EUR/GBP Tumbles on Eurozone HICP Inflation Data

EUR/GBP fluctuated near 0.8257, following stronger-than-expected February flash Harmonized Index of Consumer Prices (HICP) data. German HICP increased by 2.8%, surpassing estimates of 2.7% for the year. Month-on-month, HICP grew at a quicker rate of 0.6%, compared to expectations of 0.5%. In January, the underlying inflation data decreased by 0.2%. Spanish Manufacturing PMI rose to 49.7 in February, following a decline to 50.9 in January, slightly below the market expectation of a modest recovery to around 51.5. Italian Manufacturing PMI increased to 47.4 in February, following a slight rise to 46.3 in January, aligning with market expectations of a marginal improvement to around 46.6. French Final Manufacturing PMI grew to 45.8 points in February, up from 45.5 points in January, surpassing the market expectation of a slight decline to 45.5 points. German Final Manufacturing PMI climbed to 47.6 points in February, up from 47.3, matching the expected 46.1. Mixed inflation data has highlighted potential dovish signals for the ECB, affecting the shared currency. Today’s official data released by Eurostat indicated the Eurozone Harmonized Index of Consumer Prices (HICP) increased by 2.4% year-on-year (YoY) in February, following a growth of 2.5% in January. The market forecast for the reported period was a 2.3% acceleration. Meanwhile, the core HICP grew by 2.6% YoY in February, compared to a 2.7% rise in January, aligning with the 2.6% market expectations.

The UK Final Manufacturing PMI rose to 46.9 in February, slightly above the previous and expected 46.4. UK Mortgage Approvals declined from 67K to 66K in February, aligning with the market expectation. Mixed economic signals, including persistent manufacturing weakness and a notable deceleration in money supply growth, have highlighted potential challenges for the Bank of England’s monetary stance, affecting the pound.

In today’s session, Eurozone’s HICP inflation data and UK Final Manufacturing PMI figures will significantly influence the EUR/GBP exchange rate.

