GBP/USD Buoyed by Improved Market Sentiment

GBP/USD advanced to 1.2879, as weaker-than-expected data from the RICS Housing Price Balance and the BoE's cautious monetary policy stance weighed on the Pound. The Bank of England's (BoE) Financial Policy Committee (FPC) has warned that a major shift in global trading arrangements could potentially harm "financial stability by depressing growth." In addition, yields on 30-year gilts have skyrocketed to heights not seen since 1998, exceeding the figures observed during January's bond market upheaval. This development raises concerns about the government's capacity to harmonise growth ambitions with rigorous fiscal discipline. The committee added, "Risks linked to debt sustainability concerns, including sharp yield rises, could crystallise quickly, particularly if accompanied by rapid capital outflows," regarding debt.

On the global front, renewed concerns stemming from the trade tensions between the US and China threaten UK business activity. US President Donald Trump declared an immediate increase in tariffs on Chinese imports to 125% in response to China's retaliatory hike in duties on US products to 84%. Any further escalation in the trade war between the US and China could lead to increased product dumping by Chinese firms in alternative markets. With Chinese manufacturers offering lower-priced goods, UK companies could struggle to compete in this pricing battle. Such developments are likely to cause a sharp downturn in UK business activity, further weighing on the Pound Sterling.

On Wednesday, Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, highlighted that increasing market volatility, coupled with persistent concerns over US trade policies, poses challenges for the Fed's future monetary policy direction. He also mentioned that the existing tariff policies might impede job creation and lead to long-term inflationary risks. At the same time, Beth Hammack, President of the Federal Reserve Bank of Cleveland, cautioned that uncertainty surrounding US trade policies will continue complicating the Fed's market-smoothing efforts. Recent minutes from the March FOMC meeting indicated that officials unanimously recognised the risk of heightened inflation in the US economy. Tom Barkin, President of the Richmond Fed, adopted a cautious stance, suggesting that tariff-induced price increases could commence by June, necessitating a careful approach from the US central bank regarding rising prices. Additionally, St. Louis Fed President Alberto Musalem remarked on the risks of assuming that the Fed can ignore rising prices due to tariffs, as some of these effects may be long-lasting.

Upcoming US inflation figures and the University of Michigan (UoM) Consumer Sentiment Index survey results, along with the UK's monthly Gross Domestic Product (GDP) and factory data for February, will shape the market sentiment surrounding the GBP/USD exchange rate.

