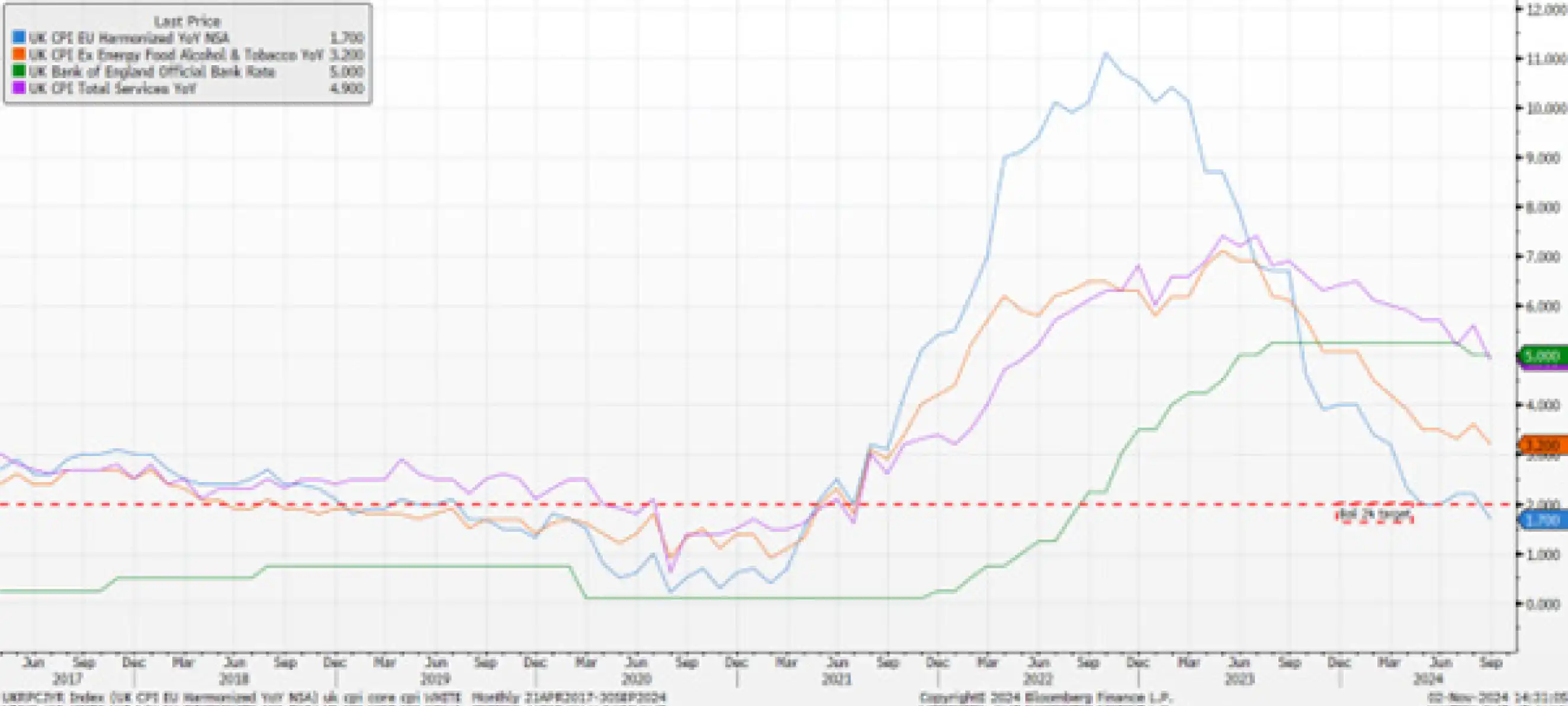

One brighter spot, though, comes from inflation, with headline CPI having fallen to a more than 3-year low 1.7% in September, while the core and services metrics pointed to a continued decline in underlying price pressures. Policymakers, however, seem unlikely to sound the ‘all clear’ on inflation just yet, particularly considering the fiscal expansion alluded to earlier on, and the upside inflation risks that it will bring.

EUR

The common currency traded broadly softer in October, snapping a run of three straight monthly gains, with the EUR in fact notching its worst monthly performance since last September, in a relatively rapid decline from $1.12, to $1.08, briefly printing 3-month lows before recovering a modicum of ground.

