FOMC PREVIEW MARCH 2025 MEETING

The FOMC is set to keep all policy settings unchanged at the March meeting, with policymakers remaining in no hurry to deliver further rate cuts, amid elevated economic uncertainty.

As such, the Committee, is near-certain to keep the fed funds rate target range at 4.25% - 4.50%, extending the pause that began at the previous meeting after delivering 100bp of easing in late 2024. Market pricing reflects this, with OIS curves indicating just a 5% probability of a 25bp cut, reflecting growing downside economic risks.

The accompanying policy statement will likely mirror January's language, viewing risks to the dual mandate as "roughly in balance" while emphasizing their data-dependent approach. Economic conditions descriptions will probably remain unchanged, noting "solid pace" of expansion, "low" unemployment, and "somewhat elevated" inflation.

Despite that, the degree of uncertainty has increased markedly since January, owing to the volatile and incoherent nature with which the Trump Administration are implementing protectionist trade policies. While the committee previously noted an "uncertain" outlook, adding "highly" to this statement may be an appropriate tweak this time around.

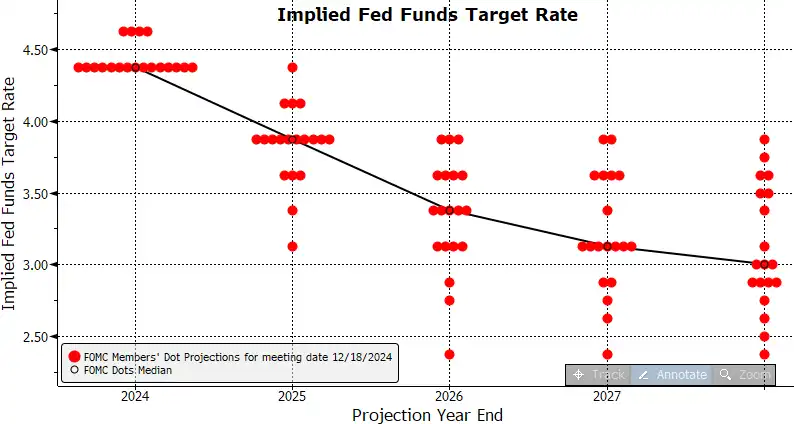

Meanwhile, the March meeting will also bring an updated round of economic projections, and a revised ʻdot plot’. December's dots indicated a median expectation of 50bp of cuts in both 2025 and 2026, with the 2025 median will likely remain unchanged this time around, signalling two 25bp cuts this year—slightly more hawkish than the ~80bp currently priced by markets.

In terms of other forecasts, policymakers will likely revise lower their expectations of short-term economic growth, in light of the aforementioned tariffs, and with consumer confidence having recently notched its biggest MoM decline in almost four years. Meanwhile, inflation expectations may be nudged higher in the short-run, also owing to those tariffs, though the 2% PCE target should continue to be achieved by the end of the forecast horizon. Unemployment projections will probably be broadly unchanged, with payrolls growth still proceeding at almost twice the breakeven pace. At the press conference, Powell will likely maintain his recent narrative that the economy remains in a "good place" with "no need to hurry" on rate adjustments. Policy will continue to be described as "moderately restrictive." His comments on quantitative tightening may prove most notable, as this program could conclude as early as May.

On the whole, the March meeting seems unlikely to materially alter the FOMC policy outlook. Though the direction of travel for rates remains lower, insufficient disinflationary progress has been made thus far to permit further cuts to be delivered. Furthermore, remaining on hold gives policymakers time to assess the impacts of Trump’s trade policies, as the bumpy path back towards 2% inflation continues.