Daily Forex Market Report 30-Nov-2022

Daily Forex Market Report 30-Nov-2022: GBP opens higher against USD, shows weakness against euro

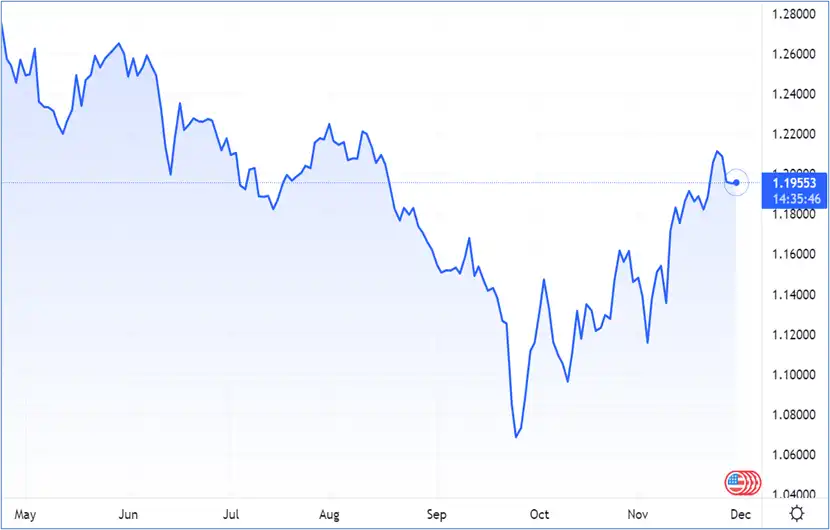

GBP/USD opened this morning at 1.194 after retreating from yesterday’s intraday high of 1.206. The pair has since gained just over 10 pips, thus is currently changing hands at 1.195.

Sterling similarly fell against the euro, with the EUR/GBP pair opening at .864 after gaining on Monday’s intraday low of .860.

Tepid UK mortgage data may have contributed to the slump- approval numbers of 60,000 came in 3,000 fewer than expected, while total lending of £4bn was 30% lower than forecast.

With higher mortgage rates expected to kick in in the coming months, demand is expected to take even more of a hit.

Can Cable close the session higher after four straight days of losses? – Source: tradingview.com

Can Cable close the session higher after four straight days of losses? – Source: tradingview.com

This morning’s British Retail Consortium shop price inflation data spelled bleak news for consumers- prices shot up 7.4% in November, above the three-month average of 6.5%, making for a record rate since the index started in 2005.

Meanwhile in the euro area, today’s yearly inflation data is expected to come in at 10.3%. A 0.3% cut back from October’s reading yes, but still far above reasonable levels whichever way you cut it.

Yet with consumer price expectations improving for the first time since February, perhaps there could be some surprises in store.

Euro sentiment seems to have improved this morning. In addition to gains against the pound, after five straight days of losses, the EUR/USD pair has jumped 0.25% to 1.035 in this morning’s Asia session.

With a busy day on the US calendar, the US Dollar Index (DXY) is currently sitting at 106.24, having dipped 0.17 in today’s trading session so far.

Quarterly GDP growth is expected to come in at 2.6%, while a slew of mortgage, retail spending and home sales should give a clearer picture of the US’s economic direction.

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our decicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services include but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.