EUR/GBP Strengthens on PMI Data

EUR/GBP traded on a stronger note near 0.8342 following the release of the Final Services PMI from both regions. The Eurozone Services PMI for February 2025 came in at 50.6, slightly below the forecast of 50.7 and down from the previous reading of 50.7, indicating a modest sector slowdown. The Eurozone's unemployment rate remained stable at 6.3% in January 2025, unchanged from December 2024's revised 6.3%. Germany's services sector remained in contraction at 49.1, although this represents an improvement from January's 47.7, reflecting persistent weakness amid broader economic challenges. France's PMI slipped below 50 to 49.2, indicating contraction and making it the weakest performer in the region, possibly due to political uncertainty and reduced consumer spending. Italy's services sector continued to expand, with a PMI of 52.4, though slightly lower than January's 53.4, demonstrating moderate growth. Spain outperformed with a strong PMI of 54.2, driven by a booming tourism sector and robust service activity.

Furthermore, the unexpectedly high February flash Harmonised Index of Consumer Prices (HICP) data from the Eurozone continues to support the shared currency. The Eurozone HICP increased by 2.4% year-on-year (YoY) in February, down from 2.5% growth in January, whereas the market had anticipated a 2.3% rise. Meanwhile, the core HICP rose by 2.6% YoY in February, compared to a 2.7% increase in January, aligning with market expectations of 2.6%. However, market anticipation of a 25 bps deduction in the Deposit Facility Rate to 2.5% in the European Central Bank (ECB) meeting on Thursday could add challenges for the shared currency.

The sterling gains ahead of Bank of England (BoE) Governor Andrew Bailey's testimony before Parliament's Treasury Committee, as investors await crucial insights on the BoE's monetary policy outlook. The S&P Global UK Services PMI data printed at 51.0 in February, fractionally up from 50.8 in January, indicating a modest increase in overall business activity during February. On the geopolitical front, traders anticipate minimal impact from US President Donald Trump's tariffs on the UK economy, as Britain holds a trade surplus with the US. Following his meeting with UK Prime Minister Keir Starmer last week, Trump stated that a trade deal could be reached "pretty quickly," where tariffs "wouldn't be necessary."

Broader market sentiment regarding the Bank of England (BoE) Governor Andrew Bailey's statements and the Eurozone Services PMI could influence the movements of the EUR/GBP.

GBP/USD Rallies Ahead of Bailey's Testimony

GBP/USD edged higher near 1.2834 as concerns over slowing US economic growth and the impact of tariffs increased. On Tuesday, Trump's 25% tariffs on imports from Mexico and Canada took effect, alongside an increase in Chinese duties to 20%. However, US Commerce Secretary Howard Lutnick suggested that President Trump may reassess his tariff policy less than 48 hours after its implementation. If the USMCA rules are adhered to, Trump will contemplate offering relief. Monday's US ISM Manufacturing PMI was 50.3, just below the forecast of 50.5 and down from January's 50.9. In contrast, S&P Global's final Manufacturing PMI for February was 52.7, above expectations and improved from the preliminary reading. Anticipated slower growth in the US core Personal Consumption Expenditure Price Index (PCE) for January, a significant drop in Consumer Confidence for February—the first downturn in Personal Spending data for January in two years—and disappointing ISM Manufacturing PMI figures for February have fueled market speculation that the Fed might restart its monetary expansion cycle in June.

While the Bank of England (BoE) Governor Andrew Bailey's easy approach towards renewed inflationary pressures could support the sterling, BoE Deputy Governor Dave's suggestion that the UK central bank should adopt a "careful and gradual" approach to monetary policy in light of uncertainty surrounding the labour market and global trade could influence the currency. The February British Retail Consortium (BRC) shop price index fell by 0.7% year-on-year overnight. However, prices increased by 0.4% month-on-month, driven by a rise in food prices. BRC Chief Executive Helen Dickinson stated that shop prices will likely rise further as retailers encounter a surge in annual costs this year due to a nearly 7% increase in the minimum wage on April 1.

In today's session, investors will pay attention to the US ADP Employment Change, US ISM Services PMI, and the US Nonfarm Payrolls (NFP) data for February for fresh impetus on the GBP/USD exchange rate.

