ECB Preview – December 2024 Meeting

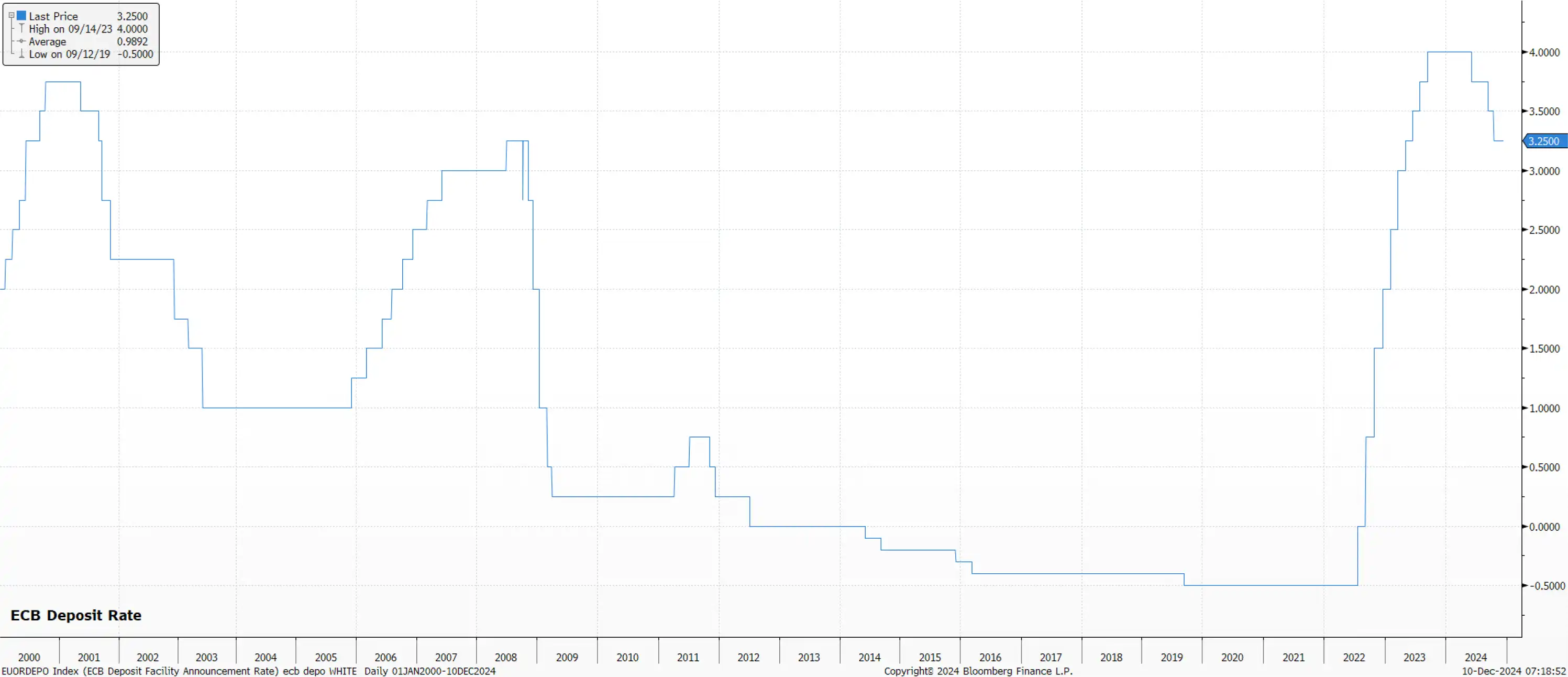

The European Central Bank (ECB) is poised to continue its measured pace of monetary policy easing, with a 25bp deposit rate cut at the December meeting, bringing the rate to 3.00%. While markets marginally anticipate the possibility of a more aggressive 50bp cut, this seems unlikely given recent ECB communications.

The macroeconomic context confronting the ECB remains complex and challenging.

The macroeconomic context confronting the ECB remains complex and challenging.

