October 2022 Currency Forecast - GBP/USD, GBP/EUR, EUR/USD

SEPTEMBER REVIEW & OCTOBER RISK EVENTS & THEMES

POUND STERLING

September was a landmark month for the pound for all the wrong reasons. Despite gaining traction against the US Dollar in the opening half, Sterling plummeted dangerously close to US$1.05 – an all-time low – on the 26th.

To many, it was a judgement on chancellor Kwasi Kwarteng’s so-called mini-budget, which banked on tax cuts for high-income earners to shore up investor sentiment. The opposite seemed to take effect, with risk-off sentiment only being exacerbated.

As a result of the mini-budget’s lead balloon response, the Bank of England (BoE) took the drastic approach of intervening in the gilts market with an unlimited long-dated bond-buying programme from the 28th, effectively bailing out the UK economy at the expense of further quantitative easing.

There was "a material risk to UK financial stability," said the BoE, so gilt auctions were pencilled in till at least the middle of October “to restore orderly market conditions”.

In response, 30-year bond yields fell more than 10%.

In response, 30-year bond yields fell more than 10%.

In response, 30-year bond yields fell more than 10%.

The effect was actually positive for the GBP/USD pair, with a couple of hundred pips added at the tail-end of the September 28 trading session. But small relief aside, the Pound still lost nearly 8% against the Dollar throughout the month.

As for the GBP/EUR pair, the pound lost ground, albeit at a less savage 3.5%.

A day prior to Kwarteng’s contentious mini-budget announcement on the 23rd, the BoE upped the base inflation rate another 50 bps to 2.25%, as was to be expected. The decision marked the seventh consecutive rate hike voted on by the MPC, but any possibility of a short-term relief rally was soon dashed.

If there was anything to celebrate, it was that August’s inflation rate of 9.9% was a fraction short of estimates. Gross domestic product (GDP) data of 2.3% was below the 2.6% expectation, though was still 40 bps up year-on-year (YoY).

But ropey data aside, unemployment fell to the lowest point since 1974. Just don’t expect your hard-earned pounds to buy you much when travelling abroad, at least for the time being.

Taking a broader look back at September, it’s safe to say that any hopes of stability following the conclusion of the drawn-out leadership debate were made in vain.

With second-quarter gross domestic product figures expected to contract by 0.1%, a UK recession looks to be underway.

Download full Report here

EURO

The Euro proved to be less volatile compared to the Pound in September, having dropped around 200 pips throughout the month. But the macro data was hardly rosy.

Pan-EU unemployment rates remained essentially flat, while inflation came in hotter than expected at 9.1%, beating forecasts by 10 basis points.

Manufacturing and services PMIs hit expectations, but industrial production underperformed. As did construction output, which fell for the fourth month in a row, with Italy, Germany and France being the worst performers.

Analysts expected a 75 bps rate hike from the European Central Bank, and that’s what they got.

Consumer confidence fell by 3.8 points to -28.8 at the start of the month, considerably worse than market expectations of -25.8. In fact, the reading was the lowest since records began in 1985, no doubt spurred on by worries surrounding the Nord Stream 1 gas pipeline.

Of course, the big talking point was the Euro slipping below parity with the US Dollar. The EUR/USD pair seemed to be improving towards the middle of the month until a reversal gained pace with some 130 pips being carved out on the 14th alone.

The Euro continued to slide from there, eventually ducking below US$0.96 by the 28th.

The running theme across the member states was a lack of consumer confidence. The Institut national de la statistique (INSEE)'s headline sentiment index fell 3% in September to 79 – well below the 100-point long-run average – to match lows last seen in May 2013.

Similarly, Italian consumer confidence weakened throughout the month to levels last witnessed at the onset of the pandemic.

Consumer confidence varied throughout 2022, but dipped sharpy in recent months – Source: Bloomberg and Daiwa Capital Markets

Consumer confidence varied throughout 2022, but dipped sharpy in recent months – Source: Bloomberg and Daiwa Capital Markets

The European Commission’s Euro-area Economic Sentiment Index (ESI) dropped for the sixth of the past seven months, to the lowest level since November 2020.

US DOLLAR

President Joe Biden’s inflation-prone fiscal policy has caused its fair share of dismay, but the proof is in the pudding for the US dollar. Against the rest of the G10 currencies – the Australian dollar, Canadian dollar, Euro, Japanese yen, New Zealand dollar, Norwegian krone, Pound sterling, Swedish krona and Swiss franc – USD was by far the strongest performer.

Consequently, US import prices fell for the second month in a row, this time by 1.7% compared to 1.5% in August, although they are still up 7.8% YoY. Cheaper fuel, petroleum and food imports predominantly contributed to the fall, which could help ease inflation pressure over time.

