GBP/USD Stumbles Amid Fears of Potential US Recession

GBP/USD fluctuated around 1.2805 as trade tensions eased following President Trump's indication of openness to negotiations with global partners, raising hopes for a potential de-escalation in trade conflicts. On Tuesday, US Customs and Border Protection confirmed it is set to begin collecting country-specific tariffs from 86 trade partners. President Trump maintained his broader tariff plans despite requests for exemptions but showed openness to discussions. On Monday, Chicago Federal Reserve Bank President Austan Goolsbee raised concerns about the economic impact of tariffs, warning that severe tariffs could lead to massive retaliation, potentially worsening inflation, as seen in 2021-22. He stressed the importance of focusing on "hard data" and watching for signs of "stagflation." Meanwhile, President of the Federal Reserve Bank of San Francisco Mary Daly highlighted growing concerns about inflationary pressure from widespread tariffs.

A renewed escalation in the US-China trade war sparked fears of a possible US recession. On Tuesday, President Trump enacted a directive to increase tariffs on Chinese products to 104%, a move aimed at countering Beijing's responses to his tariffs. Trump alleged that China is manipulating its currency to lessen the impact of these higher duties. Last week, China retaliated by hiking tariffs on US imports by 34%, following Trump's comparable tariffs introduced on Liberation Day. However, a trade war between the US and China could lead to increased product dumping by Chinese firms in alternative markets. With Chinese manufacturers offering lower-priced goods, UK companies would struggle to compete in this pricing battle. Such developments would likely cause a sharp downturn in UK business activities, further weighing on the Pound Sterling. Cautious market sentiment, driven by concerns that President Trump's tariff policies could trigger a global economic slowdown and push the UK economy into a downturn, continues to weigh on the Pound. Additionally, traders have increased their dovish bets on the Bank of England (BoE) amid fears that Trump's tariffs could send shockwaves through the UK economy. However, the Pound found some support from rising UK gilt yields, with the 10-year yield climbing to approximately 4.61%.

In the upcoming sessions, the US economic docket, including the Consumer Price Index (CPI) inflation figures, the Producer Price Index (PPI) inflation data, and the University of Michigan (UoM) Consumer Sentiment Index survey results, along with the UK's monthly Gross Domestic Product (GDP) and factory data for February, will shape the market sentiment surrounding the GBP/USD exchange rate.

NZD/USD Rebounds Following RBNZ Interest Rate Decision

NZD/USD edged higher to 0.5551, following the Reserve Bank of New Zealand's (RBNZ) decision to cut interest rates by 25 bps, bringing the Official Cash Rate (OCR) from 3.75% to 3.5% after concluding the April monetary policy meeting. While softening inflation, slowing economic growth, and early signs of labour market weakness shaped the central bank's current policy outlook, growing global trade tensions support market speculation of an additional 50-100 bps cut in upcoming policy meetings. The minutes from the RBNZ interest rate meeting indicated that future policy decisions would hinge on the medium-term outlook for inflationary pressures. Concerning tariffs, the monetary policy response will prioritise the medium-term effects on inflation. The impact of rising tariffs on both global and domestic inflation remains uncertain. Globally, ongoing US-China trade tensions are dampening sentiment, especially in light of New Zealand's robust trade connections with China. Trump has recently threatened to implement an extra 50% tariff on Chinese imports unless Beijing reduces its tariffs on US products. China has reacted by denouncing this action as "blackmail" and has promised to safeguard its economic interests. On Wednesday, China issued a white paper on US trade and economic relations, providing insights on the upcoming measures by Chinese authorities.

On the other hand, the expectation that the Federal Reserve (Fed) may soon resume cutting rates is fueled by rising worries about a US economic slowdown tied to tariffs, which is exerting pressure on the dollar. Nevertheless, the US 10-year Treasury yield rose to 4.36%, mitigating the dollar's downturn. On Tuesday, US Customs and Border Protection declared its readiness to enforce country-specific tariffs on 86 trade partners. President Trump mentioned that he is not considering pausing his extensive tariff strategies, even with several countries requesting exemptions, though he indicated some willingness to engage in negotiations. Investors will closely observe the US economic data scheduled this week, including the Consumer Price Index (CPI) and the Producer Price Index (PPI) data, for further insights on the USD's movements.

In today's session, the Federal Open Market Committee (FOMC) minutes from the March policy meeting and rising concerns over a trade war between the US and China will guide the NZD/USD exchange rate.