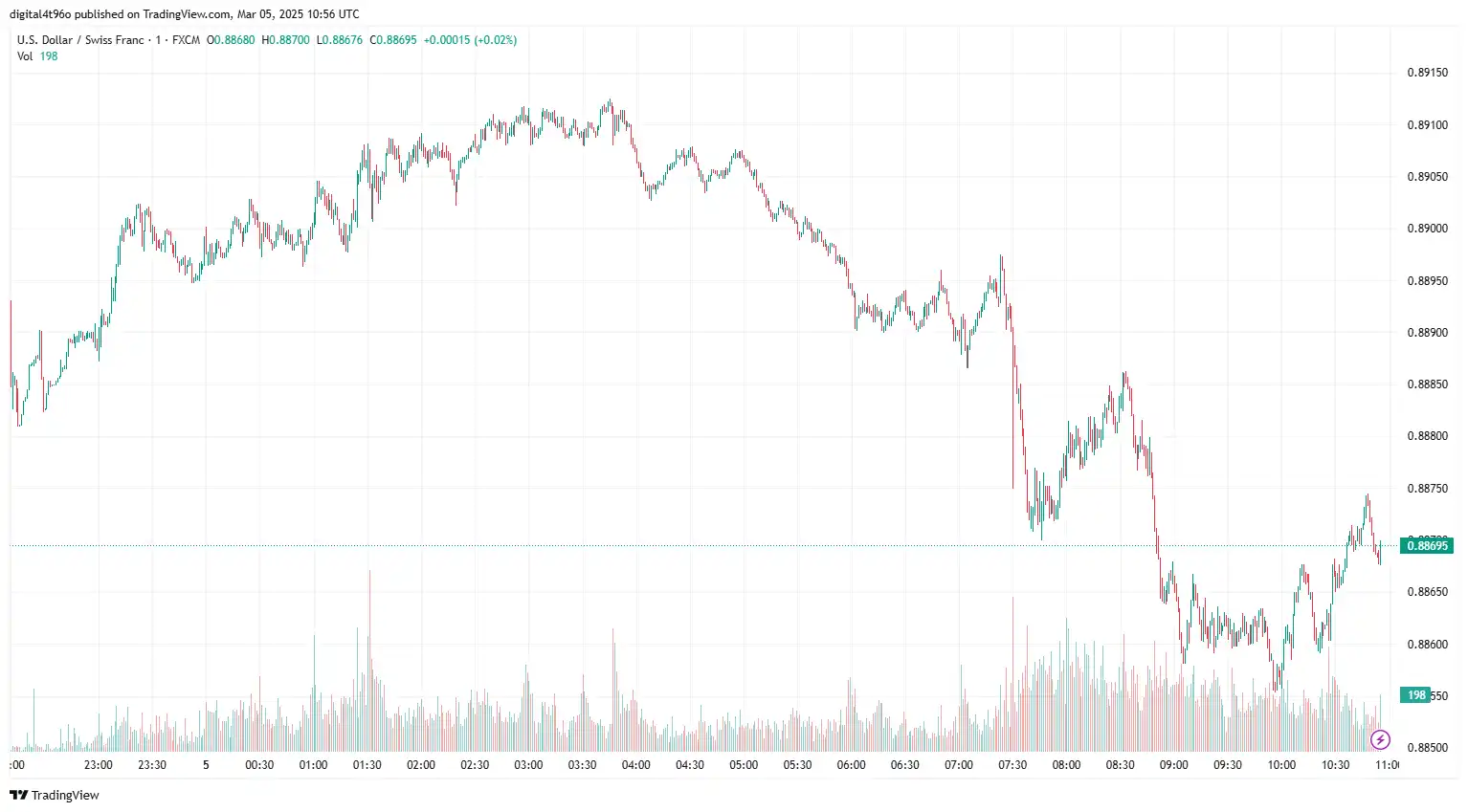

USD/CHF Sinks Following Swiss CPI Data

USD/CHF lost ground near 0.8867 as the Swiss Franc strengthened due to escalating risk-off sentiment fueled by growing concerns over a global tariff war. Tuesday's tariff imposition by President Trump on Canadian and Mexican goods, alongside a hike in duties on Chinese imports, diverted the traders towards haven flows, supporting the Swiss currency. Additionally, ongoing negotiations between US President Donald Trump and Ukrainian President Volodymyr Zelenskyy continue to influence market volatility, as Ukrainian President Volodymyr Zelenskyy agreed to devise a peace plan for Ukraine at a crucial summit in London over the weekend alongside United Kingdom Prime Minister Keir Starmer. On the domestic front, the monthly CPI rose by 0.6% in February, marking its first increase in nine months and the fastest pace since February 2021, exceeding the market expectation of a 0.5% rise. The annual inflation rate eased slightly to 0.3% in February, surpassing the anticipated 0.2% increase but down from 0.4% in January, representing its lowest level since April 2021. Meanwhile, core inflation, which excludes volatile items like unprocessed food and energy, remained unchanged at 0.9%, consistent with January's figure.

