Daily Forex Market Report 15-Nov-2022

Daily Forex Market Report 15-Nov-2022: Euro rises and Sterling gains on the US dollar

Will today’s Euro Area GDP figures pour cold water on the rally?

This morning’s price action provides more fuel to the thesis of a dollar top.

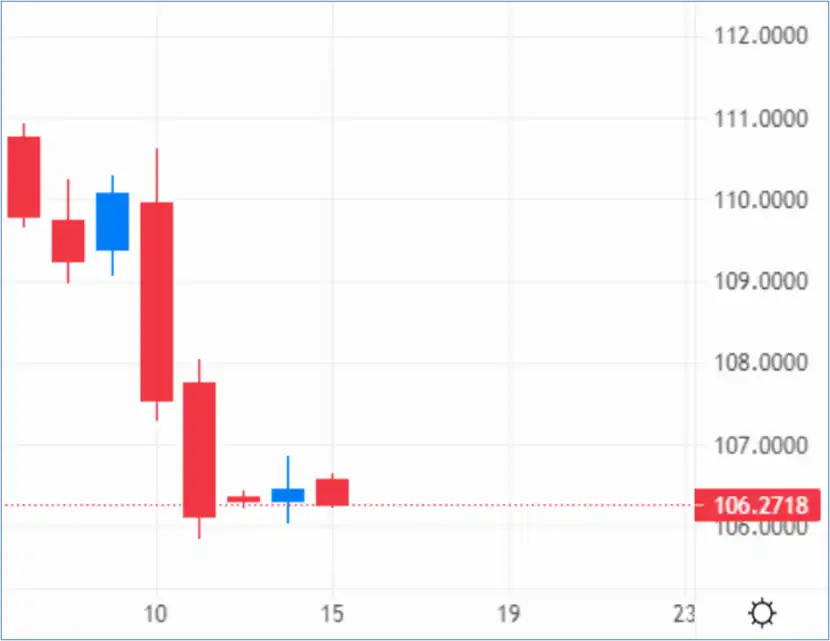

While the US Dollar Index (DYX) did end up marginally higher by the end of yesterday’s session, the index has stayed within the 106 - 106.7 range for the past three days.

Market indecision is demonstrated by the spinning top candlestick patterns formed on the daily chart; a third today would act as further confirmation of a rangebound dollar stuck at three-month lows.

Recent chat performance suggests indecisive DYX sentiment – Source: capital.com

Recent chat performance suggests indecisive DYX sentiment – Source: capital.com

Today’s UK unemployment data came in a tad higher than expected, by edging up to 3.6% in the three months to September of 2022 from 3.5% in the previous period, with average earnings up 6% year on year- still way below an inflation rate that’s predicted to hit 10.5% in tomorrow’s reading.

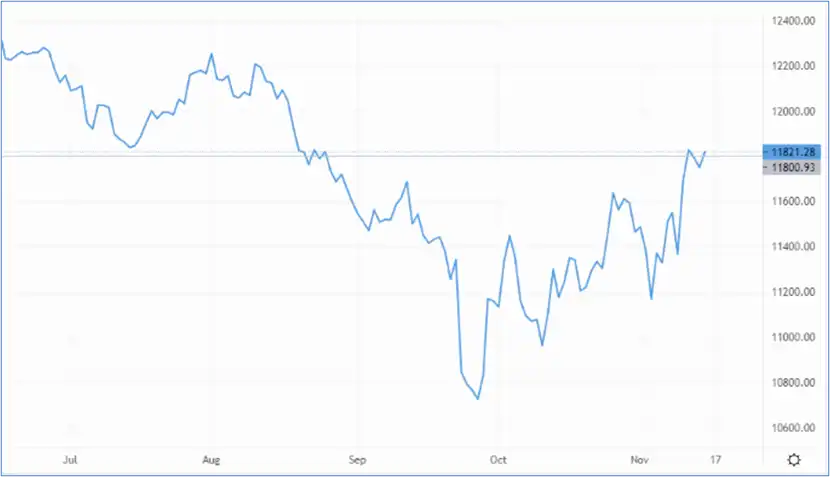

GBP/USD is up more than 50 pips to US$1.18, with most gains added in the hour since the unemployment data release.

Can Cable extend past August highs? – Source: capital.com

Can Cable extend past August highs? – Source: capital.com

EUR/GBP is changing hands at 87.8p, with the euro gaining the upper hand given the past three days of solid gains on the pair

Monday’s Euro Area industrial production reading came as a surprise, having advanced 4.9% from a year earlier in September 2022, easily beating the 3.3% forecast.

While that did little to stir momentum in the euro yesterday, the EUR/USD pair is definitely rallying today. Having added 0.6% so far, the pair has cleared a four-month high of US$1.038.

Euro area GDP figures due this morning are expected to be grim; we’ll see if that pours cold water on the euro’s bullish performance.

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our decicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.