ECB Announcement, Euro dips, softer USD supports GBP against losses

Daily Forex Report 28-Oct-2022: ECB Announcement, Euro dips, softer USD supports GBP against losses

Hikes were priced in, but potential for looser EU forward policy sent EUR/USD back below parity

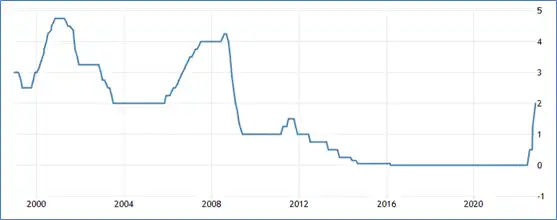

As expected, the European Central Bank upped interest rates by 75 bps, bringing the base rate to 2%- the highest since 2009.

Investors had already priced this hike in, but speculation of a dovish pivot likely caused the euro retracement that we saw.

However, “we are very much turning our back on forward guidance,” said ECB president Christine Lagarde, so nothing is set in stone.

Eurozone base rate hits a 14-year high – Source: Trading Economics

Eurozone base rate hits a 14-year high – Source: Trading Economics

Following yesterday’s meeting, the EUR/USD pair from US$1.09, cruised below parity, and settled at US$0.99.

EUR/GBP shed 70 pips to drop to a clean 86p, although some support in this morning’s Asia hours allowed the pair to drag itself up to 86.2p.

A softer US dollar has allowed the pound to gain, though positioning remains volatile – Source: capital.com

A softer US dollar has allowed the pound to gain, though positioning remains volatile – Source: capital.com

The UK received some fairly bleak economic data in the form of a 6% drop in car output, as supply-chain issues and soaring energy costs bottlenecked the sector.

But a softer US dollar has cushioned the GBP/USD pair somewhat, as currently sits at US$1.154.

The Bank of Japan is not budging on its ultra-loose monetary policy, despite revising its inflation forecast up to 2.9% from 2.3%.

As such, the yen remains weak against the US dollar despite some recent clawbacks, with the USD/JPY pair currently changing hands at 146 yen.

In a market roiled by dovish speculation, the euro slips. Sterling is cushioned by a softer US dollar.

How can I manage my FX risk?

Understanding your FX risk and exposure is paramount to your bottom line. Contact Currency Solutions today and find out how we can help you with:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

Click here for find out more.