While broad-based USD demand is somewhat responsible for the EUR softness, domestic factors certainly aren’t providing the EUR with especially much support.

While broad-based USD demand is somewhat responsible for the EUR softness, domestic factors certainly aren’t providing the EUR with especially much support.

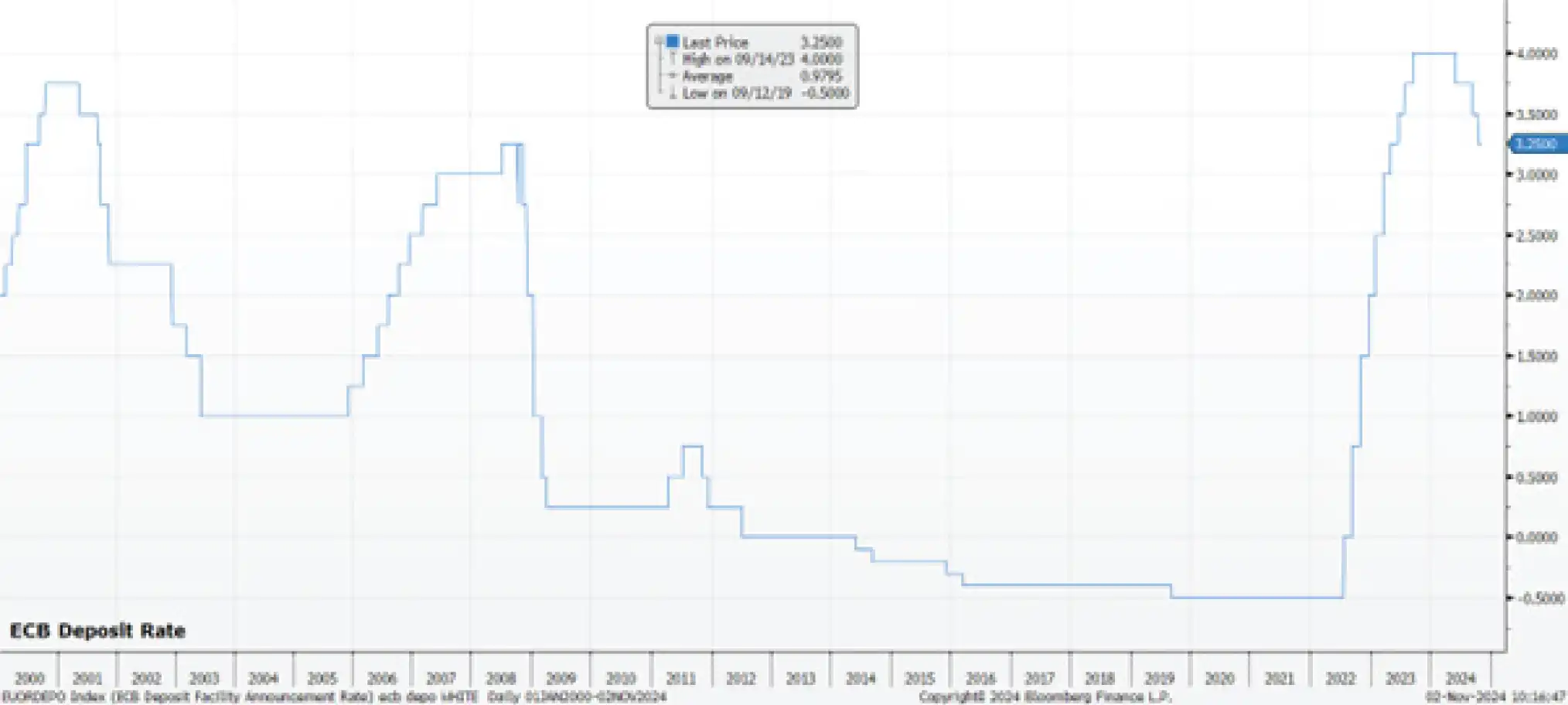

Disinflation across the eurozone has improved considerably quicker than expected, with headline CPI having fallen to 1.7% YoY in September, a 3-year low, while core CPI also continues to make progress back towards the ECB’s price target. In fact, despite the energy-induced October rebound in headline inflation, risks continue to mount that the ECB will in fact under-shoot its 2% inflation aim over the medium-term, with the Governing Council’s more dovish members having displayed particular concern over this possibility.