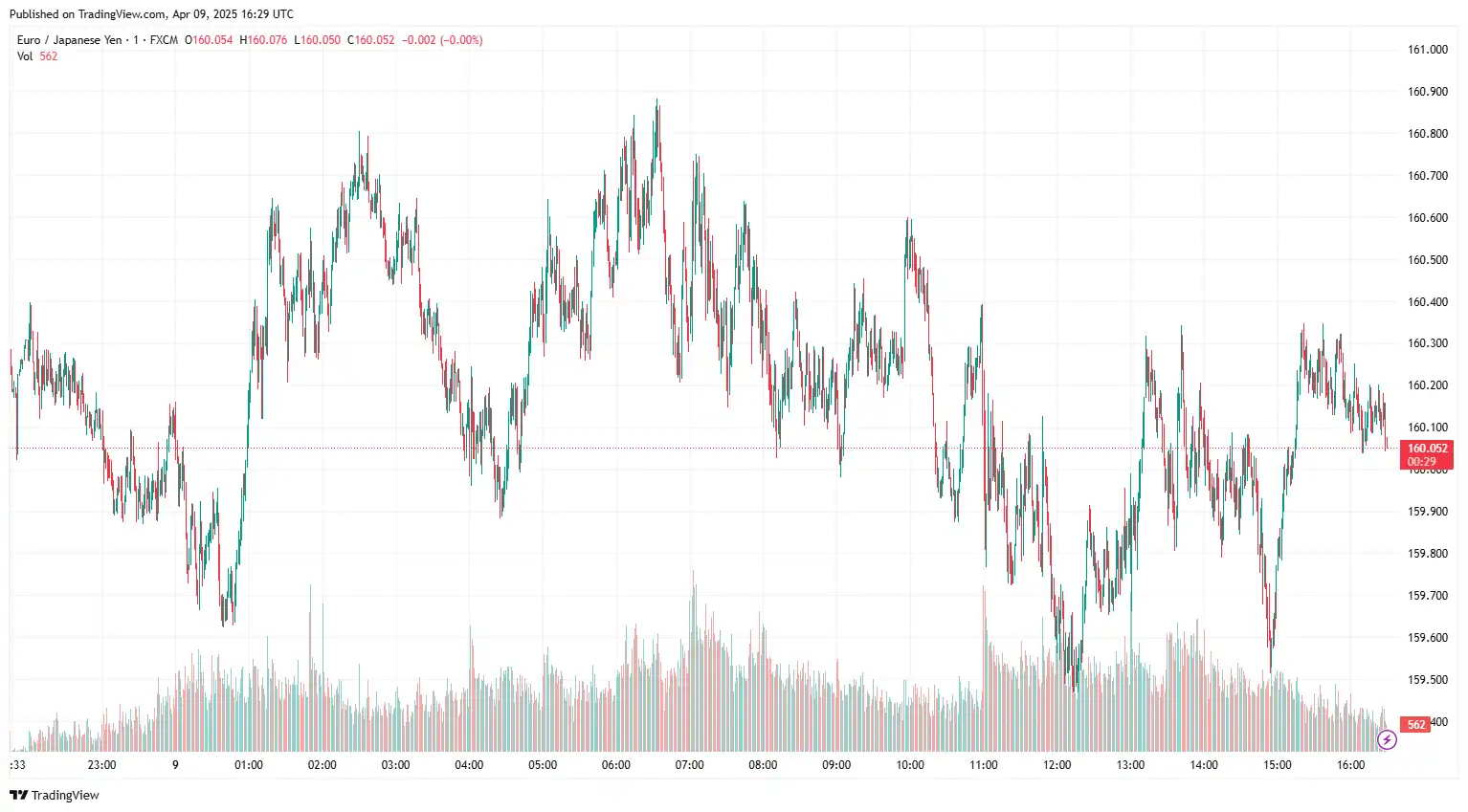

EUR/JPY Struggles Ahead of BoJ's Meeting

EUR/JPY hovered near 160.23 as a key meeting between Japan's Ministry of Finance (MOF), Financial Services Agency (FSA), and the Bank of Japan (BoJ) to discuss international financial markets and strengthen market sentiment around the Japanese yen. Moreover, the market expects the Bank of Japan to accelerate interest rate hikes due to worries about the potential economic repercussions of Trump's trade tariffs, which will persist in supporting the yen. On Wednesday, Bank of Japan (BoJ) Governor Kazuo Ueda stated that the central bank "will continue to raise rates if the economy maintains its improvement according to the outlook." He also mentioned that policy decisions will be made after assessing domestic and international risks, including economic trends, price developments, and the influence of US trade policy.

Today, Japan's Consumer Confidence Index for March was reported at 34.1, slightly below the anticipated 35.0 but higher than February's 34.7. Machine Tool Orders saw a year-over-year increase of 11.4% in March, surpassing the previous 3.5% rise. Additionally, rising concerns about a potential global recession due to tariff disputes have heightened the demand for safe-haven currencies, benefiting the yen. US President Donald Trump has consented to meet with Japanese officials to start trade negotiations, which enhances hopes for a possible US-Japan trade deal. This optimism further strengthens the JPY.