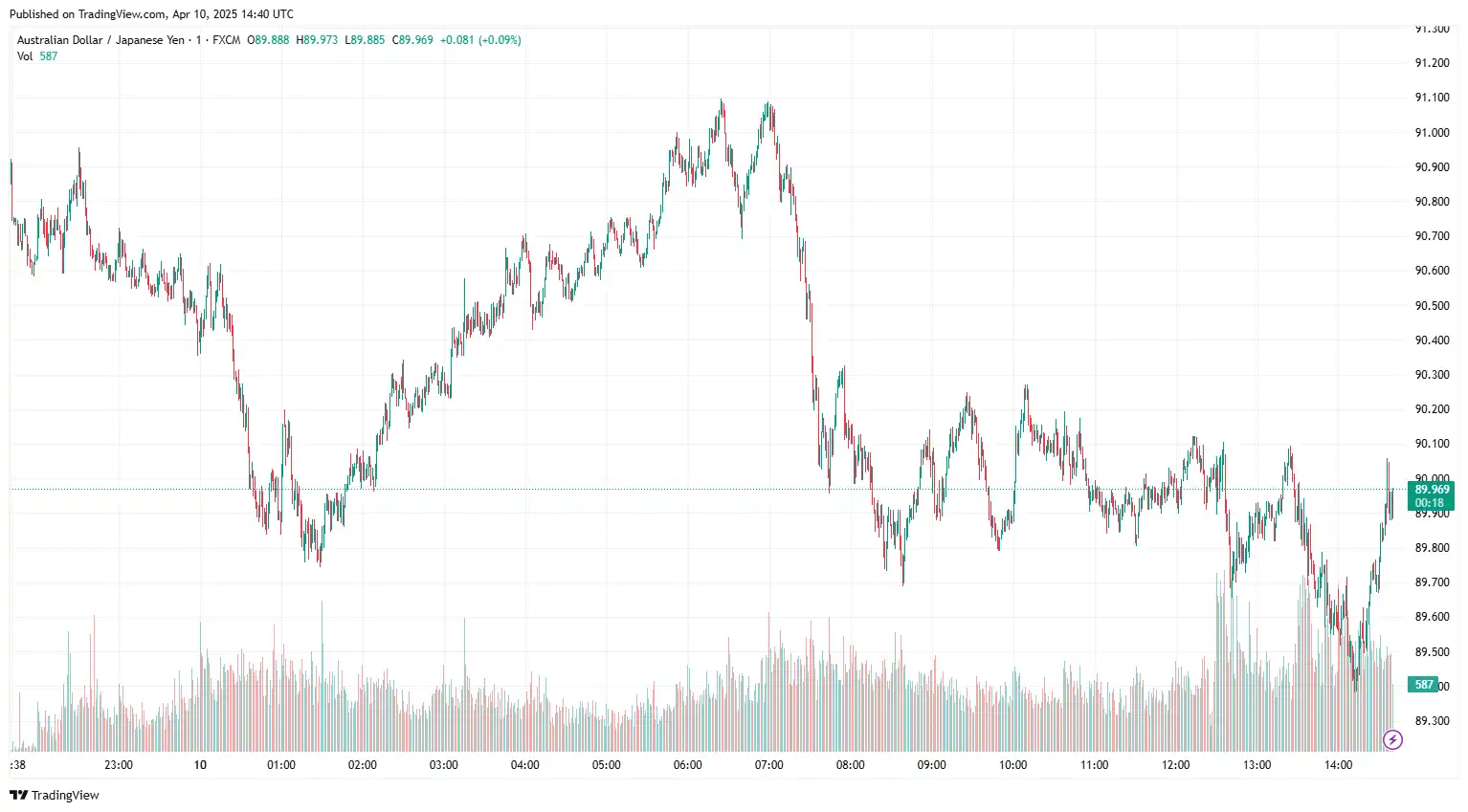

AUD/JPY Struggles on China Deflation Concerns

AUD/JPY hovered near 90.06 as optimism around renewed trade negotiations between Australia and the European Union (EU) strengthened the Aussie. During a one-hour video call on Wednesday evening, EU officials decided to resume the halted trade negotiations with Australia. EU Trade Commissioner Maros Sefcovic suggested the establishment of a new timeline for conversations with Australian Trade Minister Don Farrell. The last negotiation round failed two years ago due to conflicts regarding agricultural market access for the EU's 450 million consumers. Ongoing trade tensions between the US and China continue to dampen the risk-sensitive Aussie following Trump's announcement of an immediate tariff hike on Chinese imports to 125%, following China's retaliatory increase to 84% on US goods. In China, the Consumer Price Index (CPI) fell by 0.1% year-over-year in March, following a 0.7% drop in February, and fell short of the anticipated 0.1% increase. Monthly CPI inflation saw a 0.4% decline, worse than February's 0.2% decrease and below market expectations. Meanwhile, the Producer Price Index (PPI) fell 2.5% year-on-year in March, a larger drop than February's 2.2% decrease and the forecasted 2.3% decline.

Recently, Trump announced a 90-day pause on new tariffs for most US trade partners, proposing to maintain the lower 10% rate to facilitate greater diplomatic efforts, thereby limiting the downside for the Australian dollar. While weaker business and consumer confidence numbers indicated Australia's sluggish economic outlook, they also reinforced expectations of a dovish policy stance by the Reserve Bank of Australia (RBA), featuring additional interest rate cuts. Consumer sentiment declined significantly as the Westpac Consumer Confidence Index fell 6% in April after a 4% rise in March, the first drop since January. Similarly, the NAB Business Confidence Index dropped to -3 in March from -2, the lowest level since November. Business conditions remained stable but slightly below average, improving from 3 to 4.

On the other hand, a sharp recovery in global risk sentiment creates challenges for traditional safe-haven assets, affecting the demand for the yen. However, robust Producer Price Index (PPI) data and hawkish BoJ expectations could cap the yen's downward momentum. Japan's Producer Price Index (PPI) climbed by 0.4% month-over-month in March 2025, surpassing market expectations of a 0.2% increase. The PPI increased by 4.2% year-on-year, surpassing the anticipated 3.9% rise. On the global front, US President Donald Trump has consented to meet with Japanese officials to begin trade talks after his earlier conversation with Japan's Prime Minister Shigeru Ishiba this week. US Treasury Secretary Scott Bessent later mentioned that Japan could be given priority in tariff negotiations, heightening expectations for a prospective US-Japan trade agreement and providing additional support for the JPY.

Broader market sentiment around Australia's trade negotiations with the European Union (EU) and ongoing global trade concerns will shape the market sentiment around the AUD/JPY exchange rate.

