Daily Forex Report 04-Nov-2022

Daily Forex Report 04-Nov-2022: GBP struggles against USD as BoE faces Fed hawks

But sterling has recovered some ground this Friday after yesterday’s nosedive

Sterling had an ugly day yesterday, despite interest rate decisions from the Bank of England and the US Federal Reserve coming in as expected.

Both tossed another 75 bps hike into the fire, though the BoE’s rhetoric signalled a looser policy on the horizon.

In contrast, Fed chair Jerome Powell suggested that the terminal rate (i.e. the rate at which the Fed will draw a line in the sand) will actually be higher than expected as the bank battles to get inflation down to the 2% target.

It was these contrasting game plans that cause the pound to dip to a 13-day low of US$1.114.

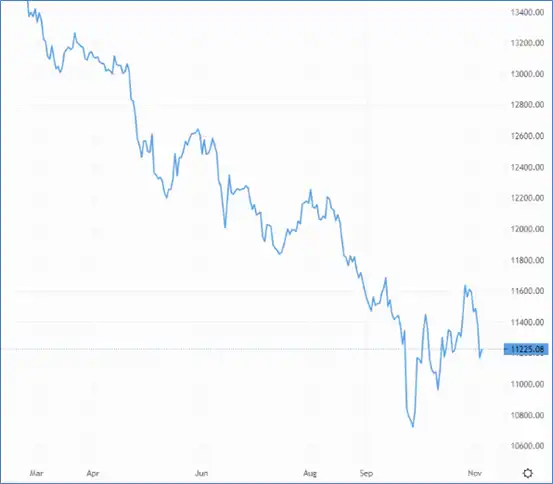

A hawkish Fed could see the pound fall further against the US dollar – Source: capital.com

A hawkish Fed could see the pound fall further against the US dollar – Source: capital.com

But this morning has seen a correction of sorts as the bulls stepped in.

With half a percent added to GBP/USD so far, the pair is currently changing hands at US$1.121.

Sterling similarly dipped against the euro yesterday, with a hefty 1.25% added to the EUR/GBP pair resulting in a nine-day high of 87.4p.

A correction has begun in Friday’s Asia trading session, pushing the pair back to 87.1p.

Sterling’s dip and recovery was also played out against the Japanese yen and the Swiss franc.

The euro continues to struggle against the US dollar. Despite some incremental gains this morning, EUR/USD has lost over 1.8% this week and is currently changing hands at US$0.978.

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our decicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services include but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.