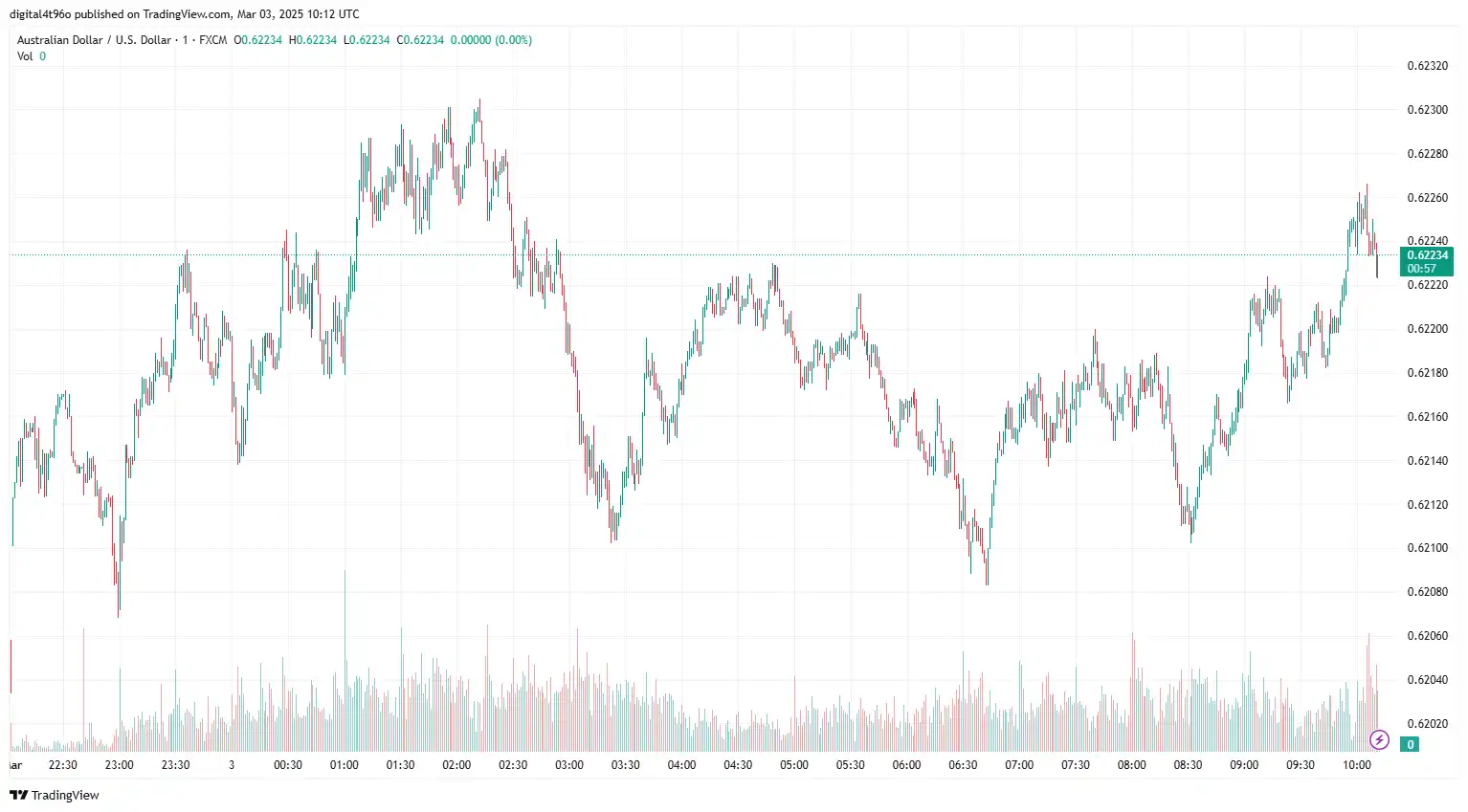

AUD/USD Subdued Ahead of ISM Manufacturing PMI

AUD/USD weakened near 0.6218, as January’s Personal Consumption Expenditures (PCE) inflation data undermined the US Dollar (USD). The US PCE inflation report aligned with expectations, with the monthly headline PCE remaining stable at 0.3%. Core PCE increased modestly to 0.3% from December’s 0.2%, while the annual headline PCE stood at 2.6%, slightly surpassing projections but unchanged from December’s figure. Core PCE decreased to 2.6%, down from a revised 2.9% in December. On the geopolitical front, negotiations for a peace deal between US President Donald Trump and Ukrainian leader Volodymyr Zelenskyy soured, escalating tensions. Zelenskyy anticipated signing an agreement allowing the US increased access to Ukraine's rare earth minerals and joining a joint press conference. However, the plan fell through after a tense exchange between the leaders in front of the press. During this confrontation, Trump openly voiced his disapproval, prompting top advisers to request that Zelenskyy leave the White House.

The Australian Dollar remained stable through the TD-MI Inflation Gauge and China Manufacturing PMI data release. Australia’s TD-MI Inflation Gauge decreased by 0.2% month-on-month in February, reversing a 0.1% rise in January. This represented the first decline since last August and followed the Reserve Bank of Australia’s (RBA) decision to reduce its cash rate by 25 basis points to 4.1% during its first monetary policy meeting of the year, indicating a persistent slowdown in underlying inflation. On an annual basis, however, the gauge increased by 2.2%, slightly below the previous 2.3% rise. In China, the PMI returned to positive territory in February, reflecting its efforts to stimulate its economy. Data from the China Federation of Logistics and Purchasing (CFLP) showed that the NBS Manufacturing PMI improved to 50.2 in February, up from 49.1 in January, surpassing the anticipated 49.9. Additionally, the NBS Non-Manufacturing PMI rose to 50.4 in February from 50.2 in January, exceeding the forecast of 50.3. Any changes in China’s economy and developments in the US-China trade tensions will inject market volatility into the Aussie.

In today’s session, the broader market sentiment regarding Trump’s tariff policies and the US ISM Manufacturing PMI report will influence the AUD/USD exchange rate.

