ECB Preview – April 2025 Meeting

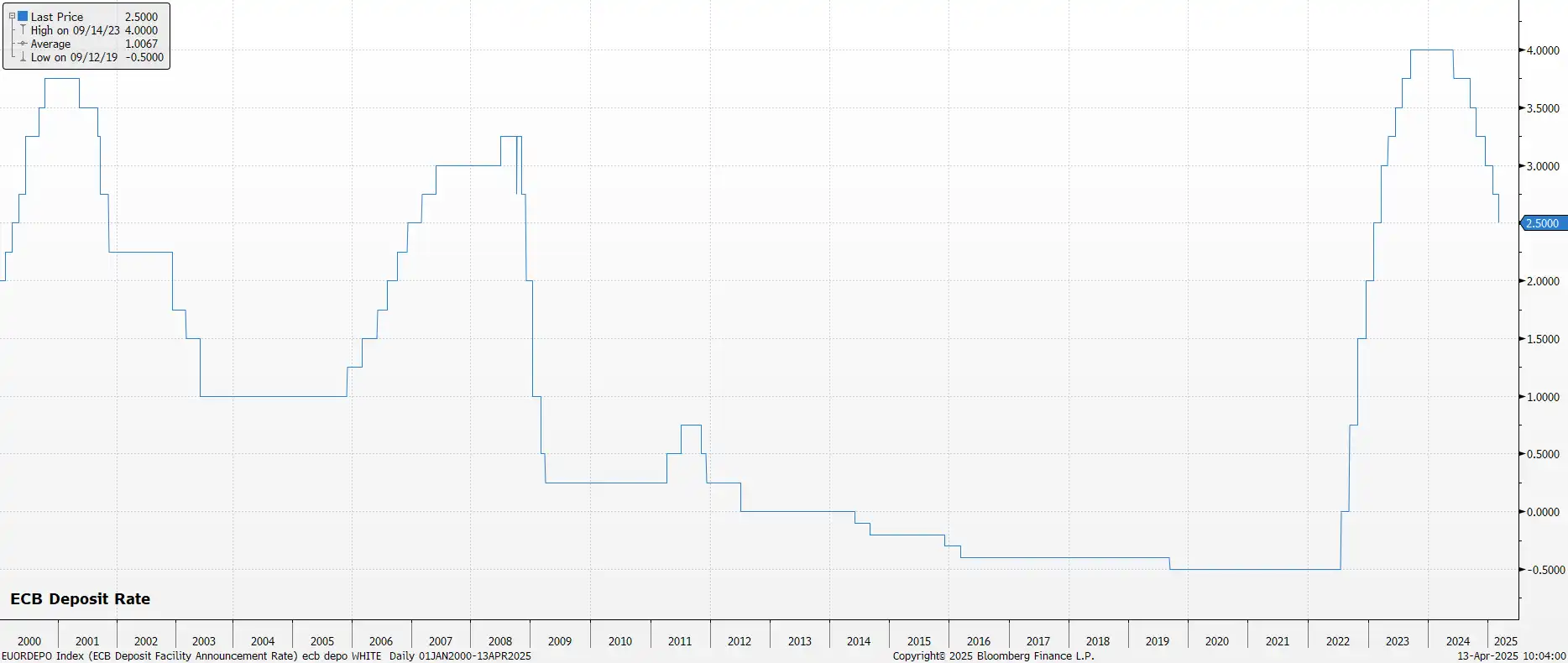

The ECB will likely continue to ease policy at the April meeting, delivering a 25bp cut to the deposit rate, in turn taking rates to 2.25%, marking the seventh rate cut of the cycle. Money markets, per the EUR OIS curve, fully discount such a move at this meeting, as well as two further such cuts by the end of the year.

That decision, however, seems unlikely to be a unanimous one, with disagreement on the appropriate policy course growing among members of the Governing Council, despite downside economic risks also mounting. Austrian representative Holzmann, for instance, has been a vocal opponent of further easing at this stage.

Despite that, guidance accompanying the ECB’s latest decision is likely to broadly unchanged from that issued last time out. Consequently, the accompanying policy statement should reiterate that policymakers will continue to take a ʻdata-dependent’ and ʻmeeting-by-meeting’ approach to future decisions, with policy not being on any sort of ʻpre-set’ course. Furthermore, the statement will likely repeat the line from March that rates are “becoming meaningfully less restrictive”, with the deposit rate now within the range of estimates for the neutral rate.