At the same time, the eurozone growth outlook remains rather glum. Though the economy notched QoQ GDP growth of 0.4% in the three months to September, the best such performance in 2 years, risks remain firmly tilted to the downside.

Not only do ongoing geopolitical tensions continue to pose headwinds to the bloc’s economy, but the continued lack of any discernible economic recovery from China, and the subsequent lack of demand that this will cause, remains a substantial issue. Said downside risks are well-evidenced by the most recent PMI surveys, which pointed to a second straight monthly contraction in overall economic output, while the all-important services metric fell to its lowest level since February.

Amid this combination of rapid disinflation, and mounting downside growth risks, it was unsurprising to see the ECB plump for a second straight 25bp cut at the October meeting, quickening the pace at which policy restriction is to be removed. Further such cuts remain likely, at every meeting, until the deposit rate reaches a neutral level, of around 2%, early next summer.

The conversation now, though, is turning to whether policymakers might need to cut rates beyond neutral, into outright loose territory, in order to attempt to stimulate the bloc’s economy, and provide further insulation against any external macroeconomic shocks.

For the time being, however, with the ECB not meeting this month, the common currency seems likely to be driven by external events once more – chiefly, developments in China, and the upcoming presidential election, more on which below. Risks to the EUR, though, once again appear biased to the downside, with there being little cause for optimism across the channel.

For the time being, however, with the ECB not meeting this month, the common currency seems likely to be driven by external events once more – chiefly, developments in China, and the upcoming presidential election, more on which below. Risks to the EUR, though, once again appear biased to the downside, with there being little cause for optimism across the channel.

USD

The dollar gained ground against its major peers last month, with the Dollar Index (DXY) advancing by over 3%, marking the greenback’s best one-month performance in over two and a half years. In turn, the DXY briefly traded north of 104.50, a 2-month high, while managing to end the month north of the 200-day moving average, a key gauge of longer-run momentum.

Propelling the dollar higher was a renewed focus on the ‘US exceptionalism’ theme upon which markets have been so reliant in recent years. Clearly, US economic growth continues to vastly outperform that of peers, while investors and policymakers alike are becoming increasingly convinced that the economy will indeed achieve a ‘soft landing’.

Propelling the dollar higher was a renewed focus on the ‘US exceptionalism’ theme upon which markets have been so reliant in recent years. Clearly, US economic growth continues to vastly outperform that of peers, while investors and policymakers alike are becoming increasingly convinced that the economy will indeed achieve a ‘soft landing’.

In terms of growth, GDP rose by 2.8% on an annualised QoQ basis in the third quarter, marking the 10th straight quarter of GDP growth, and the eighth quarter in the last nine whereby the economy has grown by a rate north of 2%. Looking ahead, the Atlanta Fed’s GDPNow tracker, which has been incredibly accurate this cycle, suggests that a similar pace of economic growth is likely to be maintained into the final quarter of the year.

At the same time, price pressures have continued to recede. Headline CPI rose by just 2.4% YoY in September, the slowest annual rate in over three years. Meanwhile, the FOMC’s preferred inflation metric, the PCE deflator, rose just 2.1% YoY in the same period, within touching distance of the Committee’s 2% target.

This combination of continued disinflation, solid economic growth, and a gradually normalising labour market, continues to give participants confidence in the aforementioned ‘soft landing’, leading to the market continuing to reside in the left hand side of the ‘dollar smile’, and leading to the greenback retaining its position as the most attractive G10 currency – on a yield, and on a growth, basis.

Given the continued confidence in inflation returning back to the 2% goal, the FOMC are set to continue to remove restriction at the November policy meeting.

Although headline nonfarm payrolls grew by a disappointing 12k in October, the figure was skewed substantially lower by the impact of one-off factors, such as strikes at Boeing, and Hurricanes Helene and Milton, which made landfall shortly before, and during, the survey week respectively. Unemployment, due to survey classification differences, held steady at 4.1% during the month, likely deterring the FOMC from over-reacting to such a substantial headline NFP surprise.

