Currency Forecast - May 2023

April Review & May Risk Events & Themes

Pound Sterling

From disappointing house prices to painfully sticky inflation, there was little to cheer about in the UK economic landscape this month.

Homeowners saw the weakest rate of annual growth in house prices in March, according to April 6 Halifax House Price Index, with prices 1.6% year on year, easing from a 2.1% increase in the previous month.

Though transaction volumes have rebounded to pre-pandemic levels, the spread between home buyer and seller pricing expectations has increased to multi-year highs, as inflated mortgage rates and inflation pressure dampen buying power for would-be homeowners.

And since we’ve gone there, let’s get the obvious out of the way: consumer price inflation continues to smash British households.

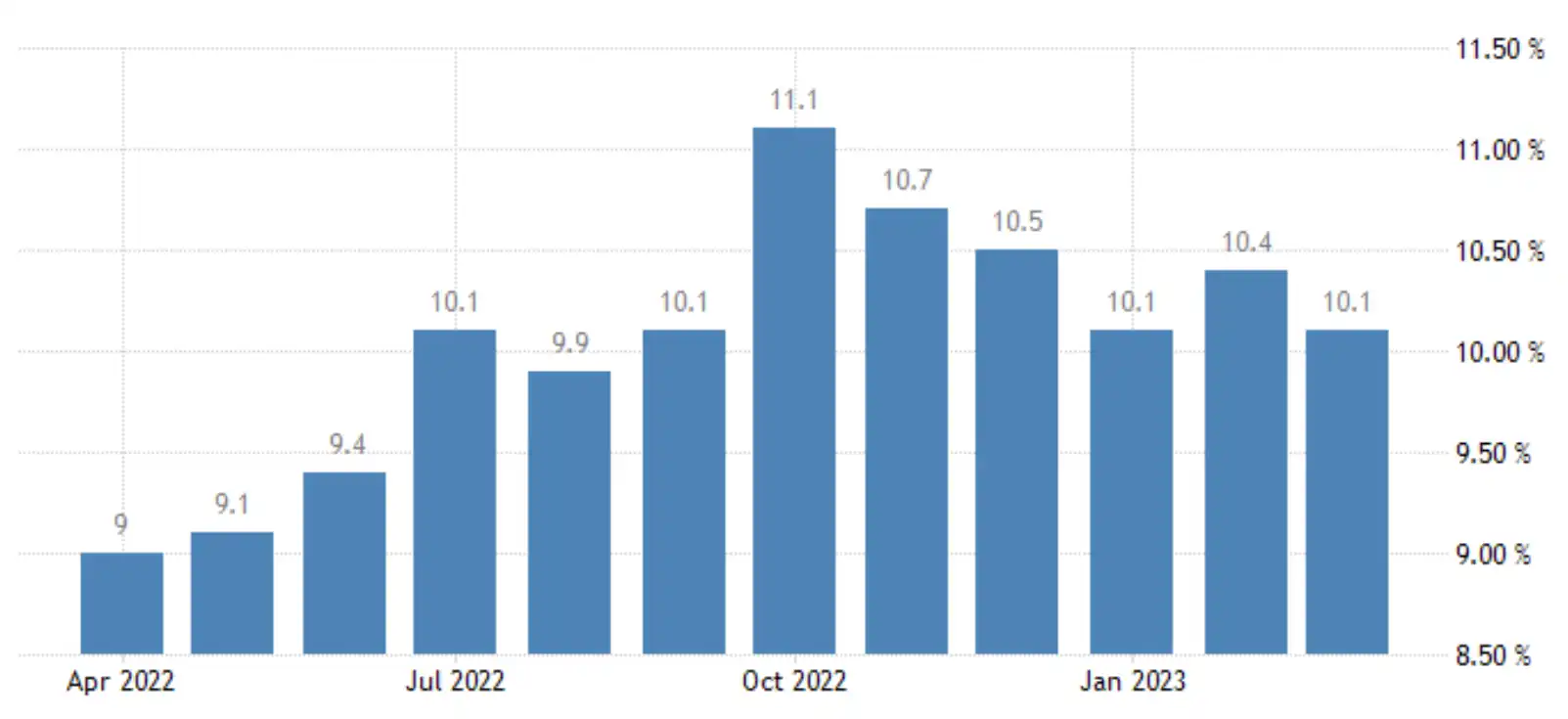

Though there was some easing in the latest read on April 19, year-on-year inflation still remained in the double digits throughout March, while European and US households managed to enjoy some relief.