Exports also fell, albeit at a softer 0.9%, thus the monthly trade deficit improved some US$2.9bn.

Year to date, the G10 set has fallen against the US dollar by an average of 16%, with the pound, krona and yen all falling over 20%.

The Canadian dollar and Swiss franc fared strongest against the US dollar – Source: Refinitive Eikon via Reuters

The Canadian dollar and Swiss franc fared strongest against the US dollar – Source: Refinitive Eikon via Reuters

The USD/EUR pair currently sits at $1.02 following the Euro’s dive below parity. USD gained 7% against the Australian dollar and close to 5% against the Swiss franc.

As for the macro data, key data sets weren’t all positive. Inflation came in even hotter than expected at 8.3% against a forecasted 8.1%. In response, the Federal Reserve conducted its third outsized interest rate hike in a row, raising the benchmark by another 75 basis points on the 21st.

Federal Reserve chair Jerome Powell ditched his “soft landing” hopes – bringing costs down without deepening recession fears – at the tail end of August. His strategy now appears to be reducing inflation by any means possible, even at the expense of jobs data.

Although, “I think there’s a chance, not a big chance, a small chance, of a soft landing,” Jamie Dimon, chief executive officer of JPMorgan Chase, said at a recent congressional hearing.

These policies take time to have any material impact in any case, so for now, the unemployment rate is one of the lowest it’s ever been and jobless claims in September were below expectation. Even consumer spending results were better than expected.

Homeowners are having to contend with rising mortgage rates, which at 6.52%, are as high as they were in 2008.

The dollar’s strength is making it more attractive as a safe haven asset for international investors who are scared of the geopolitical tensions and deepening energy crisis plaguing Europe