The US dollar is under pressure from rising worries about slowing economic growth and the effects of higher tariffs. On Tuesday, President Trump's 25% tariffs on imports from Mexico and Canada took effect, along with an increase to 20% on Chinese goods. Nonetheless, US Commerce Secretary Howard Lutnick indicated President Trump might reconsider his tariff strategy within 48 hours of its launch. If the USMCA rules are followed, Trump may consider providing relief. Monday's US ISM Manufacturing PMI was reported at 50.3, slightly below the 50.5 forecast and down from January's 50.9. In comparison, S&P Global's final Manufacturing PMI for February stood at 52.7, exceeding expectations and improving from the initial estimate. The anticipated slowdown in the US core Personal Consumption Expenditure Price Index (PCE) for January, a significant decline in Consumer Confidence for February, the first drop in Personal Spending data for January in two years, and underwhelming ISM Manufacturing PMI results for February have sparked market speculation that the Fed could resume its monetary expansion cycle in June.

In today's sessions, the key US economic data, including the ISM Services PMI, ADP Employment Change, and global tariff concerns, will shape the market sentiment around the USD/CHF exchange rate.

AUD/USD Rebounds on Robust GDP Data

AUD/USD recovered near 0.6283, following the upbeat Australian GDP reports. Gross Domestic Product (GDP) increased by 0.6% quarter-on-quarter in the fourth quarter (Q4) of 2024, compared to the 0.3% growth in the third quarter, as reported by the Australian Bureau of Statistics (ABS) on Wednesday. This figure exceeded the expectations of 0.5%. The annual GDP for the fourth quarter grew by 1.3%, in contrast to the 0.8% increase in Q3 and above the consensus of a 1.2% rise. Retail Sales, a critical indicator of consumer spending, rose by 0.3% month-on-month in January, compared to a decrease of 0.1% in December, matching with market expectations of a 0.3% increase. However, the ANZ-Roy Morgan Australian Consumer Confidence Index fell to 87.7 from 89.8 the previous week, when it had reached its highest level since May 2022. The Judo Bank Composite Purchasing Managers' Index (PMI) fell to 50.6 in February, down from 51.1 in January, marking the fifth consecutive month of growth in business activity but at a slower pace. Similarly, the Services PMI decreased to 50.8 from 51.2, indicating ongoing expansion for the thirteenth month, although at a reduced rate. In contrast, China's Services Purchasing Managers' Index (PMI) unexpectedly increased to 51.4 in February, up from 51.0 in January, surpassing market forecasts of 50.8.

On the policy front, RBA's February Meeting Minutes signalled towards the downside risks to the economy. Recent remarks by Reserve Bank of Australia (RBA) Deputy Governor Andrew Hauser emphasised that global trade uncertainty has reached a 50-year peak. He cautioned that uncertainties arising from US President Donald Trump's tariffs might lead businesses and households to postpone their planning and investment, which could hinder economic growth. On the geopolitical front, any significant development in the trade conflicts between the United States (US) and China could steer the volatility for the China-proxy Aussie. On early Wednesday, Chinese authorities unveiled their aim for about 5% economic growth by 2025, alongside a 2% target for the Consumer Price Index (CPI). Furthermore, China intends to pursue a proactive fiscal policy while maintaining real estate and stock market stability.

The US dollar experienced selling pressure, even with a risk-off sentiment, as fears that US tariffs and retaliations from other countries could lead the American economy toward recession weighed heavily. These economic fears spurred markets to increase speculation on additional interest rate cuts by the Federal Reserve.

In the upcoming sessions, US ADP Employment Change and the ISM Services data for February will significantly impact the AUD/USD exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not consider individual investment goals, financial circumstances, or specific requirements of readers. We do not endorse or recommend any particular financial strategies or products discussed. Currency Solutions provides this content as is, without any guarantees of completeness, accuracy, or timeliness.