Daily Forex Market Report 28-Nov-2022

Daily Forex Market Report 28-Nov-2022: GBP remains strong against USD, despite slight weekend dip

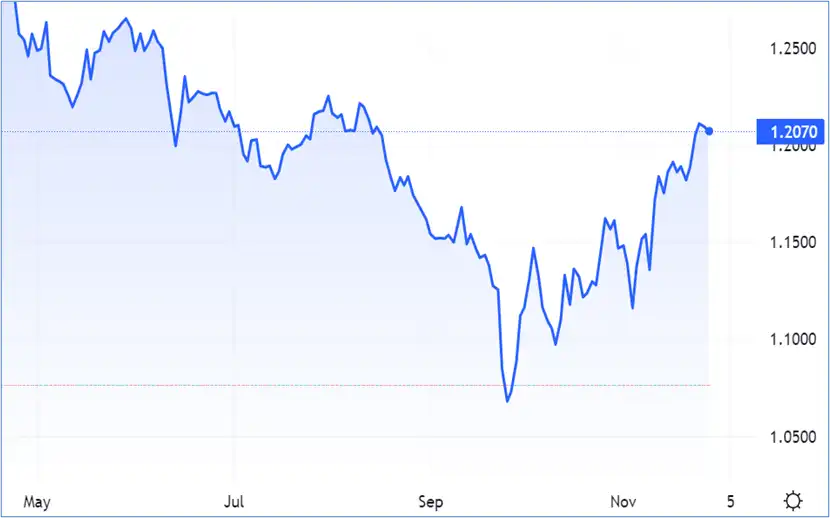

Cable pushed slightly higher this morning after losing 30 pips during the Sunday session, while UK 10-year gilt yields fell in unison by a quarter of a percent to 3.11%.

Though Sterling is lower against last week’s highs, the GBP/USD pair is still sitting strong at 1.207, supported by a weaker greenback as the market considers a slower pace of rate hikes from the US Federal Reserve following November’s softer-than-expected CPI print.

GBP/USD going strong, despite small Weekend dip – Source: dailyfx.com

GBP/USD going strong, despite small Weekend dip – Source: dailyfx.com

The US Dollar Index (DXY) pared back 0.2% in this morning’s Asia trading session, continuing a bearish trend following the release of the Federal Open Market Committee’s minutes last Wednesday.

A majority of Fed officials judged that a slowing in the pace of the fed funds rate increase would soon be the right course of action, prompting cautious sentiment towards the greenback.

EUR/USD is changing hands at 1.037, an incremental gain against the day. The pair remains buoyant due to a persistently hawkish attitude from the European Central Bank.

The euro has been trapped in a two-week losing streak against the pound, with further losses this morning bringing the EUR/GBP pair down to 85.93p.

A quiet economic calendar is scheduled for this Monday, apart from ECB President Christine Lagarde’s speech before the Committee on Economic and Monetary Affairs (ECON) of the European Parliament in Brussels.

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our decicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.