GBP/USD Struggles Amid Optimism Around UK-US Trade Deal

GBP/USD hovered near 1.3302, as uncertainty over US-China trade talks bolstered the cautious market mood. On Sunday, US Treasury Secretary Scott Bessent commented that he did not know if US President Donald Trump had talked to Chinese President Xi Jinping, limiting the optimism led by Trump's assertion that tariff talks with China were ongoing. On the economic front, data from the University of Michigan (UoM) revealed that consumer sentiment in April fell to its lowest level, decreasing from 57 to 52.2, marking the fourth-lowest reading in the data series dating back to the late 1970s. The same poll revealed that inflation expectations for one year rose from 5% to 6.5%, while for a five-year period, expectations increased to 4.4% from 4.1%. The US Census Bureau revealed a 9.2% increase in Durable Goods Orders for March, reaching $26.6 billion and totalling $315.7 billion. This growth follows a 0.9% rise in February and significantly surpasses the market's expectation of a 2% increase. Furthermore, the US Department of Labour (DOL) reported an increase in new unemployment insurance applications to 222K for the week ending April 19, slightly exceeding initial predictions and higher than the previous week's revised count of 216K (up from 215K). The report also showed a seasonally adjusted insured unemployment rate of 1.2%, with the four-week moving average dropping by 750 to 220.25K from the previous week's revised average. In addition, Continuing Jobless Claims decreased by 37K to 1.841M for the week ending April 12.

On the policy front, market anticipation that the Federal Reserve (Fed) will resume its rate-cutting cycle in June and reduce the interest rate at least three times by the end of the year, coupled with concerns about the economic fallout from Trump's trade policies, will inject market volatility into the greenback.

Conversely, Friday's upbeat domestic data, along with hopes that the UK will strike a trade deal with the US soon, supports the pound. In March, UK Retail Sales rose by 0.4% month-over-month, an increase from a prior 0.7% (originally reported as 1.0%). This outperformed the market's expectation of a 0.4% decrease. Year-on-year, Retail Sales climbed 2.6% in March, up from 2.2% previously and exceeding the forecast of 1.8%. The seasonally adjusted S&P Global/CIPS UK Manufacturing Purchasing Managers' Index (PMI) fell to 44 in April, down from 44.9 in March, indicating an unexpected decline in overall business activity. This result matched the market consensus of 44 for the period. Additionally, the Preliminary UK Services Business Activity Index dropped to 48.9 in April, down from 52.5 in March, reflecting rising global economic uncertainty and waning domestic demand, falling short of the expected 51.3. Stronger economic data could temper market expectations of a dovish monetary policy stance from the Bank of England (BoE) in upcoming policy meetings.

Amid a lack of major key data releases today, broader market sentiment around trade tariff negotiations will shape the market sentiment for the GBP/USD exchange rate.

EUR/USD Subdued Amid US-China Tensions

EUR/USD faces challenges near 1.1359, as mixed signals on US-China trade relations influence the market sentiment. Despite US President Donald Trump's claims of progress and his conversations with China's President Xi Jinping, Beijing has denied that trade negotiations are occurring. Also, US Treasury Secretary Scott Bessent did not confirm that any tariff discussions were underway. On Friday, China announced exemptions for specific US imports from its 125% tariffs, according to sources. This decision has raised hopes that the extended trade war between the two largest economies might be nearing its end. Adding to the uncertain market atmosphere, US Agriculture Secretary Brooke Rollins mentioned on Sunday that the Trump administration is engaged in daily discussions with China about tariffs. Rollins highlighted that negotiations were active and that agreements with other nations were also "very close." However, a Chinese embassy spokesperson on Friday strongly refuted any ongoing negotiations with the US, asserting, "China and the US are not having any consultation or negotiation on tariffs." The spokesperson called on Washington to "stop creating confusion." Furthermore, a Beijing official reiterated on Thursday that no "economic and trade negotiations" are currently happening and underscored that the US must "completely cancel all unilateral tariff measures" to create a conducive environment for talks.

On the domestic front, the market anticipates that the European Central Bank (ECB) will choose dovish expectations, significantly influenced by rising concerns that Eurozone inflation may fall short of the ECB's 2% target. On Thursday, Olli Rehn, a policymaker at the ECB and governor of the Finnish central bank, indicated that the central bank should not overlook the potential for a "larger interest rate cut." On the economic front, business sentiment in Germany saw a minor improvement in April, as the IFO Business Climate Index rose to 86.9 from March's 86.7. This figure surpassed the market expectation of 85.2. Additional details from the report showed that the IFO Current Assessment Index climbed to 86.4, up from 85.7 during the same period, whereas the Expectations Index fell slightly to 87.4 from 87.7.