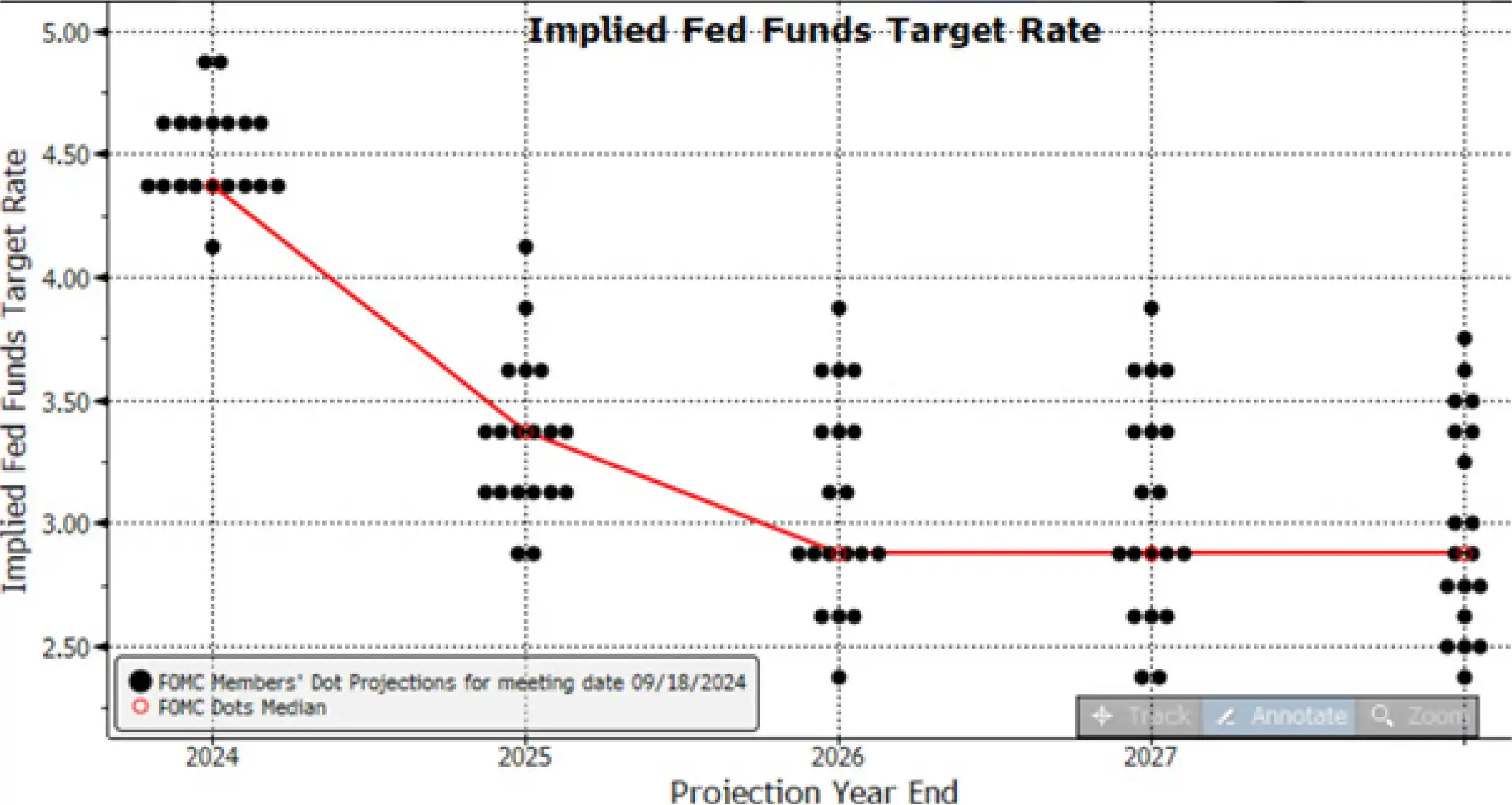

As a result, another 25bp cut stands as the most likely outcome from the November confab, with further 25bp cuts to be delivered at every meeting beyond then, until the fed funds rate falls to a neutral 3% level next summer. That said, were the labour market to materially weaken, likely entailing unemployment rising north of the 4.4% year-end SEP projection, a larger 50bp cut would be on the table once more.