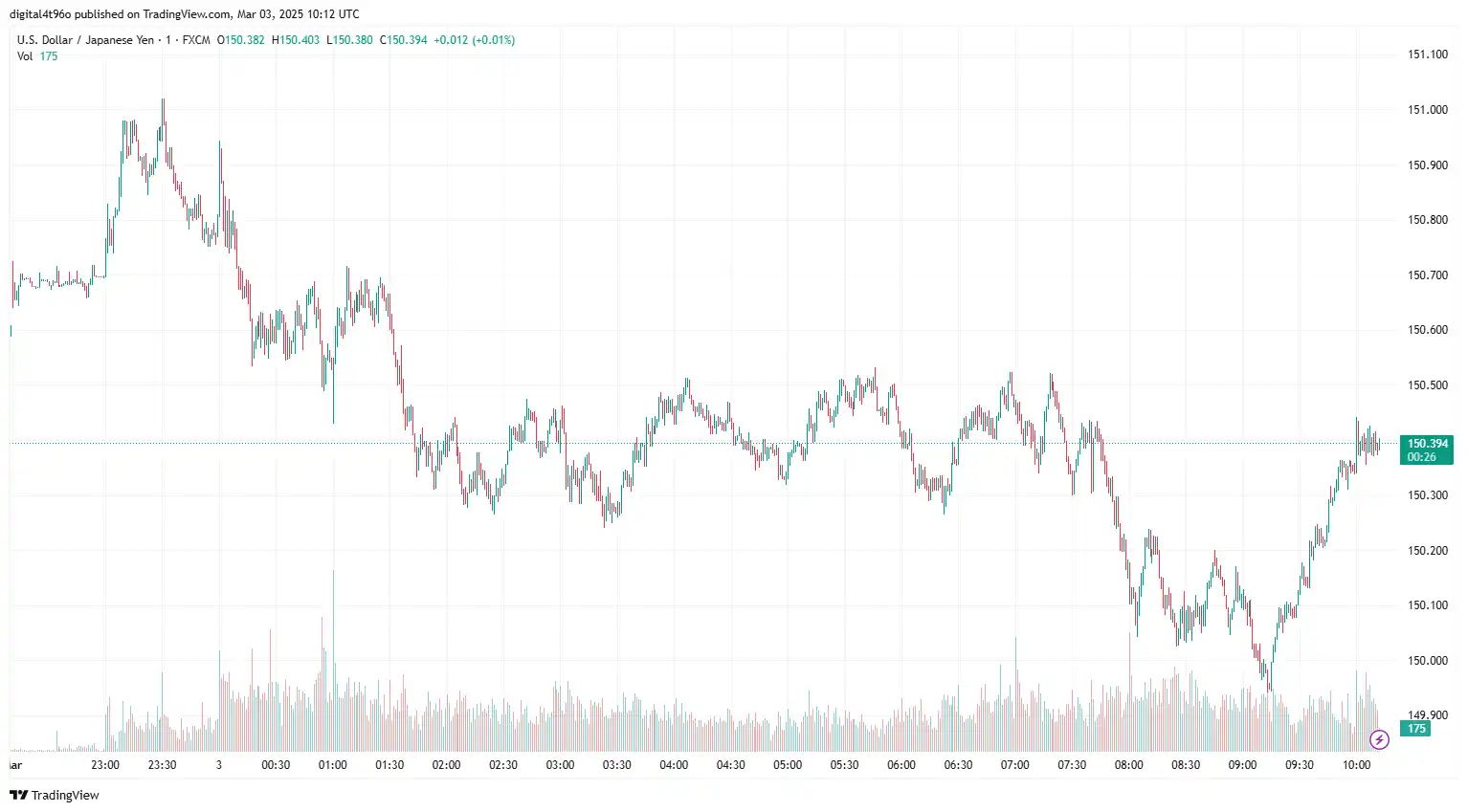

USD/JPY Struggles as US Inflation Slows

USD/JPY declined near 150.11, reflecting hawkish Bank of Japan (BoJ) expectations. On Monday, Japan’s Vice Finance Minister for International Affairs, Atsushi Mimura, noted that both large firms and small-to-medium-sized businesses expect significant wage increases. Last week, BoJ Governor Kazuo Ueda warned that the uncertainty regarding US President Donald Trump’s potential tariff policies could affect the global economic outlook, necessitating careful adjustments in monetary policy. Last week, BoJ Deputy Governor Shinichi Uchida commented, "Japan's economy is experiencing a moderate recovery, though some weaknesses persist. The underlying inflation rate is gradually rising toward the 2% target," reinforcing that the Bank of Japan (BoJ) will continue raising interest rates this year.