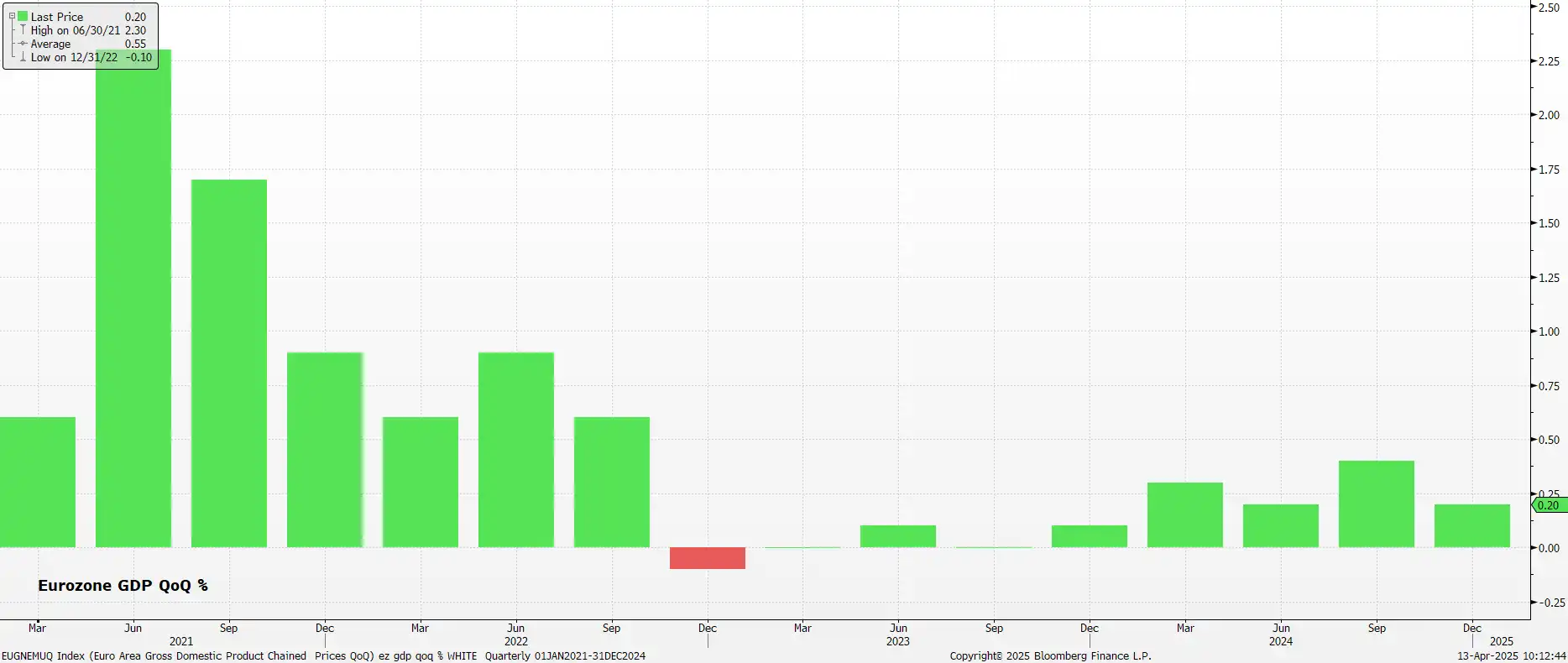

Though no updated forecasts are due this time around, the macroeconomic has clearly shifted significantly since the last confab at the beginning of March. Chiefly, downside risks facing the eurozone economy have mounted significantly since the imposition of President Trump’s ʻreciprocal’ tariffs, even if the levy has been halved – for 90 days – from the initially announced 20%.

Even this reduced levy, though, will be a significant hit to the already-anaemic growth being seen in the eurozone, particularly considering the 25% levies on automobiles, steel, and aluminium which remain in place. Furthermore, the 3-month pause has exacerbated, rather than alleviated, uncertainty, likely prompting a further hit to the bloc’s growth prospects.

Amid those weaker growth prospects, the likelihood of a sustained undershoot of the 2% inflation aim has also mounted, particularly amid signs that stubborn services price pressures within the bloc are finally beginning to abate.

Consequently, it seems increasingly likely that the ECB will need to cut deeper, and faster than had previously been expected, even if they are no longer the ʻonly game in town’, with eurozone fiscal policy finally becoming more expansionary.

At the post-meeting press conference, though, President Lagarde is unlikely to explicitly guide towards any particular policy path, instead sticking resolutely to the line that policy will continue to be made in a ʻdata-dependent’ fashion. It’s likely that the Governing Council would rather wait until the next meeting in June, which coincides with a new round of staff macroeconomic projections, and by which point greater trade clarity may have been obtained, before making more concrete remarks on the policy outlook. Still, the probability of rates now needing to move below neutral, and into outright ʻeasy’ territory, has grown significantly, and now seems basically a ʻdone deal’.