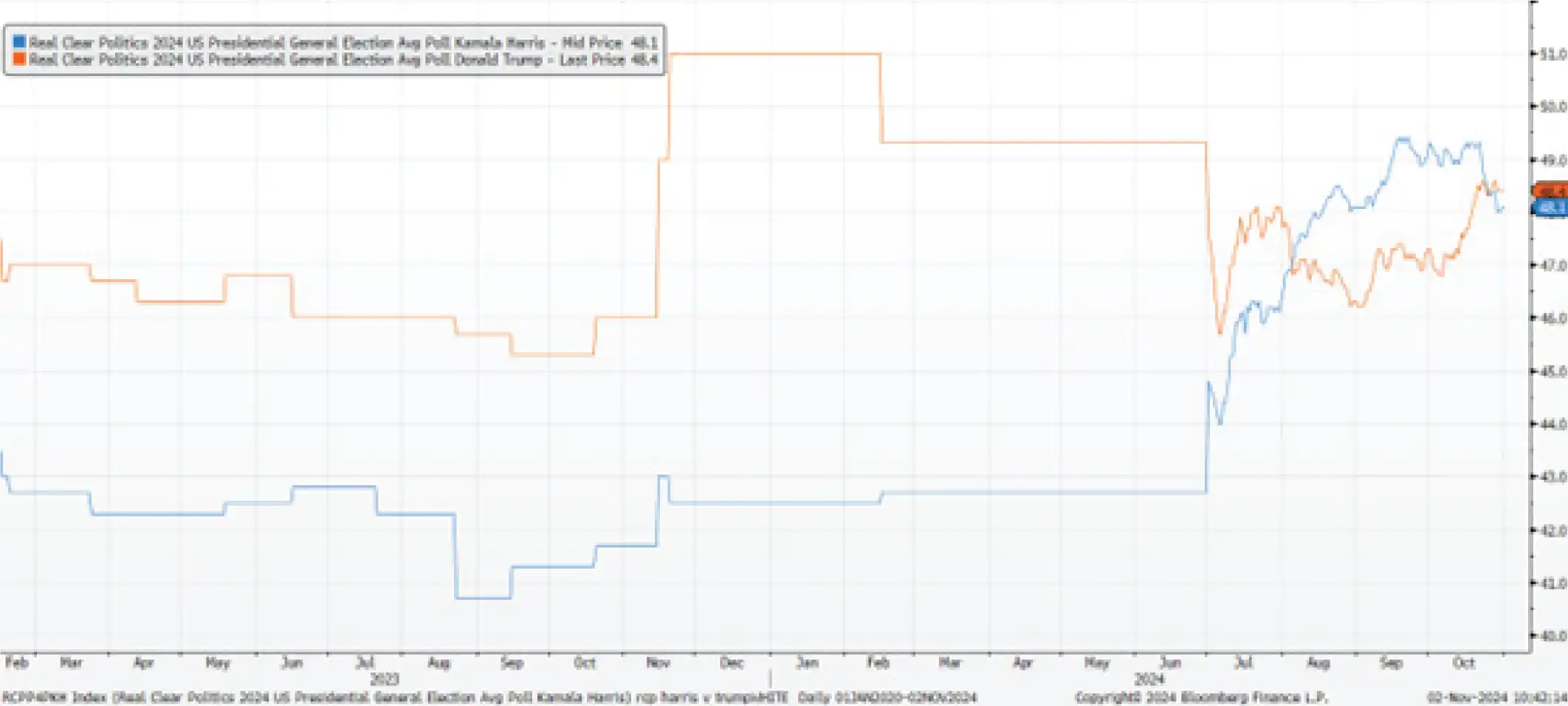

Of course, it is the presidential election that will likely stand as this month’s main event, as opposed to anything that the FOMC may or may not do.

Of course, it is the presidential election that will likely stand as this month’s main event, as opposed to anything that the FOMC may or may not do.

National polling continues to have Trump and Harris neck-and-neck, with the vast majority of polls in the seven key swing states also pointing to an incredibly tight race, with most sitting well within the polling margin of error.

At a high level, one would argue that a Trump victory is likely to be a USD-positive outcome, if only due to the mechanical weakness that such a result would cause in other currencies which are likely to be the target of tariffs under such an administration, namely the CNH/Y, MXN, and EUR. In contrast, a Harris victory could bring some USD weakness, as pre-election hedges are unwound, and the aforementioned currencies find demand, as tariff and trade war risk recedes.