In today's session, the European Central Bank (ECB) Vice-President Luis de Guindos's speech and the potential trade de-escalation between China and the US will influence the movements of the EUR/USD.

AUD/JPY Sinks on Easing US-China Tensions

AUD/JPY edged lower near 91.48, as growing anticipations that the Reserve Bank of Australia (RBA) will reduce the interest rate by 25 bps in May's policy meeting undermined the Australian Dollar (AUD). Recently, Westpac predicted that the Reserve Bank of Australia (RBA) would lower interest rates by 25 basis points at its meeting on May 20, supporting ongoing market speculation. Moreover, increasing economic uncertainties and growing concerns about the global trade outlook could add further downward pressure to the risk-sensitive Aussie. The Judo Bank Manufacturing PMI decreased to a two-month low of 51.7 in April, down from 52.1 in March. While manufacturing output continued to show expansion, the rise in new orders was modest. Meanwhile, the Services PMI slightly declined to 51.4 from 51.6 in the previous month, and the Composite PMI also fell to 51.4 from 51.6.

On the global front, China's decision to exempt certain US imports from its 125% tariffs ignited the hopes that persistent trade conflicts between the world's two largest economies may be resolved soon, elevating the market mood. Nevertheless, this optimism was dampened when a spokesperson for the Chinese embassy informed a leading news portal that "China and the US are not engaging in any discussions or negotiations about tariffs" and called on Washington to "stop generating confusion."

Conversely, optimism regarding the de-escalation of trade tensions between the world's two largest economies reduced the demand for safe-haven assets, weighing on the yen. Additionally, growing concerns about the economic risks from US tariffs have tempered the aggressive bets on an immediate interest rate hike by the Bank of Japan (BoJ). Atsushi Mimura, Japan's Vice Minister for International Affairs and senior currency diplomat, denied a media claim suggesting that Bessent informed Japanese Finance Minister Katsunobu Kato during last week's meeting that a weaker US Dollar and a stronger yen are desirable. On the other hand, Bessent mentioned in a post on X Saturday that he had highly productive discussions with his Japanese counterpart, raising optimism for a potential US-Japan trade agreement. Friday's Tokyo Consumer Price Index (CPI) for April climbed 3.5% YoY, compared to 2.9% in the previous month, as reported by the Statistics Bureau of Japan on Friday. Meanwhile, the Tokyo CPI, excluding fresh food and energy, came in at 2.0% in April, up from 1.1% in March. Additionally, the Tokyo CPI excluding fresh food rose 3.4% year-over-year (YoY) in April, up from the expected 3.2% and from 2.4% in the prior month.

Amid a lack of data, global trade sentiment will be a key driver of the AUD/JPY exchange rate in today's session.