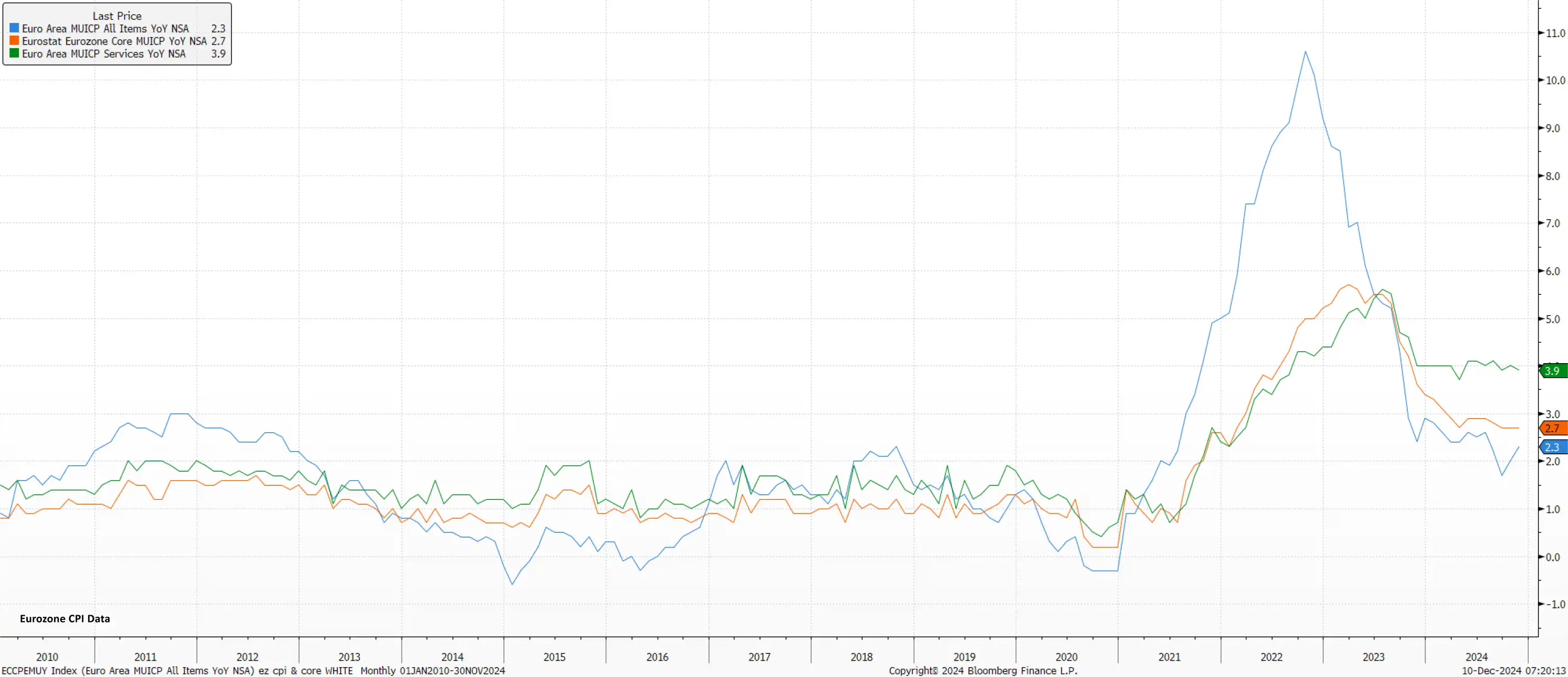

Disinflationary progress has been bumpy of late, with headline inflation having re-accelerated to 2.3% in November, driven primarily by higher energy prices. Core inflation remains stubborn, holding steady at 2.7%, with services inflation persistently hovering around 4% - all metrics still exceeding the ECB's 2% target, and showing some concerning signs of price pressures becoming embedded.

