EUR/GBP Slumps due to BoE Dovish Bets

EUR/GBP edged lower to near 0.8497, as dovish remarks from the European Central Bank (ECB) weighed on the euro. On Thursday, Olli Rehn, a policymaker at the ECB and governor of the Finnish central bank, indicated that the central bank should not overlook the potential for a "larger interest rate cut." Today, the ECB's Executive Board member Piero Cipollone commented that "trade policy uncertainty could reduce business investment."

He also added, "The potential for sudden stops in capital flows, payment disruptions, and volatility in currency markets requires robust contingency planning. There are further signs that geopolitical considerations increasingly influence investment decisions in gold." Germany's GfK Consumer Climate Indicator rose to -20.6 as May 2025 approached, up from a slightly revised -24.3 in the previous period, exceeding market expectations of -26.0 and marking the highest level since November 2024. The annual Consumer Price Index (CPI) in Spain stood at 2.2%, a slight decrease from 2.3% in March, driven by lower energy and fuel prices compared to the same period last year. Spain's Gross Domestic Product (GDP) grew by 0.6%, a slight slowdown from the revised 0.7% growth in the previous quarter and falling short of the expected 0.7% increase. Moreover, market anticipation that the European Central Bank (ECB) will adopt a dovish stance is mainly influenced by the possibility that Eurozone inflation may fall short of the ECB's 2% target, which will continue to affect the shared currency.

On the other hand, the sterling fell against the euro due to the market sentiment confidence that the Bank of England (BoE) would reduce interest rates at the May policy meeting, which was supported by easing inflation expectations in the United Kingdom and heightened global economic tensions. On Friday, Bank of England policymaker Megan Greene stated that a potential trade war could have a "net disinflationary" impact on the economy during a discussion with the Atlantic Council think tank. She also raised alarms about "weak productivity" and the "risks to the labour market" stemming from an increase in employer contributions to social security schemes. On the data front, UK Retail Sales increased by 0.4% month-on-month in March, compared to a rise of 0.7% prior. This figure surpassed the market consensus of a decline of 0.4%. On an annual basis, Retail Sales jumped by 2.6% in March, compared to a rise of 2.2% previously, which is better than the estimation of 1.8%.

In today's session, the German GfK Consumer Climate Index and Spanish Flash CPI, along with BoE's Dave Ramsden speech, will shape the market sentiment around the EUR/GBP exchange rate.

