US Dollar gives up gains

Daily Forex Market Report 24-Jan-2023: US Dollar gives up gains

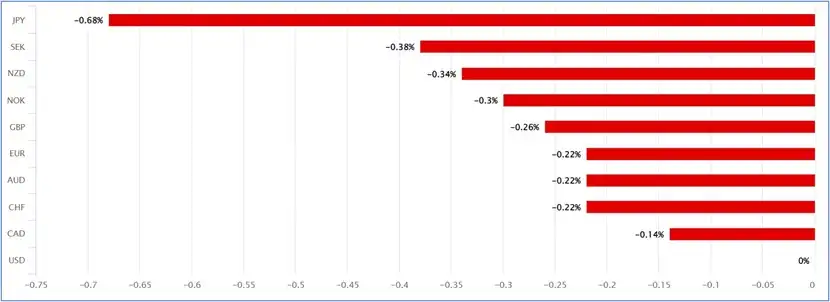

The US dollar was flagging again on Tuesday morning, giving up the small gains it had made the day before, as markets prepared for the release of more PMI data later.

Moving up against the USD, the Japanese yen was up 0.64% to 129.8, the pound up 0.29% to 1.2409 and the euro climbing 0.23% to 1.0894.

The dollar index (DXY) was down 0.32% at 101.81, having oscillated around the 102 mark for almost two weeks now.

Source: Tradingview

Source: Tradingview

‘Flash’ purchasing managers index survey results have already been released for the likes of Japan and Australia, with a 9am release for the EU figures for manufacturing, services and composite indices, with UK PMIs at 9.30am and the US at 2.45pm.

“It’s become increasingly clear that larger swings in the dollar are now driven by data releases given the market's heightened sensitivity to the US growth story ahead of next week’s Federal Open Market Committee (FOMC) meeting,” said analysts at ING.

Preliminary PMIs releases, while not being as highly regarded as the ISM in the US, could still have an effect on the dollar due to that elevated sensitivity to data.

“Some improvement in the market’s sentiment around the health of the service sector in the US should help limit downside exposure for the dollar. In that case, DXY may hold around 102.00 today unless PMIs in Europe surprise to the upside. Richmond Fed manufacturing data is the other release in the US calendar today.”

Advances were also being made by EUR, dancing 0.46% higher against the Turkish lira and 0.33% rise versus the rand.

The single currency was being helped by European Central Bank officials fighting back against speculation of a smaller 25-basis points hike since the weekend.

Elsewhere in the G10 currencies, the Aussie dollar broke above 0.7000 against USD yesterday, back as the most popular long trade in 2023 so far.

Tonight/tomorrow morning’s CPI data there will be the next trigger for more moves, especially if inflation is proving sticky and the market decides against its recent opinion that the central bank may need to delay the expected pause in its rate-hiking cycle.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.