Sterling faces tough session; Euro falls against the Dollar; USD gains on Yen

Bank of England’s intervention provides modicum of Sterling support

The Bank of England’s dramatic intervention in the sovereign markets encouraged a modicum of support for the pound and despite shedding a few pips overnight, GBP/USD is at least in a stronger position this morning than it was at the start of the week.

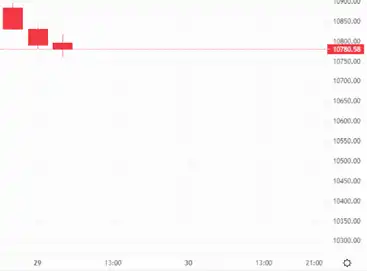

Currently sitting at US$1.08, the four-hour chart shows a slight bear advantage on a spinning-top candlestick, though it could go either way in today’s trading session.

A slight bear advantage is taking hold this Thursday morning – Source: capital.com

A slight bear advantage is taking hold this Thursday morning – Source: capital.com

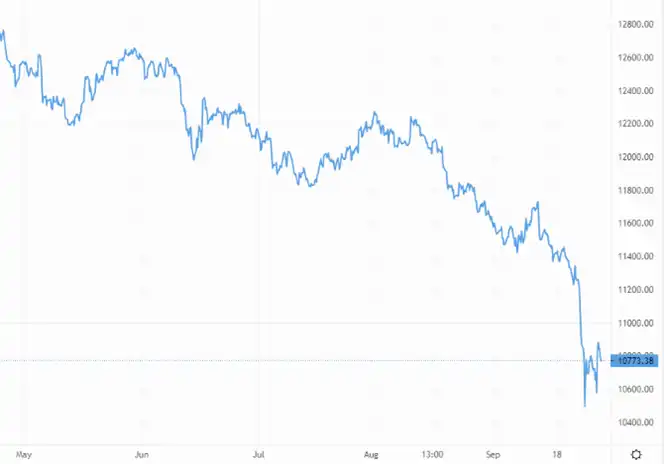

Not that there’s a huge deal to celebrate for pound holders in the long run, but any sign of stemming the downward spiral to parity should be met with some enthusiasm.

Despite a degree of support, long-term outlook for the pound is still grim – Source: capital.com

Despite a degree of support, long-term outlook for the pound is still grim – Source: capital.com

The Euro is losing some ground against the US Dollar this morning after what turned out to be a net positive Wednesday session.

At just shy of US$0.97, the EUR/USD pair is sitting level with an early-week high.

To find the best rates for today, speak to our brokers or visit our page here for an instant quote.

Germany’s flash inflation figures are due this afternoon, with general consensus pointing to an uptick on soaring energy prices.

The USD remains on top against all major currencies, having added 0.8% against the Canadian dollar and 0.4% against the Japanese yen.

With little on the US economic calendar today, we can expect the Dollar’s position to stand its ground.