GBP runs out of steam

Daily Forex Market Report 31-Jan-2023: GBP runs out of steam against USD, EUR/GBP volatility persists

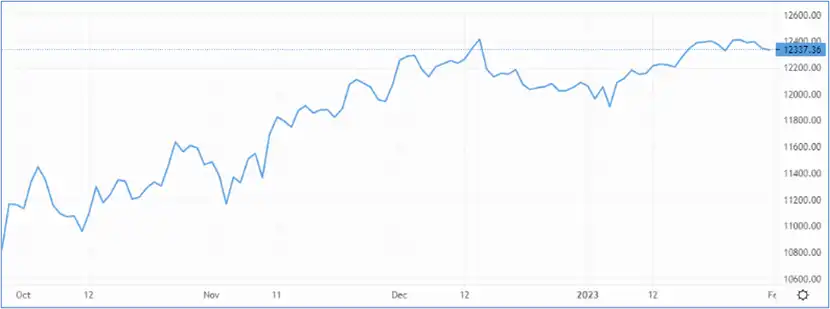

Cable took a sharp 0.4% fall to 1.235 throughout yesterday’s session in further confirmation that the pound’s strength against the dollar throughout January may have run out of steam at the 1.240 price point.

For now, the pair has stayed put at 1.235, with a spinning-top candlestick pattern inferring a general climate of indecision among traders in anticipation of the UK, EU and US central bank interest rate decisions scheduled for the following two days.

GBP/USD peters out – Source: capital.com

GBP/USD peters out – Source: capital.com

The dollar appears well supported this week even though a dovish 25 bps hike from the Federal Reserve is broadly expected, with the US Dollar Index (DXY) adding 0.35% to 101.86 yesterday and gaining further to 101.88 in this morning’s opening hours.

One near-term effect of the rate-hike cycle in the US has been the sharp rise in overnight federal funds borrowing as deposit withdrawals send banks scrambling for liquidity from other sources.

This Bloomberg report suggests that a seven-year high of US$120bn in daily federal funds borrowing was clocked on January 27.

EUR/USD reversed from an intraday high of 1.091 to close Monday 0.2% lower at 1.084, with incremental losses chalked up this morning too.

Ever the volatile trading pair right now, EUR/GBP finished 0.2% higher at 87.84p on Monday, but today has been comparatively bearish, with traders pushing the pair 10 pips down to 87.74p.

On today’s economic calendar, UK consumer credit borrowing is due later this morning. Spending actually picked up sharply for the month of November in preparation for the holiday season, though December figures are expected to show that consumers are starting to rein things in again.

Euro area GDP growth will be announced later, with year-on-year estimates suggesting a 40 bps decline to 1.8% for the last quarter of 2022.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services include but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.