UK inflation at double digits for seven consecutive months – source: tradingeconomics.com

Food prices were the biggest culprit (alongside rent and utilities), so much so that major UK supermarkets including Sainsbury’s and Tesco have been accused of profiting from greedflation (i.e. exploiting inflation to create excessive profits).

If you ask the Bank of England’s chief economist Huw Pill, however, workers are to blame for demanding higher wages. "Somehow in the UK, someone needs to accept that they're worse off and stop trying to maintain their real spending power by bidding up prices, whether through higher wages or passing energy costs on to customers”, said Pill, to much-deserved outrage.

Meanwhile, gross domestic product ground to a halt in February, per the April 13 read, coming below consensus expectations of 0.1%.

So, what did all this mean for the pound? Higher consumer and tighter employment figures typically make for a cocktail of interest rate hikes, resulting in the market pricing in another 25bps hike in May, which would bring the base rate to 4.5%, with more possibly to come.

International money took this as a bullish signal for the pound, especially with US inflation as low as 5% and the prospect of a dovish Fed pivot on the cards.

Cable hit 1.254, a 10-month high, on April 14, supported by ongoing concerns in the US financial sector that evidently spooked dollar bulls. A few hawkish comments from Federal Reserve member Christopher Waller were enough to cause a dollar rally, sending Cable back down to the 1.24 range.

Cable closes higher – source: capital.com

The pound still had the upper hand against the dollar come the end of the month, closing 1.9% higher at 1.2557.

Euro

The EUR/GBP story differed to the Cable story, influenced by different macroeconomic factors.

Firstly, the annual inflation rate in the euro area, while coming down considerably, remained stubbornly high at 6.9%. Furthermore, core EU inflation, which strips out energy and food, actually hit a record high of 5.7% in March.

EU core inflation, the highest on record – source: tradingeconomics.com

Secondly, it would be reticent not to discuss the lingering effects of the Credit Suisse collapse. The fact that it almost feels like ‘old news’ says it all - while dramatic at the time, the impact on the wider financial services sector has not been as dramatic as some have prepared for.

This all led to a solid bit of upside for the euro in the first half of the month, with further tailwinds emerging on April 13 in the form of slightly better-than-expected industrial production figures (2% year-on-year production growth against a 1.4% forecast), which came as a relief for those fretting about German output.

On the same day, UK GDP figures underwhelmed, causing further euro upside. The EUR/GBP hit a zenith of 0.8863 on April 17, nearly 1% high from the start of the month.

The pair was rather volatile for the rest of April, hitting lows of 0.8791 on April 19 and swinging back to six-week highs of 0.8874 on April 25 before another swing lower on April 27 on the back of a deteriorating industry confidence indicator that from to -2.6 from -0.5 in March.

For all the swings and roundabouts, EUR/GBP was just a tad over 0.2% lower at 0.8767 come the end of April.

Dollar

Dollar depression was the name of the game in April. The US Dollar Index (DXY) fell from 102.256 at the start of the month to 101.28593 by the end, shaving a little under 1% on average against the basket of major foreign currencies.

While there were sure-fire signs of economic cooling – namely the drop in year-on-year inflation to 5% and the biggest decline in producer prices since April 2020 – the primary cause of dollar depression was no doubt the contagion in the financial sector in the wake of March’s spate of banking collapses.

