US Dollar weakens against GBP and EURO

Daily Forex Market Report 19-Dec-2022: US Dollar weakens against GBP and EURO as the year comes to a end

As the end of the year approaches, everything is quiet on the economic calendar.

In the meantime, the pound is showing strength against the US dollar, having closed the Sunday session 0.2% higher at 1.215 and already added another 0.4% to 1.220 in this morning’s Asia window.

Indicatively, the US Dollar Index (DXY) shed half a percent to 103.89, and looks likely to continue acting bearishly as the day progresses.

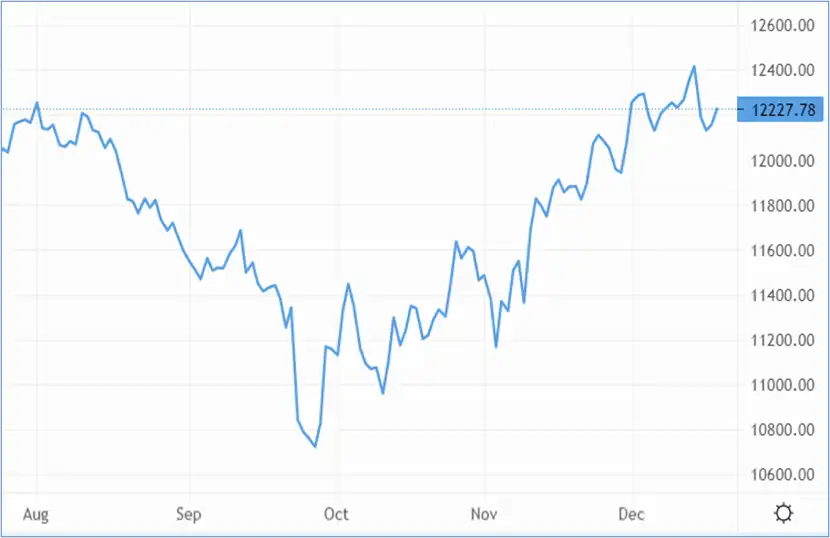

Cable enjoys some upside following previous week’s dip – Source: capital.com

Cable enjoys some upside following previous week’s dip – Source: capital.com

Among the cross pairs, the pound opened stronger against the Japanese yen at 166.05, while the GBP/CAD pair is on course for a strong session having added 0.2% to 1.667 so far.

Yields on British 10-year gilts are slightly lower at 3.4%.

The euro continues its hot streak, having climbed half a percent against the greenback in today's opening hours. At 1.064, there is likely more upside for the EUR/USD as the session progresses.

However, while EUR/GBP opened strong at 87.15p, the pair has encountered some downside as the Asia window progresses, and has dipped around 10 pips at the time of writing.

Although the economic calendar is quiet, today’s euro area wage growth reading should give an insight into the region’s inflation battle.

Wages saw the biggest increase in two years at the last reading. Great for employees, but policymakers are probably hoping for a softer reading today as the EU continues to fight uber-sticky inflation.

How to manage FX Risk/Exposure?

Understanding your FX risk and exposure is paramount to your bottom line. At Currency Solutions our decicated team of experts can help you manage and understand you exposure or risk.

Employment data also failed to impress, while the goods trade balance widened its deficit more than expected.

As such, Federal Reserve chair signalled a slower pace of interest rate hikes in the months to come.

"It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down,” said Powell, though he did note that the terminal rate could be "somewhat higher" than the 4.6% indicated by in the September projections.

EUR/GBP closed the Wednesday session at .863, around 12 basis points below the intraday high, though the euro has the slight upper hand this morning having added a few pips.

Yesterday’s EU headline inflation data came in at a flat 10% against a 10.3% forecast, though that figure is still unacceptable high given the 2% target, so excessive rate hikes are likely to stay on the agenda in the coming months.

Combined with Powell’s dovish overtures, EUR/USD jumped a full percentage point to 1.042 yesterday, and continued to rally another 0.33% to 1.045 in today’s Asia window.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.