GBP/USD Struggles Following Fed Rate Decision

GBP/USD fluctuated near 1.2447 as the Federal Reserve (Fed) held interest rates steady, in line with market expectations. Fed Chair Jerome Powell emphasised a data-driven approach to rate adjustments, adding that the Federal Open Market Committee (FOMC) closely monitors policies enacted by US President Donald Trump's administration. Current economic conditions alongside extensive trade policies, are expected to bolster the greenback. US Gross Domestic Product is expected to expand at 2.6%, slightly below December’s3.1%, while the Q4 core PCE Price Index is anticipated to reach 2.5%, up from 2.2% in Q3.

On the other hand, sterling gained support from comments by UK Prime Minister Keir Starmer and UK Chancellor of the Exchequer Rachel Reeves. Reeves expressed optimism about the economy, stating that it is on the verge of a "turnaround" during a speech in Oxfords hire. She pledged to eliminate "stifling and unpredictable" regulations to enhance productivity. Market sentiment is confident about the Bank of England's (BoE) anticipated 25 bps rate cut to 4.5% in its first policy meeting of the year, driven by slower-than-expected UK inflation and a surprising decline in December's Retail Sales. However, this could be offset by growing market volatility.

In upcoming sessions, broader market sentiment around the Fed's decision and Trump's policies will drive GBP/USD movements.

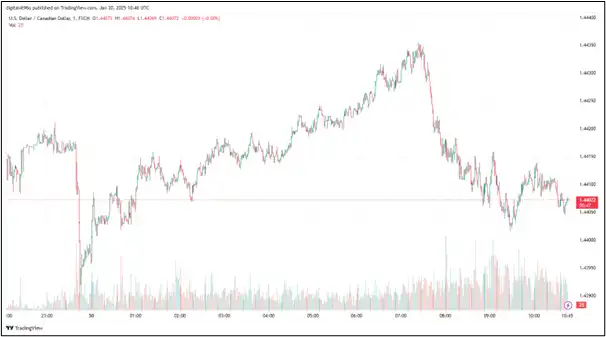

USD/CAD Buoyed Post-BoC Rate Cut

USD/CAD edged higher near 1.4416 following the Federal Reserve's decision to maintain its interest rate range at 4.25%-4.50% during its January meeting. During a press conference, Fed Chair Jerome Powell highlighted that the Federal Open Market Committee (FOMC) would closely analyse Trump's economic conditions and "real progress on inflation or some weakness in the labour market before we consider making adjustments."

The Bank of Canada (BoC) cut interest rates by 25 bps, lowering its primary reference rate to 3.0%. The bank also announced the end of its quantitative tightening programme and is anticipated to resume asset purchases in early March. BoC Governor Tiff Macklem stated on Wednesday, "A big increase in tariffs is a big disruption to the Canadian economy. Monetary policy can't fix that," emphasising the central bank’s limitations in mitigating potential trade war damage with the US. Still, he will do his best to make it less painful. He added,

"The potential for a trade conflict triggered by new US tariffs on Canadian exports is a major uncertainty. This could be very disruptive to the Canadian economy and is clouding the economic outlook." Additionally, a bearish sentiment surrounding crude oil prices could further undermine the commodity-linked Loonie.

In the upcoming sessions, market sentiment around both central banks' decisions, US Q4 GDP data, concerns over Trump's tariff plans, and oil price dynamics will influence the USD/CAD pair.

EUR/GBP Sinks Ahead of ECB Rate Decision

EUR/GBP hovers near 0.8366 as investors brace for the ECB interest rate decision and the preliminary reading of the fourth-quarter Eurozone Gross Domestic Product (GDP). The ECB is widely expected to reduce interest rates by 25 bps, bringing the Deposit Rate down to 2.75%.

French Consumer Spending, an indicator of a rise in household consumption expenditure on goods, increased by 0.7%, up from the previous 0.2%. Meanwhile, French GDP collapsed slightly in the fourth quarter of 2024, at -0.1% from the prior 0.4%. Spanish flash estimate of the Consumer Price Index (CPI) printed at 3.0% in January, exceeding the previous 2.8% and expected 2.9%. Furthermore, both Italian and German Preliminary GDP contracted in the fourth quarter of 2024.

German GDP declined 0.2% QoQ in Q4 from the previous and expected 0.1%, while the annual GDP rate plunged by 0.2% in Q4 after -0.3% reported in Q3 and against the estimated 0% print. The Eurozone economy showed no growth in Q4 2024, following a 0.4% expansion in Q3, missing the expected 0.1% growth. Year-on-year GDP growth remained at 0.9%, which aligns with Q3 but below the anticipated 1%. The unemployment rate rose to 6.3% in December, up from 6.2% in November.

Sterling remained steady against its major peers as Chancellor of the Exchequer Rachel Reeves stated that the economy is on the brisk edge of a "turnaround." She promised to remove "stifling and unpredictable" regulations to facilitate productivity. This provoked mixed investor sentiments, with many doubting that her proposed measures would be adequate to meet the government's ambitious growth targets.

On the monetary policy front, a confident market sentiment surrounding the Bank of England's (BoE) potential rate cut of 25 bps to 4.5% in its first policy meeting of the year, coupled with the risk of stagflation in the UK economy, driven by weakening labour demand and stubborn inflation, could inject market volatility.

Apart from the ECB's interest rate decision, a preliminary reading of the Eurozone Gross Domestic Product (GDP) for Q4 and ECB President Christine Lagarde's press conference will significantly influence the EUR/GBP exchange rate.

NZD/USD Subdued Amid Tariff Uncertainty

NZD/USD lost traction near 0.5650 as the New Zealand Dollar struggled due to dovish expectations that RBNZ would implement another 50 basis point (bps) rate reduction in the next policy meeting. Recent Trade Balance reports published a trade surplus of NZ$219 million in December, supported by a strong 17% increase in exports, outpacing a 6.5% rise in imports. However, ANZ Business Confidence dropped to a five-month low of 54.4 in January, down from 62.3 in December. The Business Outlook Index also fell for the third consecutive month, reaching 54.4 in January 2025, its lowest since August, reflecting signs of a slowing economy.

On Wednesday, RBNZ chief economist Paul Conway expressed a dismal economic outlook for the country, highlighting weak productivity, investment, and trade. He also mentioned that easing domestic pricing pressures and declining inflation expectations could pave the way for further cuts to the Official Cash Rate (OCR), as indicated in November.

The Fed's decision to maintain its overnight borrowing rate at 4.25%-4.50% strengthened USD. During the press conference, Fed Chair Jerome Powell stated there would be no immediate rate cuts until inflation and employment data justified them. He expressed confidence that progress in reducing inflation will continue this year but emphasised that rates will remain on hold as he waits for data to confirm this. Investors will crucially monitor today's US fourth-quarter Gross Domestic Product (GDP) growth data. Marketers anticipate a slowdown in annualised GDP growth, forecasting 2.6% from 3.1% in the previous quarter. Inflation concerns remain, with the Q4 GDP Price Index expected to rise to 2.5%, up from 1.9%.

Apart from Q4 GDP numbers, dovish expectations around RBNZ's interest rate decision, US weekly Initial Jobless Claims, and Pending Home Sales figures will drive the NZD/USD pair.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not consider individual investment goals, financial circumstances, or specific requirements of readers. We do not endorse or recommend any particular financial strategies or products discussed. Currency Solutions provides this content as is, without any guarantees of completeness, accuracy, or timeliness.