Indicative of such was San Francisco bank First Republic North’s existential troubles. The major regional lender’s stock price crashed 49% on April 25, a day after it revealed its customers had withdrawn US$100bn of deposits during the March crisis.

A devalued greenback made for a strong EUR/USD pair, which added 1.6% to reach 1.101 by the end of the month. GBP/USD fared slightly better, adding 1.9% to close at 1.2557.

Euro gets the upper hand against the greenback – source: capital.com

The US debt ceiling also became a hot topic among US economic circles in the latter half of April. As is always the case with US partisan politics, both sides of the aisle are debating whether to raise the government borrowing limit in order to finance its own obligations.

With weaker tax receipts potentially bringing the US closer to the debt ceiling and the risk of defaulting on certain debt obligations increasing, investors may be feeling more apprehensive about the dollar’s stability.

“As key central bank meetings draw closer, markets appear to favour European currencies to the detriment of the dollar, whose rate advantage is being eroded,” said analysts at ING. Jitters in the US banking story, as quarterly earnings are released, may hit Fed rate expectations before they are channelled through more structurally defensive trades in FX.

May Risk Events & Key Themes

USD

Rate hikes: we’ve had over a month without any rate hikes, so top of the list for US dollar risk factors is May’s Federal Reserve meeting in the coming week. In short, another small hike of 25 basis points is expected by markets - the last of the year - to take the Fed Funds rate to 5.25%. Looking back to the minutes from the last meeting, in March, around 10 days after the collapse of Silicon Valley Bank, the main points were concerns about the stickiness of high inflation, anticipation that banking turmoil would be likely to result in tighter credit conditions for households and businesses, and expectations of a mild recession this year.In the past week, this has been further solidified with GDP data coming in below forecast. With banking problems fresh in mind, several rate-setters pondered pressing pause, while others opted for a smaller hike than previously planned.

First Republic Bank: Now that First Republic Bank has folded, will that lead the Fed to pause? It’s quite possible. FOMC’s deliberations at the last meeting were heavily coloured by fears of a credit crunch, with members acknowledging that banking sector developments had “affected their views of the economic and policy outlook”. Most economists polled by Bloomberg see the tightening in credit conditions brought about by recent banking stresses as at least equivalent to a 25bps hike - so does the Fed even need to hike?

Inflation: if we take a 25bps hike as a given, though, the risk factor moves onto what clues Fed boss Jerome Powell gives about policy intentions for the rest of the year and when rates might start to be cut. Inflation is not cooling as fast as policymakers want (though faster than in the UK) and labour markets remain tight. With a recession seen as more than just possible in 2023, markets are currently pricing in rates being cut as soon as November, while economists forecast the Fed will wait until early next year. Data for the rest of the month will be examined to corroborate the slowing of the economy, with any confirmation putting further pressure on USD.

EUR

Rate hikes: for the European Central Bank, which concludes its policy meeting a day after the Fed, there is little doubt that a hike is coming. But the question is whether it will be 25bps or double that. Back at the March meeting, ECB chief Christine Lagarde revealed there had been a discussion over whether core inflation was already at a turning point, though some members including Isabel Schnabel feel that even if core inflation has peaked this is not necessarily enough to stop hiking. The reason is that inflation may have morphed from a supply-side issue to a demand-side issue.

Next week sees a flood of big data including EU inflation print, credit data and the latest bank lending survey. This is likely to “tip the balance” for the ECB, as predicted by economists at ING, with more benign economic data potentially signalling more hikes. As the ECB is confident that the banking crisis in Europe is contained, policymakers are determined to use rate hikes to fight inflation. “The fact that there are still no signs of any disinflationary process, discounting energy and commodity prices, as well as the fact that inflation has increasingly become demand-driven, will keep the ECB in tightening mode,” said ING. However, with a looming recession in the US and a potential credit crunch in the eurozone, “the risk is high that every next rate hike could turn out to be a policy mistake”.