On the domestic data front, the latest Tokyo CPI report indicates a slowdown in inflation, with the headline CPI rising 2.9% YoY in February, down from 3.4% in January. Core CPI increased 2.2% YoY, below January's 2.5%. CPI ex-Fresh Food also rose by 2.2% YoY, missing expectations and dropping from 2.5% the previous month. The Statistics Bureau noted the headline CPI for Tokyo fell to 2.9% YoY in February, while core CPI edged down from 2.5% to 2.2% YoY. A further gauge, excluding fresh food and energy, remained stable at 1.9%. Japan's Industrial Production decreased by 1.1% MoM in January, marking three consecutive months of contraction. However, Japanese retail sales rose 3.9% YoY in January, an improvement from December’s 3.5%, and increased by 0.5% MoM from December to January, just below the forecasted 0.6%.

Meanwhile, the US core PCE price index, coupled with uncertainty and escalating tension surrounding the Russia and Ukraine conflict, weighs on the greenback. Trump's tariff policy will likely heighten inflationary pressures, leading markets to expect a tighter monetary policy approach from the Federal Reserve (Fed). January’s PCE inflation figures aligned with forecasts, showing a monthly headline PCE of 0.3%, which remains stable compared to the last reading. The core PCE also registered at 0.3%, a rise from December’s 0.2%. The annual headline PCE was 2.6%, slightly above predictions and consistent with December’s figure of 2.6%. The core PCE dropped to 2.6%, down from a revised 2.9% in December. Additionally, the Chicago Purchasing Managers Index (PMI) rose to 45.5, exceeding the consensus of 40.6 and showing improvement from January’s 39.5.

Today’s Manufacturing Purchasing Managers’ Index (PMI) is expected to continue its upward momentum, supporting the greenback and influencing the USD/JPY pair.

USD/CAD Muted by Softer US Dollar

USD/CAD traded in a narrow range near 1.4435, as mixed growth signals emerged from the Canadian economy. Canada’s economy grew by 2.6% compared to the same quarter in 2023, outpacing the previous year’s 2.2% growth, which had been upwardly revised from 1%. Market participants had anticipated that the economy would have expanded at a more modest rate of 1.9%. In December, the Canadian economy grew by 0.2%, reflecting the same pace as the decline in November. Economists had predicted a higher growth rate of 0.3%.

On the policy front, Trump confirmed that tariffs on imports from Canada and Mexico are set for March 4, with reciprocal tariffs on other nations continuing. However, uncertainty remains as Canada and Mexico negotiate to avert 25% tariffs on their US exports, attempting to assure Trump that their border security and fentanyl trafficking measures are sufficient as the deadline nears. On Thursday, he also affirmed that he plans to impose 25% tariffs on imports from Canada and Mexico, scheduled to take effect on Tuesday. However, a rise in crude oil prices could support the commodity-linked Canadian Dollar (CAD).

On the other hand, looming tariff fears continue to shape market sentiment around the greenback. Additionally, Friday’s release of January’s Consumption Expenditures (PCE) inflation data, which aligned with forecasts, eased concerns about unexpected inflation spikes in the United States. In the upcoming sessions, crude oil price movements, escalating geopolitical tensions, and US ISM Manufacturing PMI figures will influence the USD/CAD movements.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not consider individual investment goals, financial circumstances, or specific requirements of readers. We do not endorse or recommend any particular financial strategies or products discussed. Currency Solutions provides this content as is, without any guarantees of completeness, accuracy, or timeliness.