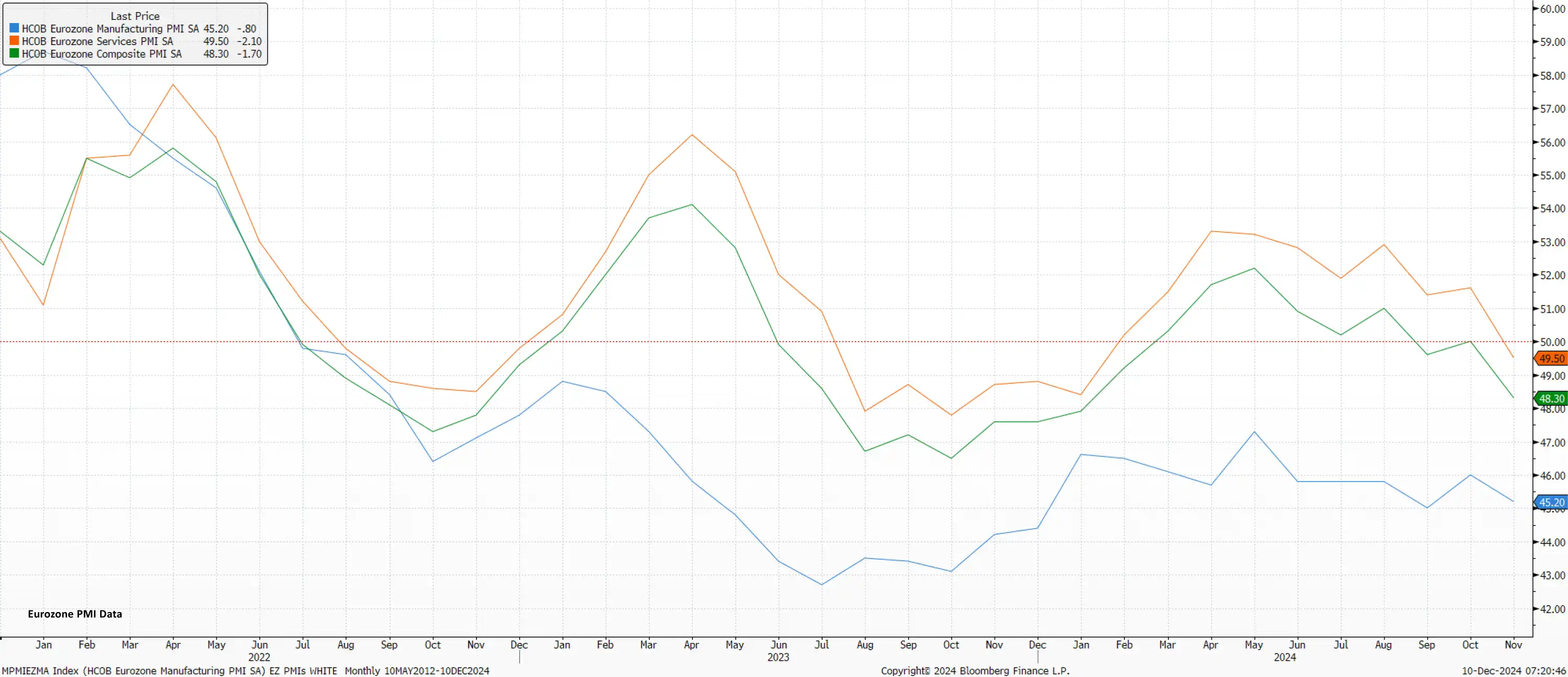

Simultaneously, the eurozone's economic momentum has significantly weakened. November's PMI surveys pointed to a contraction across the board, with the composite PMI dropping to a 10-month low of 48.3. Leading indicators suggest minimal prospects of immediate economic recovery, with new orders declining for six consecutive months and business confidence at a 12-month low.

Compounding these challenges are multiple external and domestic risks. The Chinese economic slowdown continues, with authorities seemingly more focused on financial market stabilization than economic stimulation and failing to deliver on expected levels of fiscal stimulus. The impending return of Donald Trump to the White House threatens substantial trade tariffs and a potential renewed trade war; meanwhile, the eurozone remains exposed to ongoing geopolitical tensions in the Middle East and Ukraine, which present further downside risks.

Domestically, political instability in both France and Germany adds uncertainty. German elections are due to be held early in 2025, while France's government has collapsed, with the budget deficit on track to reach 6% of GDP, substantially exceeding EU limits.

The ECB's upcoming macroeconomic projections are expected to remain broadly unchanged from September, albeit with downside risks for both growth and inflation. The projections will likely forecast overly-optimistic GDP growth of 1.3% in 2025 and 1.5% in 2026, with inflation still seen returning to the 2% target by Q2 2025.

The base case, looking forwards, remains that policymakers will deliver 25bp cuts at each of the next five meetings, reducing the deposit rate to a neutral 2% by early June 2025. However, risks to this view tilt dovishly, and towards the possibility of more rapid rate cuts.

The critical policy debate for 2025 will centre on whether rates should descend below the neutral level into explicitly accommodative territory - a move that appears increasingly probable unless economic conditions substantially improve by mid-2025.