GBP

Local elections: the Bank of England hike is a week after its US and EU peers, with some big risk events beforehand, including macroeconomic data and political events - the key one likely to be the local elections on 4 May across more than 230 English councils. It is the first major litmus test for Rishi Sunak since he became Prime Minister in October, while also indicating how the Labour Party could fare at the general election expected next year. It remains to be seen how markets view the possibility of a government led by Sir Keir Starmer, though the pound has fallen from above $1.5 when the Tories came to power in 2015 to almost parity last year, so there might be a feeling it can’t do much worse.

Hikes, hikes, hikes: although the BoE appeared to have concluded its tightening cycle, members of the monetary policy committee have stressed that they are keeping their options open, especially if there are more signs of “inflation persistence”. The latest weekly wages and consumer price inflation data both were above expectations, suggesting Threadneedle Street could have one more hike in its locker. The market is now even seeing 0.75%of hikes to a peak of about 5%, following the most recent inflation numbers. Economists also are now confident of a hike on 11 May, with CEBR economist Sam Miley predicting May’s hike will be the last. With policymakers concerned about inflation becoming embedded, and core inflation remaining stubbornly high while some prices such as food are even showing accelerating price growth, the CEBR expects the Bank of England to implement one more rate hike this year in response to these trends, taking the base rate to 4.5%.

Inflation: the MPC makes its decision two weeks before inflation data, its core focus, is released. With committee members stressing that much of the impact of past hikes is yet to feed through, they may want to wait until later in the summer to move again. However, if inflation remains high on 24 May, then confidence about another hike could grow, giving a boost to the pound.

KEY DATES IN APRIL

United Kingdom

- May 2 Manufacturing PMIs, Nationwide housing prices

- May 4 Local elections, S&P Global services PMIs, BoE money and credit, BoE Bailey speech, new car sales

- May 5 S&P Global construction PMI

- May 9 BRC retail sales, Halifax house prices, BBA mortgages

- May 11 Bank of England policy decision, BoE monetary policy report, GDP, industrial production, balance of trade

- May 16 Unemployment, weekly earnings, claimant count

- May 19 GfK consumer confidence, CBI industrial trends

- May 23 S&P Global flash PMIs, public sector borrowing

- May 24 Inflation

- May 26 Retail sales

- May 31 BoE mortgages, consumer credit

EUROZONE

- May 2 Inflation flash, loans to households, loans to companies, M3 money supply, HCOB manufacturing PMI

- May 3 Unemployment

- May 4 ECB policy decision, HCOB services PMI

- May 5 Retail sales

- May 15 Industrial production

- May 16 GDP, balance of trade, employment change, ZEW economic sentiment

- May 17 Inflation final

- May 22 Consumer confidence flash

- May 23 HCOB services and manufacturing flash

- May 24 ECB non-monetary policy meeting

- May 30 Economic sentiment

UNITED STATES

- May 1 S&P Global manufacturing PMI, ISM manufacturing PMI

- May 2 Fed Redbook, JOLTS, factory orders

- May 3 Fed decision, ADP employment, services PMIs (S&P Global and ISM)

- May 4 Balance of trade, non-farm productivity, initial jobless claims

- May 5 Non-farm payrolls

- May 9 IBD/TIPP economic optimism

- May 10 Inflation, budget statement

- May 11 Producer prices, initial jobless claims

- May 12 Import/export prices, Michigan consumer sentiment

- May 15 NY Empire State manufacturing

- May 16 Retail sales, industrial production, NAHB housing market index

- May 17 Building permits, housing starts

- May 18 Initial jobless claims, Philly Fed manufacturing index, existing home sales

- May 23 S&P Global flash PMIs, new home sales, building permits

- May 24 FOMC minutes

- May 25 Initial jobless, Chicago Fed activity index

- May 26 Durable goods, core PCE prices, personal spending/income

- May 30 CB consumer confidence, Dallas Fed manufacturing, S&P/Case-Shiller home prices

- May 31 JOLTs job openings

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our dedicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.