The Euro faced added pressure due to deteriorating market sentiment following the implementation of US retaliatory tariffs and dovish expectations for the European Central Bank (ECB). Several ECB policymakers, including Bank of Italy Governor Piero Cipollone, Bank of France Governor François Villeroy de Galhau, and Bank of Greece Governor Yannis Stournaras, have supported further monetary easing. Poland's Finance Minister Andrzej Domański warned that disrupted supply chains and rising corporate costs could weaken European growth and put pressure on regional currencies. He also highlighted the potential for "adverse social consequences" and higher consumer prices, according to a report. Monday's Eurozone retail sales rose 2.3% year-on-year in February, surpassing expectations, but monthly growth was only 0.3%, below the 0.5% forecast. Investor sentiment dropped sharply, with the Sentix Investor Confidence Index falling to -19.5 from -2.9 in March. Germany's industrial output contracted by 1.3% month-on-month in February, worse than the expected 1.1% decline and 4% year-on-year. Germany's trade balance for February was EUR 17.7 billion, slightly below expectations. Factory orders remained flat, indicating stagnation, while industrial orders fell 2% year-on-year, contrasting with a prior rise.

In today's session, market sentiment surrounding the US-Japan trade deal and the statement issued by Japan's Ministry of Finance, Financial Services Agency, and the BoJ's joint meeting will influence the EUR/JPY exchange rate.

AUD/USD Gains Ahead of China's High-Level Meeting

AUD/USD advanced to 0.6011, reflecting positive market sentiment after President Trump suggested a willingness to negotiate with trade partners. Trump's remarks boosted optimism for a potential easing of global trade tensions. The risk-sensitive Aussie encountered challenges due to heightened market volatility following the US's anticipated 50% tariff on Chinese imports, which is particularly significant given Australia's robust economic relationships with China. In response, Beijing labelled Trump's recent threats as "blackmail" and pledged to protect its interests. On Wednesday, senior officials from China's State Council and various government and regulatory bodies are expected to convene in response to US President Donald Trump's 104% tariffs on Chinese goods. The agenda includes discussing strategies to enhance domestic consumption and bolster capital markets. On Tuesday, the People's Bank of China (PBoC) announced its intention to support a sovereign fund as needed, reiterating its commitment to purchasing additional stocks. In a statement, China's central bank indicated that it would enhance funding assistance through a re-lending program to Central Huijin Investment Ltd. whenever necessary to maintain stability in the capital markets. Any significant development in the US-China trade concerns will impact the Australian economy, with China being an important trade partner to Australia.

Recent business and consumer confidence data suggest that Australia's economic outlook is still fragile. Consumer sentiment saw a significant decline, as the Westpac Consumer Confidence Index dropped by 6% in April, following a 4% increase in March—marking the first decrease since January. Meanwhile, Australia's business sentiment also decreased, with the NAB Business Confidence Index falling to -3 in March from a revised -2, the lowest level recorded since November. Although business conditions remained fairly stable, they were slightly below average, showing a small improvement from 3 to 4. The weak data has strengthened expectations for a more dovish approach from the Reserve Bank of Australia (RBA), anticipating further rate cuts.

Meanwhile, the US Dollar (USD) remains under pressure as investors expect that Trump's tariff agenda could lead to a resurgence in inflation and slower economic growth. On Tuesday, US Customs and Border Protection announced its readiness to collect tariffs from 86 trade partners. Trump stated he would not pause his plan for additional tariffs on many countries, despite trade partners' requests to avoid these levies, but suggested he might consider negotiations. Concerns regarding an economic slowdown and a potential recession in the United States are putting downward pressure on the Greenback as markets adjust their expectations for more rate cuts from the Federal Reserve (Fed) this year.

Market participants will closely monitor US inflation data and the Federal Open Market Committee (FOMC) minutes of the March policy meeting for further direction on AUD/USD's movements.

Stay Ahead in the Currency Game

Whether you're a daily FX trader or handle international transactions regularly, our 'Currency Pulse' newsletter delivers the news you need to make more informed decisions. Receive concise updates and in-depth insights directly in your LinkedIn feed.

Subscribe to 'Currency Pulse' now and never miss a beat in the currency markets!

Ready to act on today’s insights? Get a free quote or give us a call on: +44 (0)20 7740 0000 to connect with a dedicated portfolio manager for tailored support.

Important: This blog is for informational purposes only and should not be considered financial advice. Currency Solutions does not consider individual investment goals, financial circumstances, or specific requirements of readers. We do not endorse or recommend any particular financial strategies or products discussed. Currency Solutions provides this content as is, without any guarantees of completeness, accuracy, or timeliness.