Daily Forex Report 08-Nov-2022

Daily Forex Report 08-Nov-2022: US Dollar down against GBP as mid-term elections gear up

Euro bulls eye parity opportunity on a weaker US Dollar Index

A lot of noise is being made about the mid-term elections in the US, but regardless of outcome, fiscal policy is unlikely to be affected; the Federal Reserve will charge along with its inflation-driven rate hikes whether the chambers turn red, blue or gridlocked.

But the greenback weakened in anticipation of the result anyway, with GBP/USD adding 1.5% in yesterday’s session.

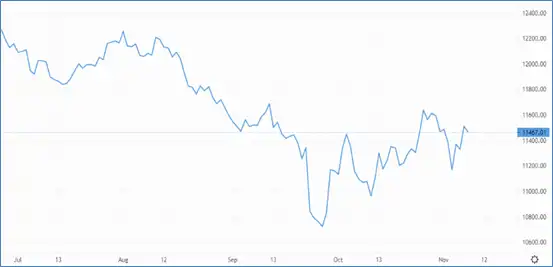

Cable has drawn back 0.4% to US$1.147 in this morning’s Asia session, with no clear path laid out for the day.

GBP/USD: A bullish opportunity amid mid-terms furore? – Source: capital.com

GBP/USD: A bullish opportunity amid mid-terms furore? – Source: capital.com

However, Michael Wilson, the top-ranked strategist at Morgan Stanley, expects an equities rally if polls prove accurate and the Republicans secure at least one chamber.

That could come at the expense of the Dollar Index (DYX), which at 110.54, is already weaker against the five-day period.

Today could be an opportunity for euro bulls to push EUR/USD back above parity – where it’s temptingly close – should sentiment turn against the greenback.

Parity was briefly touched toward the end of yesterday’s session, but the bears pushed the pair back down to its current exchange price of US$0.999.

Sterling is currently going for 87.09p against the euro after a bearish performance yesterday following a monthly fall of -0.4% in the Halifax House Price Index.

Today’s economic calendar is pretty clear, apart from Euro Area retail sales which are expected to show a -1.5% decline year on year.

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our decicated team of experts can help you manage and understand you exposure or risk.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.