That said, there are other moving parts to consider. The make-up of Congress will be key, particularly if one party, most likely the GOP, is able to achieve a ‘sweep’, winning all three of the White House, Senate, and House of Representatives. Such an outcome would likely lead to significantly higher government spending, from which the resulting growth sugar-rush could further boost the greenback’s appeal over the medium-term.

On the whole, though, market participants will be craving certainty on election night. If, as in 2020, the election result is not known for a number of days, or if the result is subject to numerous re-counts and legal challenges, some USD headwinds may emerge.

GBP/USD TOP BANK FORECASTS

BoE PREVIEW - NOVEMBER 2024 MEETING

The Bank of England are set to deliver a 25bp Bank Rate cut at the conclusion of the November MPC meeting, with money markets discounting around a 4-in-5 chance of such action, by virtue of continued disinflationary progress having been made, both at a headline level, and in terms of the eradication of persistent underlying price pressures.

The vote split among MPC members is likely to be much more convincing than the narrow 5-4 majority by which this cycle’s first cut, in August, was decided. Instead, this time around, the MPC are likely to vote 8-1 in favour of a 25bp cut, with only external member Mann likely to dissent in favour of keeping policy on hold. There are two-sided risks to this call, however, with Greene also potentially favouring a hold, while Dhingra may prefer to instead plump for a larger 50bp cut.

The vote split among MPC members is likely to be much more convincing than the narrow 5-4 majority by which this cycle’s first cut, in August, was decided. Instead, this time around, the MPC are likely to vote 8-1 in favour of a 25bp cut, with only external member Mann likely to dissent in favour of keeping policy on hold. There are two-sided risks to this call, however, with Greene also potentially favouring a hold, while Dhingra may prefer to instead plump for a larger 50bp cut.

In any case, guidance accompanying the cut is likely to be broadly unchanged from last time out. Again, the statement is likely to be a broad reiteration of that issued after the September meeting, noting that policy must remain “restrictive for sufficiently long”, and that the Committee will continue to take a data-dependent, and meeting-by-meeting approach to determining the appropriate stance of policy. The GBP OIS curve, incidentally, prices just a 12% chance of another 25bp cut before year-end.

Such pricing owes in large part to the inflationary implications from Chancellor Reeves’ ‘tax and spend’ Budget, outlined at the end of October. This, in conjunction with the dovish repricing of the market rate curve since the August forecast round, is likely to see inflation expectations revised around 0.2pp higher over the next 2 years, though the BoE are still likely to see the 2% target being sustainably achieved over that period.

This latter point is plausible given the continued progress made in removing signs of persistent price pressures from within the economy, as shown by the continued, and relatively rapid, falls in both core, and services, CPI metrics.

Despite this, uncertainties brought about by the Budget, particularly considering the adverse Gilt market reaction to the government’s borrowing plans, are likely to see the MPC plot a relatively cautious path of removing further policy restriction. As such, a quarterly pace of 25bp cuts remains the base case, with Governor Bailey’s recent remarks around policymakers potentially becoming “a bit more activist” in removing restriction looking somewhat folly, given newly emerged upside inflationary risks.

Despite this, uncertainties brought about by the Budget, particularly considering the adverse Gilt market reaction to the government’s borrowing plans, are likely to see the MPC plot a relatively cautious path of removing further policy restriction. As such, a quarterly pace of 25bp cuts remains the base case, with Governor Bailey’s recent remarks around policymakers potentially becoming “a bit more activist” in removing restriction looking somewhat folly, given newly emerged upside inflationary risks.

Consequently, the 25bp cut delivered this week is likely to be the last until next February, though a faster pace of cuts could follow from then onwards, so long as disinflation continues.

For the pound, the November MPC decision is unlikely to be a major event. Given that the GBP OIS curve already fully discounts a 25bp cut, and the Bank are highly unlikely to make any explicit pre-commitments beyond then, there may well be little for participants to get their teeth into. Furthermore, the BoE meeting is sandwiched between the presidential election, and the next FOMC decision, likely limiting long-term conviction given the plethora of event risk for traders to be grappling with.

