Daily Forex Report 03-Nov-2022

Daily Forex Report 03-Nov-2022: US Dollar leaps ahead following hike, Euro gains support against GBP

Will the hawks force BoE forward once again?

As expected, the US Federal Reserve raised interest rates by 75 bps yesterday, marking the fourth straight jumbo hike in a row.

The market is starting to price in a looser policy, i.e. 25 to 50 bps, according to Daniele Antonucci, chief economist at Quintet Private Bank.

Antonucci said: “The important bit was that the central bank acknowledged the substantial cumulative monetary policy tightening and the likely further impact on the economy. These changes in the statement suggest that the Committee is probably leaning towards slowing the pace of rate hiking to 50 bps at the December meeting.”

Unsurprisingly, this propelled the greenback forward. The GBP/USD pair is currently at nine-day lows of US$1.136.

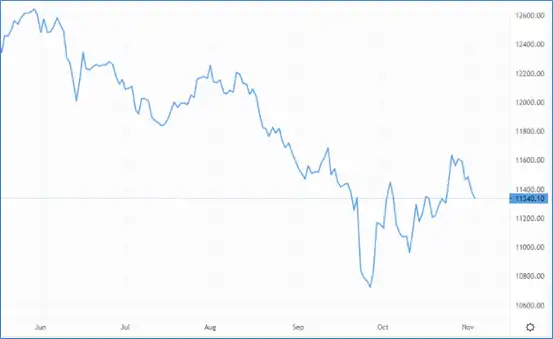

Cable gears up for today’s BoE rate decision – Source: capital.com

Cable gears up for today’s BoE rate decision – Source: capital.com

But it was the euro that took the hardest beating, having closed the Tuesday session 64 pips lower and dipping another 26 pip in this morning’s Asia session so far.

At US$0.978, the EUR/USD pair has returned to two-week lows.

EUR/GBP is finding more support; the pair is currently changing hands at 86.18p having closed higher yesterday.

That could change when the Bank of England announces its interest rate decision later today.

Expectation is for another jumbo 75 bps hike, and anything softer could see a cooling off for the British pound.

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our dedicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services include but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.