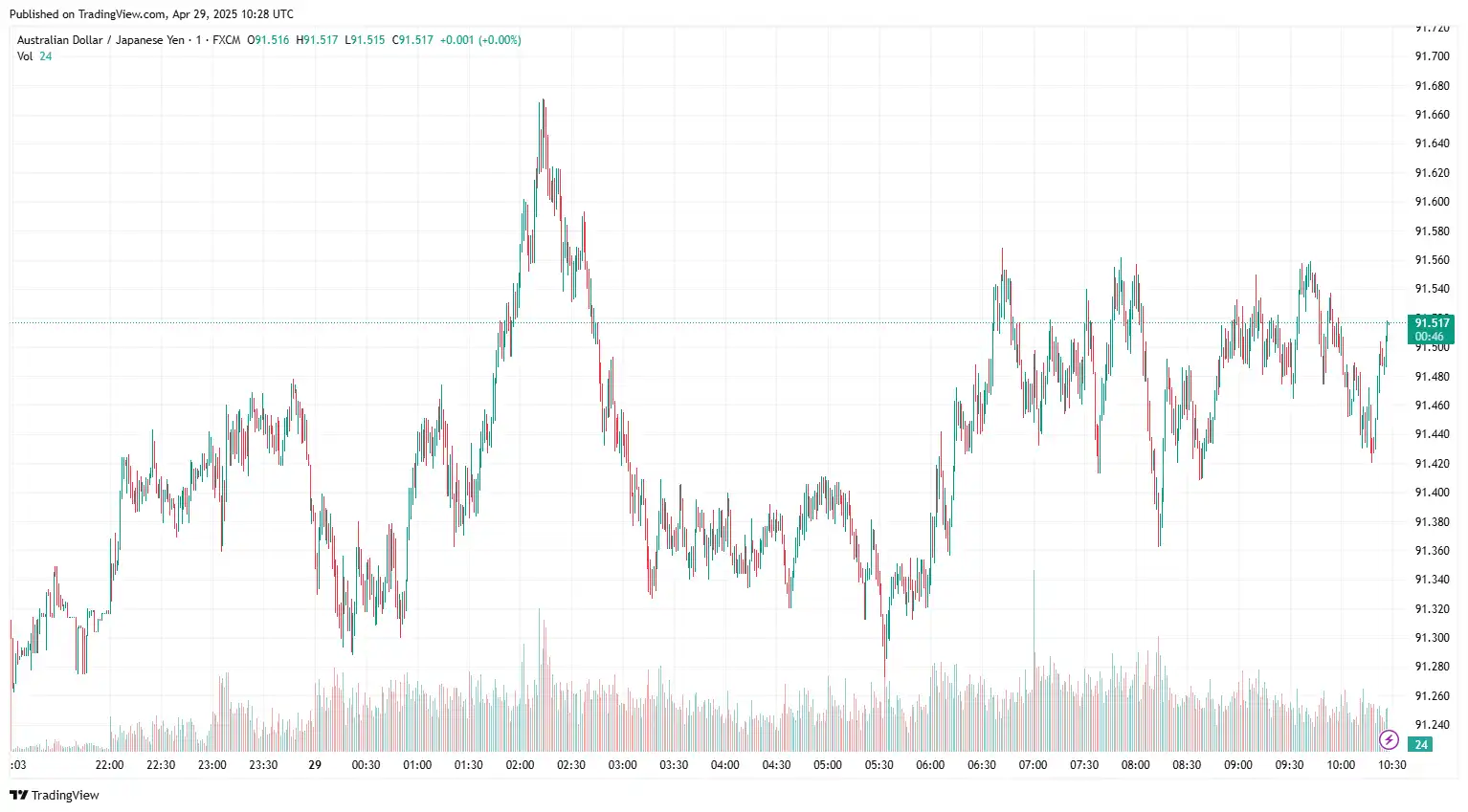

AUD/JPY Fluctuates Amid Mixed Market Sentiment

AUD/JPY hovered near 91.46 as investors brace for the Bank of Japan (BoJ) interest rate decision on Thursday. However, hopes for the de-escalation of the US-China trade war and growing concerns about the economic risks from US tariffs have tempered the bets to keep interest rates steady amid risks to the fragile economy from US tariffs. Investors will closely monitor the BoJ's updated economic projections for insights on the timeline for the next rate hike, which will influence the yen's movements. Atsushi Mimura, Japan's Vice Minister for International Affairs, denied claims that Bessent informed Finance Minister Katsunobu Kato during last week's meeting that a weaker US Dollar and a stronger yen are desirable.

Bessent stated on X that he had productive discussions with his Japanese counterpart, raising optimism for a potential US-Japan trade agreement. Friday's Tokyo Consumer Price Index (CPI) for April rose 3.5% YoY, up from 2.9% the previous month, according to the Statistics Bureau of Japan. The Tokyo CPI, excluding fresh food and energy, was 2.0% in April, an increase from 1.1% in March. The Tokyo CPI, excluding fresh food, increased 3.4% YoY in April, surpassing the expected 3.2% and rising from 2.4% in the prior month. Russian President Vladimir Putin announced an unexpected unilateral ceasefire in the Ukraine conflict for 72 hours starting from May 8. However, Ukraine's President Volodymyr Zelensky rejected this three-day truce. This scenario sustains the geopolitical risk premium and could further benefit the safe-haven JPY.

On the other hand, rising expectations that the Reserve Bank of Australia (RBA) will reduce interest rates by 25 basis points in May's policy meeting continue to pressure the Australian Dollar (AUD). Westpac recently forecasted that the RBA would lower rates by 25 basis points at its meeting on May 20, reinforcing ongoing market speculation. Additionally, increasing economic uncertainties and escalating concerns regarding the global trade outlook may further weaken the risk-sensitive Aussie. Globally, China's decision to exempt some US imports from its 125% tariffs sparked optimism that the lingering trade disputes between the world's two largest economies might soon be resolved, lifting market sentiment. However, this optimism waned when a Chinese embassy spokesperson stated to a prominent news outlet that "China and the US are not engaging in any discussions or negotiations about tariffs" and urged Washington to "stop generating confusion."

Broader market sentiment around the trade tariff negotiations will remain the primary driver for the AUD/JPY exchange rate.