EUR/USD Stabilises Ahead of US CPI Data

EUR/USD entered into positive traction near 1.0984 as investors braced for the US March Consumer Price Index (CPI) inflation report. In March, the annual inflation is expected to rise at an annual pace of 2.6%, slightly below the 2.8% reported in February. Core CPI inflation, excluding the volatile food and energy categories, is projected to ease to 3% in the same period from a year earlier, compared to a 3.1% growth in the previous month. Monthly, both the CPI and the core CPI are anticipated to rise 0.1% and 0.3%, respectively. Any sharp movement in the consumer inflation number could influence the Federal Reserve's (Fed) monetary policy outlook, injecting market volatility into USD. On Wednesday, Federal Reserve Bank of Minneapolis President Neel Kashkari stated that rising market volatility, amid ongoing US trade policy concerns, would challenge the Fed's future monetary policy outlook. He also added that current tariff policies could hinder job creation and provoke long-term inflationary pressures. Meanwhile, Federal Reserve Bank of Cleveland President Beth Hammack warned that the uncertainty related to US trade policy will continue complicating the Fed's ability to engage in market-smoothing operations.

Recent FOMC meeting minutes from March revealed that officials unanimously agreed the US economy was at risk of experiencing higher inflation. Richmond Fed President Tom Barkin used a cautious tone, indicating that tariff price hikes could begin by June and that price surges require the US central bank to proceed carefully. Furthermore, St. Louis Fed President Alberto Musalem stated that it is risky to assume the Fed can overlook higher prices resulting from tariffs, as there is a chance some effects could persist.

On the other hand, the euro gained ground following the German conservatives under Friedrich Merz clinching a coalition deal with the centre-left Social Democrats (SPD) to stimulate growth in Europe's biggest economy amid a global trade war that threatens recession. Recent comments from European Commission President Ursula von der Leyen emphasised that "the European Union (EU) remains committed to constructive talks with the US on tariffs." On Thursday, European Central Bank (ECB) policymaker and Bank of France head François Villeroy de Galhau commented, "Trump's tariff pause decision is less bad news but still bad news elements out there in America."

In today's session, US inflation figures and speeches by influential FOMC members will drive the EUR/USD exchange rate.

USD/CAD Sinks Amid US Recession Fears

USD/CAD lost momentum near 1.4090 following US President Donald Trump's 90-day pause on reciprocal tariffs. On Wednesday, President Trump announced that he authorised a 90-day halt on new tariffs for most US trade partners, reducing them to 10%, to facilitate trade negotiations with those countries. "The 90-day pause is an encouraging sign that negotiations with most countries have been productive," said Mark Hackett at Nationwide. "It also injects some much-needed stability into a market rattled by uncertainty. Late Wednesday, Canadian Prime Minister Mark Carney commented that a pause on reciprocal tariffs announced by US President Donald Trump is a welcome reprieve for the global economy. However, Tuesday's remark from the Canadian Ministry suggested that 25% counter-tariffs announced by the Canadian government will remain in place "until the US eliminates its tariffs against the Canadian auto sector." Meanwhile, bearish movement in crude oil prices could add further volatility to currencies, with Canada being the largest oil exporter to the US, dragging CAD lower. Apart from global trade concerns, the upcoming snap election on April 28 could influence the political landscape in Canada.

Conversely, the 'greenback' recovered later in the session after US President Donald Trump announced a 90-day suspension of most new tariffs, with the exception of those aimed at China. On Wednesday, Federal Reserve Bank of Minneapolis President Neel Kashkari noted that rising market volatility, fueled by ongoing concerns about US trade policy, could challenge the Fed's future monetary outlook. He also highlighted that current tariffs could hamper job creation and lead to long-term inflationary pressures. Meanwhile, Federal Reserve Bank of Cleveland President Beth Hammack warned that the uncertainty surrounding US trade policy would continue to make it difficult for the Fed to implement market-smoothing measures. Minutes from the March FOMC meeting revealed that officials unanimously agreed the US economy is at risk of higher inflation. Richmond Fed President Tom Barkin struck a cautious note, suggesting that tariff-driven price hikes could begin by June, and emphasised the need for the central bank to tread carefully in light of potential price surges. Additionally, St. Louis Fed President Alberto Musalem cautioned that the Fed may not be able to ignore the higher prices caused by tariffs, as some effects could be longer-lasting.

In the absence of any market-moving Canadian economic data, US inflation figures, along with crude oil price dynamics, will be the key drivers for the USD/CAD exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not consider individual investment goals, financial circumstances, or specific requirements of readers. We do not endorse or recommend any particular financial strategies or products discussed. Currency Solutions provides this content as is, without any guarantees of completeness, accuracy, or timeliness.