Sterling reacts to surprise inflation

Daily Forex Market Report 23-Dec-2022: Sterling reacts to surprise inflation reads

EUR slows against the US Dollar

As it turns out, the US is still beating the UK in terms of gross domestic product.

Yesterday showed that UK GDP growth is slowing faster than expected, while across the Atlantic, the US economy grew 3.2% in the third quarter, better than the 2.9% forecast, thus rebounding from two straight quarters of contraction.

Consumer spending among Americans rose more than anticipated (2.3% versus 1.7% forecasted), as growth in healthcare and other services partially offset a decrease in spending on motor vehicles, food and beverages.

Cable responded by falling sharply from an intraday high of 1.214, hitting lows of 1.199 before entering a slight correction.

By the end of the day, the pound had lost around 0.3% to 1.203 but has inched higher to 1.204 in this morning’s Asia trading window.

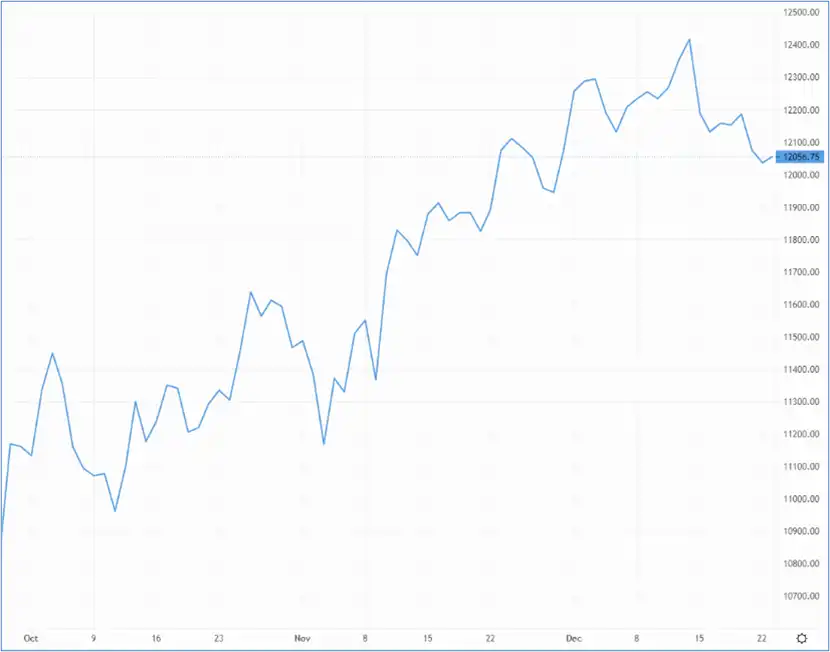

GBP/USD reacts to US GDP growth – Source: capital.com

GBP/USD reacts to US GDP growth – Source: capital.com

The euro continues to gain against the pound, with another quarter percent added yesterday and a handful of pips added this morning.

At 88.12p, the EUR/GBP pair is heading above November highs, with October highs in its sights next.

EUR/USD seems to be running of steam after six weeks of consistent gains. Currently changing hands at 1.061, the pair has been trading sideways for a good week now.

Inflation continues to rattle Japan, unsurprising given the bank’s general refusal to budge on its hand-off monetary policy.

In this morning’s reading, the annual inflation rate crept up to 3.8% from 3.7% a month earlier, the highest reading since January 1991, due to high prices of imported raw commodities and persistent yen weakness.

After falling sharply at the start of the week on news that the Bank of Japan may at least reconsider its yield curve policy, the USD/JPY regained its composure and currently stands at 132.28, with GBP/JPY changing hands at 159.68.

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our dedicated team of experts can help you manage and understand you exposure or risk.

Employment data also failed to impress, while the goods trade balance widened its deficit more than expected.

As such, Federal Reserve chair signalled a slower pace of interest rate hikes in the months to come.

"It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down,” said Powell, though he did note that the terminal rate could be "somewhat higher" than the 4.6% indicated by in the September projections.

EUR/GBP closed the Wednesday session at .863, around 12 basis points below the intraday high, though the euro has the slight upper hand this morning having added a few pips.

Yesterday’s EU headline inflation data came in at a flat 10% against a 10.3% forecast, though that figure is still unacceptable high given the 2% target, so excessive rate hikes are likely to stay on the agenda in the coming months.

Combined with Powell’s dovish overtures, EUR/USD jumped a full percentage point to 1.042 yesterday, and continued to rally another 0.33% to 1.045 in today’s Asia window.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.