Download full Report here

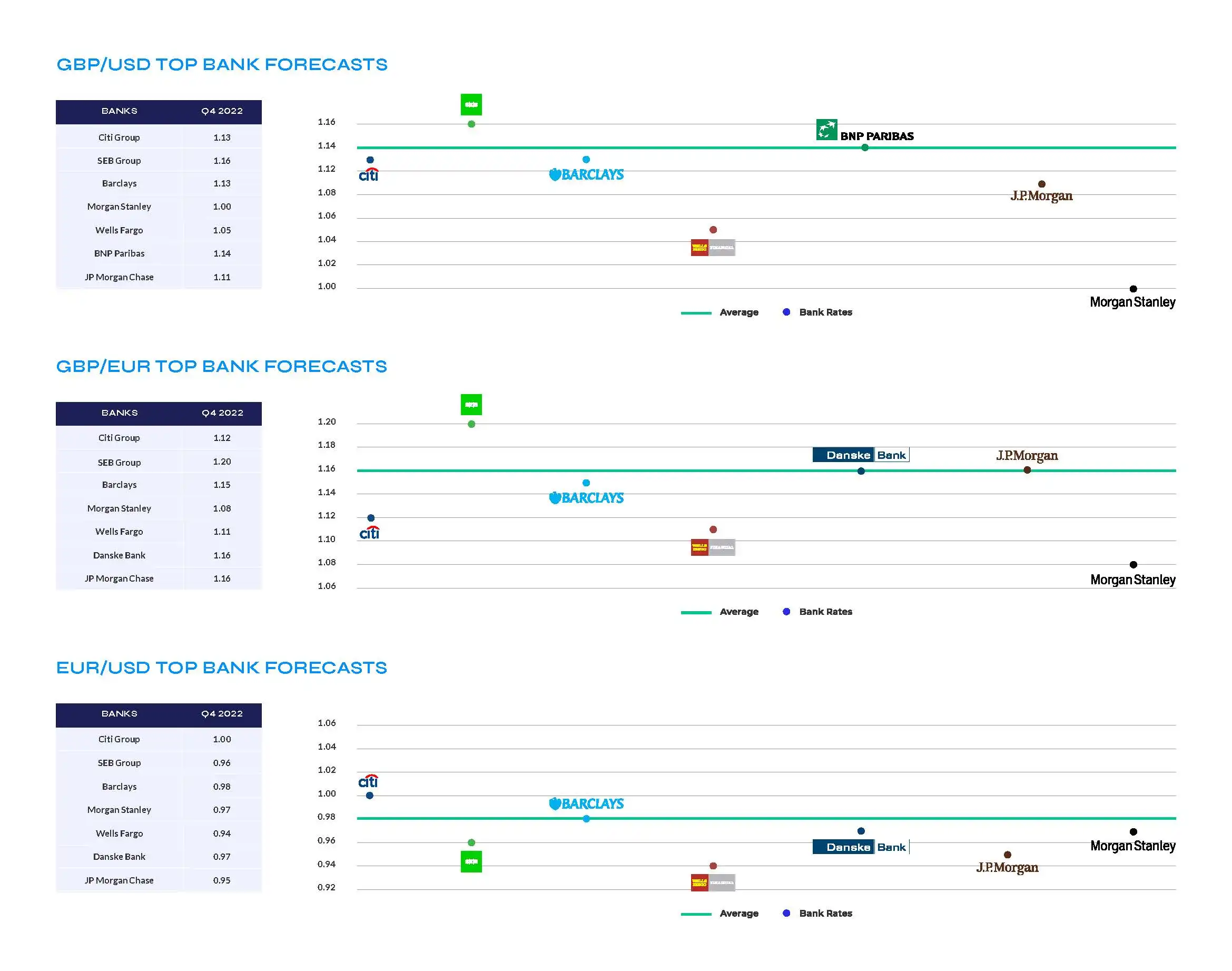

TOP BANK FORECASTS

OCTOBER RISK EVENTS AND KEY THEMES

UNITED KINGDOM

Borrowing overdrive: Prime minister Liz Truss and Kwasi Kwarteng seem unphased by the reaction to their mini-budget, which drew widespread criticism – not just domestically, even the International Monetary Fund (IMF) took umbrage – for its sweeping tax cuts and borrowing policies. Government borrowing could push up interest rates once again, just as the BoE sought to calm the waters. In addition which may the be the first of many embarrassing U-turns, plans for the 45p tax rate cut have been scrapped.

Quantitative easing: The BoE was forced into rescue mode following Kwarteng’s poorly received budget. Since the bank is now buying an unlimited amount of gilts to stave off a genuine financial crisis, we can expect even higher inflation as QE kicks in. The BoE did promise to stop its buying spree by the middle of October.

Mortgage meltdown: Providers are already starting to take their mortgage products off the table, and the trend is likely to continue. With fewer mortgages being offered and those that are available coming with hefty price tags, the housebuilding sector could suffer a blow, while average household spending power will also take a hit.

EUROZONE

Parity: EUR/USD parity is already upon us, but will continue to be a running theme throughout October, if only because of the poor image it reflects onto the continent. The trading pair could very well head above US$1 in the opening stages of the month, but sustaining that level is another thing altogether.

Energy crisis: Winter is fast approaching, yet Europe’s energy crisis is only getting worse. Energy companies are likely to hike gas prices given the bottlenecks resulting from the Russian invasion of Ukraine. EU-wide windfall taxes aimed at curbing prices for businesses and households are likely, but anxiety surrounding Europe’s reliance on Russian supplies is palpable.

Italy’s new administration: Italy’s newly elected premier Giorgia Meloni is a mixed bag of fiscal policies. Certain publications have been quick to write her off as far-right or even fascist, though her Brothers of Italy party tend to align themselves closer to Trump’s vision of new-school conservatism. The government hasn’t been totally forthright in regards to its stance on taxes and spending, so a clearer picture will hopefully take place in October.

UNITED STATES

An overvalued dollar: October will test the dollar’s mettle. Some observers, including bond veteran Bill gross, believe that USD is overvalued right now and are betting on a Sterling recovery. Justifications given include an ongoing (albeit tightening) trade deficit and a more relaxed approach to rate hikes taken by the Federal Reserve.

Unemployment: US unemployment figures could be poised to go up. Government policy has been heavily invested in maintaining the country’s impressively labour statistics, even at the expense of fiscal policy, but there is a sense that tampering inflation is beginning to take the front seat.The Fed has an inflation target of 2%, and a cooling of the labour market could be one piece of the puzzle.

US-China relations: Taiwan remains a sticking point in US-China relations following house speaker Nancy Pelosi’s surprise visit in July. Talks on climate change and security have broken down between the world’s two largest economies. Although envoy Nicholas Burn is trying to encourage dialogue, China’s closeness to Russia could prove to be another sticking point. The two countries are highly competitive in the technology sector, so a Trump-era trade war on in the highly interconnected semiconductor sector could be at stake.

Download full Report here

Key Dates in October:

The old adage comes to mind, "In the land of the blind the person with one eye is king", thankfully we have both eyes and we're always looking to support our partners and customers having their best interests in mind.

The volitility of the market has brought into focus the improtants of risk management when it comes to FX, and as such, Currency Solutions is always on hand to help manage and mitigate any FX losses you may incur. Call us today for a free consultatation or click here for an instant quote.

Download full Report here