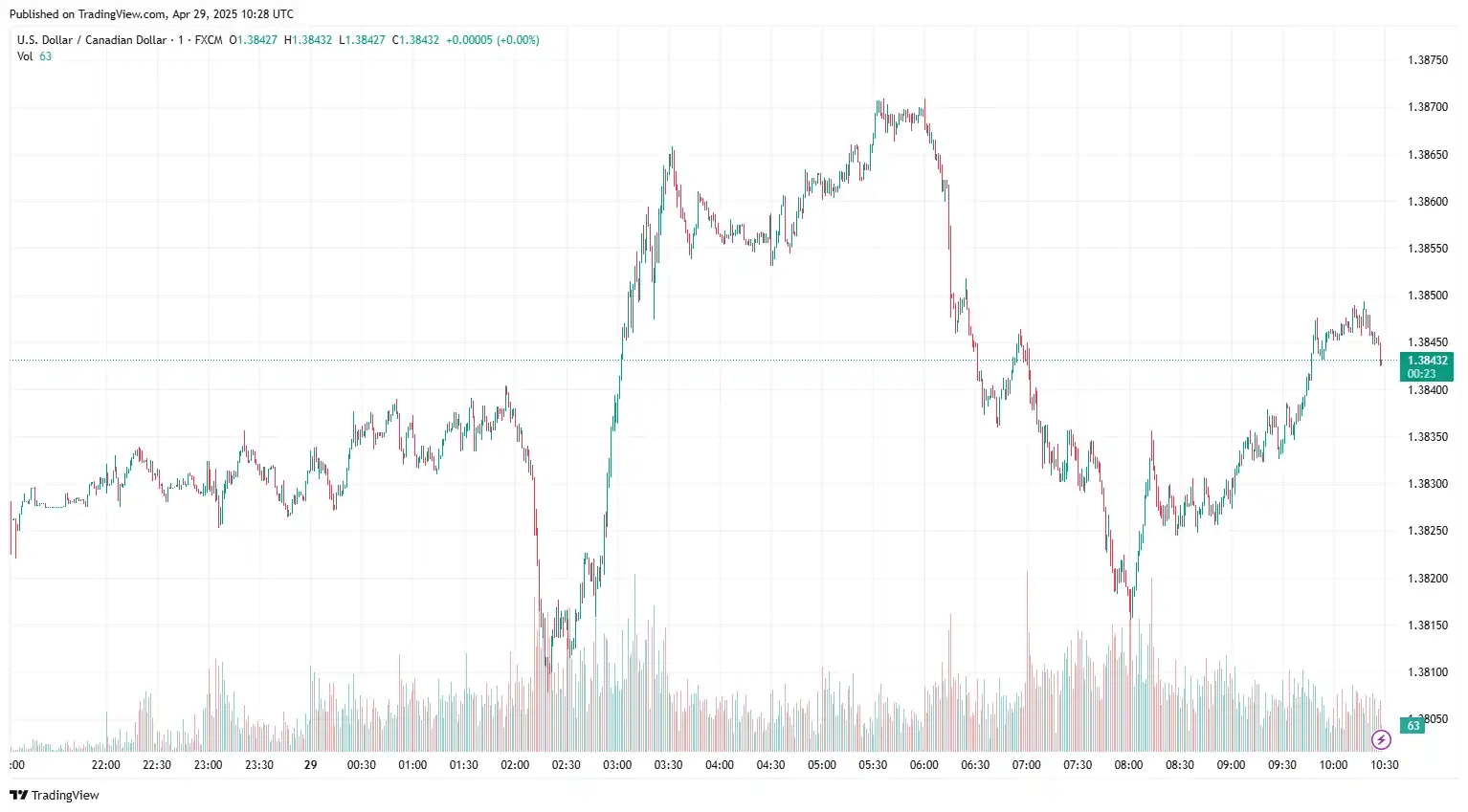

USD/CAD Wobbles on Canada's Federal Election Results

USD/CAD struggled near 1.3832 as the Canadian dollar lost ground following the election results in Canada. In Monday's election, Canadian Prime Minister Mark Carney's Liberal Party retained power but did not achieve the necessary majority to strengthen his trade negotiation stance with US President Donald Trump. The Liberals were ahead in 167 electoral districts, short of the 172 seats needed for a majority in the 343-seat House of Commons. Reports indicate that the opposition Conservatives followed with 145 seats while vote counting continues. During his victory speech in Ottawa, Carney stated, "Our old relationship with the United States, a relationship based on steadily increasing integration, is over. The system of open global trade anchored by the United States, though not perfect, has delivered prosperity for our country for decades, and that system is now over." Moreover, bearish sentiment surrounding crude oil prices continues to undermine the commodity-linked Loonie. West Texas Intermediate (WTI) oil prices are declining as advancements in US-Iran nuclear talks suggest that Iranian crude may soon return to the market. Furthermore, the anticipation that the Organization of the Petroleum Exporting Countries and its allies, collectively known as OPEC+, might boost production for a second straight month is putting additional pressure on oil prices.

