Daily Forex Market Report 22-Nov-2022

Daily Forex Market Report 22-Nov-2022: USD loses some of its gains, China 1st Covid death in 6 months

Sharp drop in German producer prices interpreted as sign of a big recession ahead added to EUR weakness

The US dollar is giving up some of its recent gains on Tuesday, with the New Zealand dollar one of the notable upwardly mobile pairs ahead of an expected aggressive rate hike tomorrow.

For currency traders who were not too distracted by the World Cup football, it has been a relatively quiet 24 hours.

China and the implications for a further handbrake on global growth has been a big focus as a return to lockdowns are anticipated in the People’s Republic following the weekend news that they’d had their first Covid death in six months. The biggest currency move over the past day has been the dollar-rouble, aka Barney, up 3.3%, with nothing else moving much more than 0.5%.

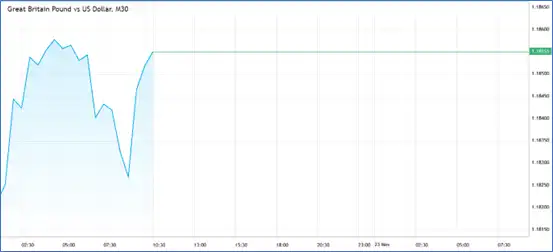

For the pound, after a down and up day against USD yesterday, it is up 0.2% today at 1.1847, and flat against the euro at 0.8666.

EUR/USD is also flat at 1.02624 after the single currency yesterday fought back from the decline seen in the second half of last week.

Yesterday, a sharp drop in German producer prices was interpreted as a big recessionary sign and added to the EUR weakness.

With a national holiday in Japan, USD/JPY is also taking a bit of a breather at 141.847, having wriggled from below 139 just over a week ago.

Events and data to watch today include a speech from Reserve Bank of Australia Governor Lowe this morning, eurozone current account numbers this morning and consumer confidence later, Canada housing and retail figures, while in the US it’s the Redbook index and Richmond Fed manufacturing index.

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our decicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.