FOMC PREVIEW - NOVEMBER 2024 MEETING

The FOMC will continue the process of policy normalisation at the November meeting, albeit likely at a slower pace than seen in September, with the base case being for policymakers to deliver a 25bp cut, taking the target range for the fed funds rate to 4.50% - 4.75%, in turn marking the second cut of the cycle. The USD OIS curve, as near as makes no difference fully prices such a cut, while also seeing a roughly even chance of another 25bp reduction at this year’s final meeting, in December.

Though the decision to deliver a 50bp cut last time out was not unanimous, with Governor Bowman preferring a more modest 25bp reduction, the November meeting is likely to see a unanimous vote, with Bowman falling back in line with the remainder of the Committee.

Though the decision to deliver a 50bp cut last time out was not unanimous, with Governor Bowman preferring a more modest 25bp reduction, the November meeting is likely to see a unanimous vote, with Bowman falling back in line with the remainder of the Committee.

Along with such a reduction, the FOMC’s statement guidance is likely to be broadly unchanged from that delivered after the September confab. As such, the policy statement should re-commit to a ‘data-dependent’ and ‘meeting-by-meeting’ approach being taken moving forward.

That said, taking into account the September ‘dot plot’, which pointed to a total of 100bp of cuts in 2024, a 25bp reduction this time out would leave another such cut as the base case for December, were the dots to be adhered to.

Though there are no new economic forecasts due this time around, the US economy has evolved broadly in line with the September SEP since the last policy meeting. This is despite a considerably softer than anticipated +12k October NFP figure though, given the degree to which the data was detrimentally skewed by one-off weather events, policymakers are unlikely to place significant weight on the data.

Though there are no new economic forecasts due this time around, the US economy has evolved broadly in line with the September SEP since the last policy meeting. This is despite a considerably softer than anticipated +12k October NFP figure though, given the degree to which the data was detrimentally skewed by one-off weather events, policymakers are unlikely to place significant weight on the data.

As such, the economic assessment is likely to remain broadly unchanged, with policymakers again referring to a “solid pace” of economic growth, inflation figures which continue provide confidence in a sustainable return towards 2% over the medium-term, and an unemployment rate which “remains low”.

It is also worth noting that the outcome of the presidential election, which may not even be known by the time Chair Powell begins his post-meeting press conference, will have no bearing whatsoever, with Powell likely to do his utmost to stress the FOMC’s independence from political developments, playing such questions with a ‘straight bat’, no matter how much journalists may probe him on the matter.

It is also worth noting that the outcome of the presidential election, which may not even be known by the time Chair Powell begins his post-meeting press conference, will have no bearing whatsoever, with Powell likely to do his utmost to stress the FOMC’s independence from political developments, playing such questions with a ‘straight bat’, no matter how much journalists may probe him on the matter.

That said, the timing of the November FOMC meeting does potentially pose issues for market participants attempting to digest the decision, with electoral uncertainties likely to cloud the outlook considerably. Despite this, participants in the FX arena continue to display a greater focus on growth differentials, than the monetary policy outlook, at this juncture, likely leaving the medium-run path of least resistance to continue pointing to the upside for the greenback.

KEY DATES IN NOVEMBER

GBP

- November 1: Manufacturing PMI (Oct F)

- November 5: Services PMI (Oct F)

- November 7: BoE Decision

- November 12: Labour Market Report (Sep)

- November 14: GDP (Q3 – 1st Est.)

- November 20: CPI (Oct)

- November 22: Retail Sales (Oct), Flash PMIs (Nov)

EUR

- November 4: Manufacturing PMI (Oct F)

- November 6: Services PMI (Oct F)

- November 7: Retail Sales (Sep)

- November 14: GDP (Q3 – 2nd Est.)

- November 19: CPI (Oct F)

- November 22: Flash PMIs (Nov)

- November 29: Flash CPI (Nov)

USD

- November 1: Labour Market Report (Oct), ISM Manufacturing PMI (Oct)

- November 5: ISM Services PMI (Oct), Presidential Election

- November 7: FOMC Decision

- November 8: UMich Sentiment (Prelim. – Nov)

- November 13: CPI (Oct)

- November 14: PPI (Oct)

- November 15: Retail Sales (Oct)

- November 26: FOMC Minutes (Nov)

- November 27: GDP (Q3 – 2nd Est.), Core PCE Prices (Oct)

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.