On the other hand, rising signs of easing US-China trade tensions created an optimistic market risk sentiment, supporting the greenback. US President Trump expressed a willingness to reduce tariffs on Chinese goods, while Beijing has announced exemptions for certain US imports, provoking hopes for a quick resolution to the prolonged trade dispute between the world's two largest economies. However, the unpredictable nature of Trump's trade policy continues to influence the cautious market outlook, eroding investor confidence in US assets. On Monday, US Treasury Secretary Scott Bessent stated that he met with Chinese officials last week but did not discuss tariffs. He highlighted that although communication between the two governments is ongoing, it is Beijing's responsibility to initiate steps to alleviate trade tensions, referencing the current trade imbalance. Market expectations are that the Federal Reserve (Fed) will restart its rate-cutting cycle in June, decreasing the interest rate by at least three times before the year ends. This, along with worries about the economic impact of Trump's trade policies, will create volatility in the dollar.

In the upcoming sessions, key US economic releases, including the preliminary Q1 GDP report, March PCE inflation data, and April Nonfarm Payrolls, along with crude oil price dynamics, will influence the USD/CAD exchange rate.

USD/JPY Stabilised Amid Positive Risk Tone

USD/JPY held steady at 142.83 amid hopes for the de-escalation of the US-China trade war, which undermined demand for traditional safe-haven assets. However, growing concerns about the economic risks from US tariffs have tempered the bets to keep interest rates steady amid risks to the fragile economy from US tariffs by the Bank of Japan (BoJ) in its policy decision on Thursday. Investors will pay attention to the BoJ's updated economic projections for clues about the timeline for the next rate hike, which will shape the yen's movements. Atsushi Mimura, Japan's Vice Minister for International Affairs, denied a claim that Bessent informed Finance Minister Katsunobu Kato during last week's meeting that a weaker US Dollar and a stronger yen are desirable. Bessent stated on X that he had productive discussions with his Japanese counterpart, raising optimism for a potential US-Japan trade agreement. Friday's Tokyo Consumer Price Index (CPI) for April rose 3.5% YoY, up from 2.9% the previous month, according to the Statistics Bureau of Japan. The Tokyo CPI, excluding fresh food and energy, was 2.0% in April, rising from 1.1% in March. The Tokyo CPI excluding fresh food increased 3.4% YoY in April, above the expected 3.2% and up from 2.4% in the prior month. Russian President Vladimir Putin announced an unexpected unilateral ceasefire in the Ukraine conflict for 72 hours starting from May 8. However, Ukraine's President Volodymyr Zelensky rejected this three-day truce. This scenario continues the geopolitical risk premium and could further benefit the safe-haven JPY.

On the other hand, rising signs of easing US-China trade tensions created an optimistic market risk sentiment, supporting the greenback. US President Trump expressed a willingness to reduce tariffs on Chinese goods, while Beijing has announced exemptions for certain US imports, provoking hopes for a quick resolution to the prolonged trade dispute between the world's two largest economies. However, the unpredictable nature of Trump's trade policy continues to influence the cautious market outlook, eroding investor confidence in US assets. US Treasury Secretary Scott Bessent said on Monday that many countries have offered' very good' tariff proposals. This comes on top of optimism over the potential de-escalation of trade tensions between the US and China and remains supportive of a positive risk tone. Market expectations are that the Federal Reserve (Fed) will resume its rate-cutting cycle in June and lower borrowing costs by a full percentage point by the end of 2025. This, along with worries about the economic impact of Trump's trade policies, will create volatility in the dollar.

In the upcoming sessions, BoJ's interest rate decision and updated economic projections, along with US JOLTS job openings, US Personal Consumption Expenditures on Wednesday, and the Nonfarm Payrolls (NFP) data will influence the USD/JPY's movements.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not consider individual investment goals, financial circumstances, or specific requirements of readers. We do not endorse or recommend any particular financial strategies or products discussed. Currency Solutions provides this content as is, without any guarantees of completeness, accuracy, or timeliness.