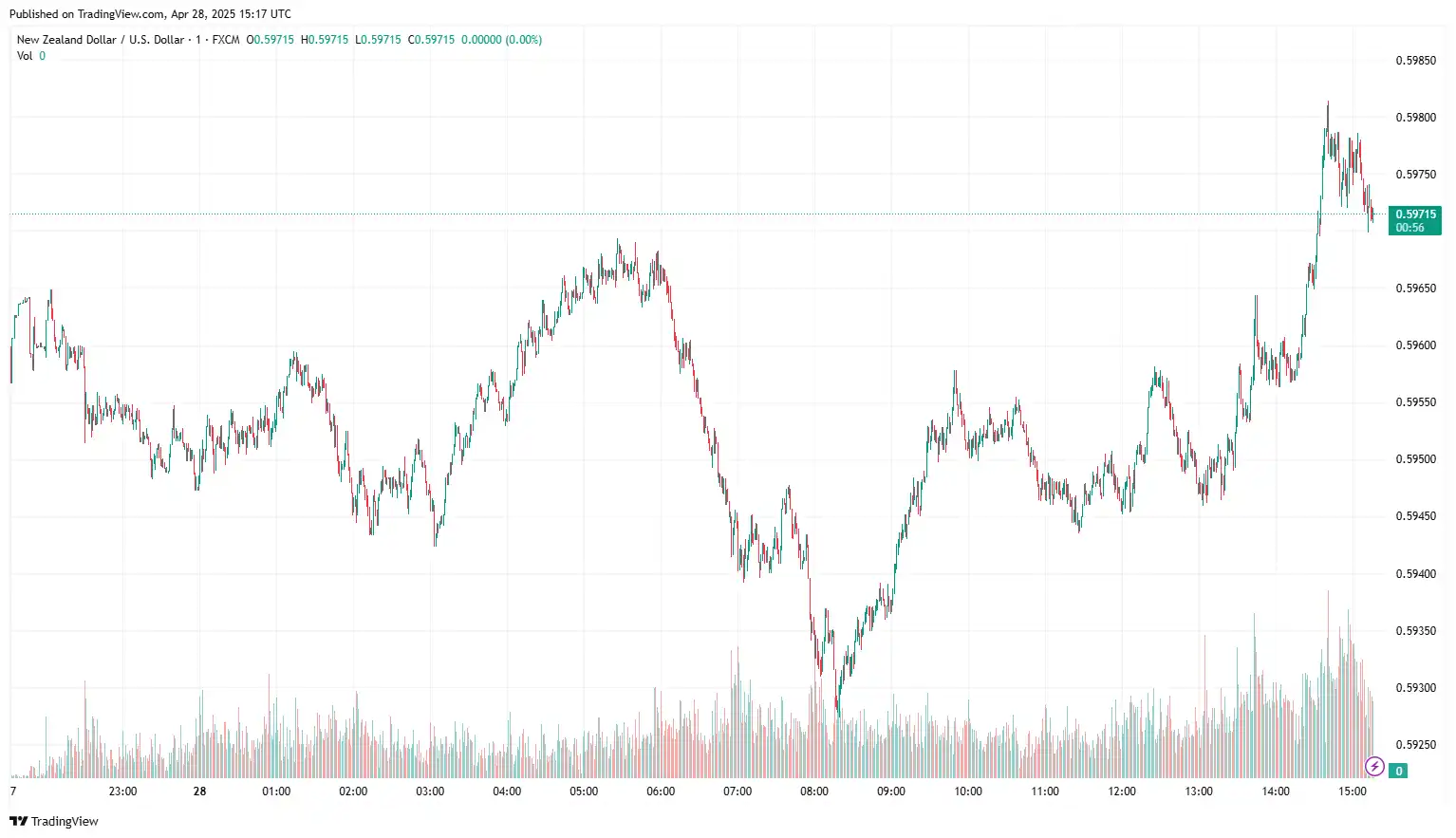

NZD/USD Softens Due to Improved US Dollar Sentiment

NZD/USD lost ground near 0.5935 as signs of easing trade tensions strengthened the greenback. On Friday, China announced exemptions for certain US imports from its 125% tariffs, according to sources. This announcement has sparked optimism that the prolonged trade war between the world's two largest economies could be approaching a resolution. To further complicate market uncertainty, US Agriculture Secretary Tom Vilsack noted on Sunday that the Biden administration is engaging in daily talks with China regarding tariffs. Rollins emphasised that negotiations are ongoing and that agreements with other countries are also "very close." On the economic front, consumer sentiment in April fell to 52.2, the lowest since the late 1970s, down from 57. Inflation expectations for one year rose to 6.5% from 5%, while five-year expectations increased to 4.4% from 4.1%. Durable Goods Orders rose 9.2% in March to $26.6 billion, totalling $315.7 billion, exceeding the expected 2% increase. New unemployment insurance applications rose to 222K for the week ending April 19, slightly above expectations and higher than the previous week's 216k. The insured unemployment rate was 1.2%, with the four-week moving average dropping by 750 to 220.25k. Continuing Jobless Claims decreased by 37K to 1.841M for the week ending April 12. Regarding monetary policy, the market expects the Federal Reserve (Fed) to restart its rate-cutting cycle in June, anticipating at least three interest rate reductions by year's end. Additionally, fears about the economic impact of Trump's trade policies will contribute to volatility in the dollar.

Conversely, the New Zealand Dollar (NZD) is under added strain due to hints of diminishing demand from China. Reports show that several Chinese manufacturers are halting production and exploring new markets because of US tariffs, leading to fewer orders and impacting employment levels. While these disruptions have not yet reached widespread levels, they could eventually harm New Zealand's export industry, considering China's crucial role as a trading partner. Additionally, the NZD continues to face downward pressure as market expectations grow for the Reserve Bank of New Zealand (RBNZ) to implement further monetary stimulus. A 25-basis-point rate cut is largely anticipated for the RBNZ's May meeting, with projections indicating that rates could drop to 2.75% by year-end.

Investors will keep a close eye on any additional signs of reduced tensions between the US and China, as well as official statements from both governments for further insights into the NZD/USD exchange rate.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not consider individual investment goals, financial circumstances, or specific requirements of readers. We do not endorse or recommend any particular financial strategies or products discussed. Currency Solutions provides this content as is, without any guarantees of completeness, accuracy, or timeliness.