Daily Forex Market Report 24-Nov-2022

Daily Forex Market Report 24-Nov-2022: GBP tops 1.21, USD Falls amid Fed Minutes

Hong Kong Dollar bears the Brunt of Fed

US Dollar

The US dollar fell to its lowest in over a week after the release of the latest Federal Reserve meeting minutes, but there are buyers for the greenback this morning while the US goes on holiday for Thanksgiving.

Minutes from the last Federal Open Market Committee meeting confirmed most members of the rate setting group believe they should start slowing the pace of rate hikes soon, which was pretty much known.

Pound Sterling

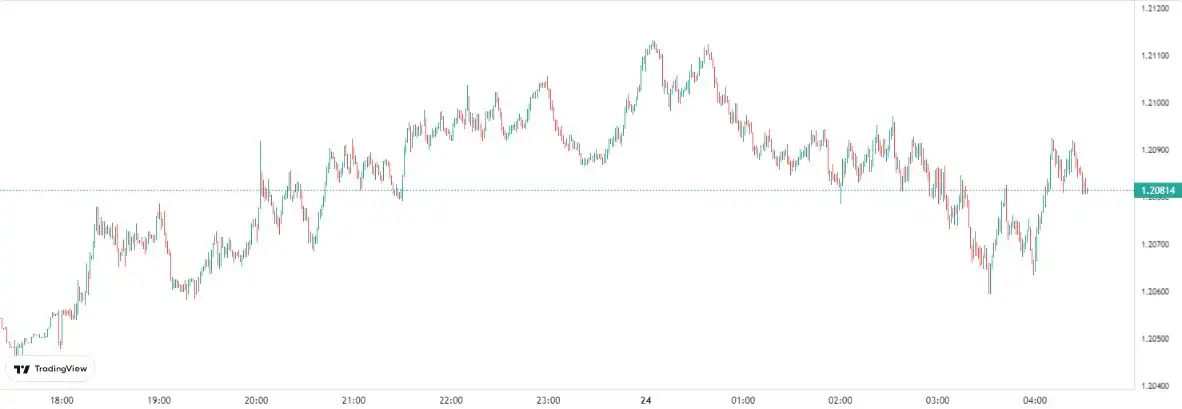

Sterling topped 1.21 for the first time since mid-August, while the euro butted up against recent highs above 1.044.

Sterling topped 1.21 for the first time since mid-August - Source Trading View

Sterling topped 1.21 for the first time since mid-August - Source Trading View

Euro

With EUR pushing through its recent highs as well as the 200-day moving average, some traders suggested this could herald further US dollar weakness.

Trading in the single currency this morning has been weaker, with EURUSD up just 0.2% at 1.0416 despite Germany’s most prominent leading indicator, the Ifo index, staging a strong rebound.

Hong Kong Dollar

The Hong Kong dollar was source of much chatter after absorbing plenty of pain this year as the Fed hikes rates.

Hedge fund billionaire Bill Ackman said on Twitter that he has taken a “large notional short position” against the HKD in view that its peg with the dollar cannot last much longer.

“The peg no longer makes sense for Hong Kong and it is only a matter of time before it breaks,” he added in a tweet – echoing previous bets against the peg by George Soros and Kyle Bass in the past that both failed.

The Hong Kong Monetary Authority has a mandate to keep the currency trading in a range of HK$7.75 to HK$7.85 to the USD, which it has managed so far.

HKD has traded at the weaker end of the peg range for most of the year but pressure has eased amid indications that the Fed might be slowing the pace of rate hikes, leading the USD to HK$7.81 from the HK$7.85 level it has traded since January.

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our decicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.