Volatility expected in the forex market

Daily Forex Market Report 30-Jan-2023: Volatility expected in the forex market as traders gear up for a week of interest rate announcements

There is a feeling of uncertainty and volatility in the forex market today as traders gear up for a week of interest rate announcements that will lay bare the central banks’ monetary policies across the US, UK and EU.

Cable has consolidated below the 1.24 mark after trading sideways on Sunday and heading 0.2% lower this morning while the US Dollar Index (DXY) managed to add around 0.13%.

In the wider time frame, DXY remains definitively bearish having lost over 3% since the intra-month high, a trend that is unlikely to change if, as is highly likely, the Federal Reserve implements a 25 bps rate hike on Wednesday.

Hell, the Fed might even announce a pause in rate hikes altogether to complement the States’ northern neighbour Canada’s surprise decision last week.

As for the Bank of England, consensus points to a bulkier 50 bps hike come Wednesday, which should prove a bullish catalyst for the GBP/USD pair.

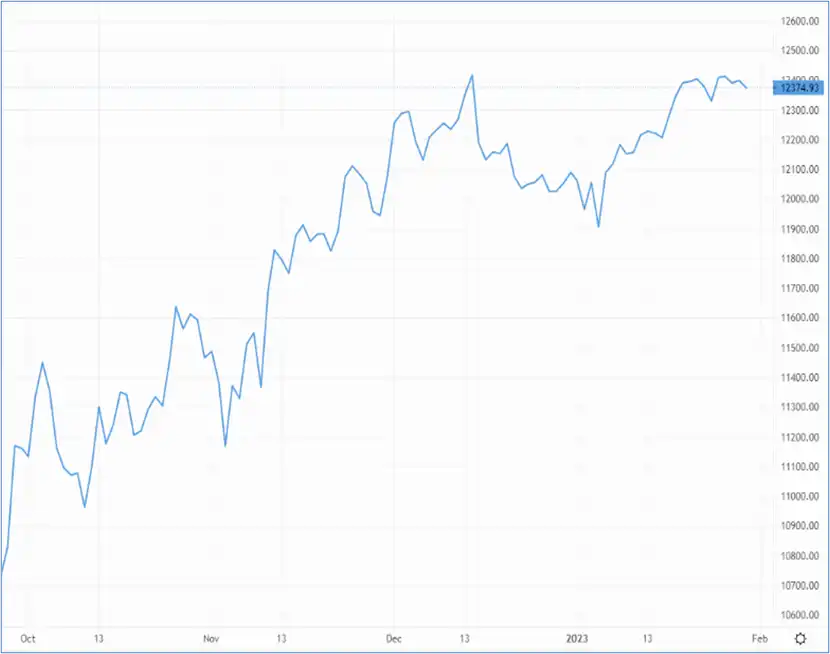

GBP/USD struggled to break above December 2022 highs – Source: capital.com

GBP/USD struggled to break above December 2022 highs – Source: capital.com

EUR/USD barely budged in the Sunday session, a trend that filtered through to this morning, with the pair losing a handful of pips to 1.086.

Eurozone economic sentiment gauges scheduled for release today are expected to show slight improvements across the industrial and services sectors.

After the wild mood swings observed earlier this month, EUR/GBP has consolidated at 87.67p after barely registering any price action in the past two trading sessions.

What does FX Risk/Exposure mean?

There are three types of foreign exchange exposure companies face:

- Economic exposure

- Conversion exposure

- Transaction exposure

In short, FX/forex (foreign Exchange) exposure means the risk that an individual or company takes when executing transactions in foreign currencies.

If a business is looking to make transactions globally or in multiple currencies, it's important that they first identify their exposure to risk in order to put a calculated risk management strategy in place.

FX Risk/Exposure Management - How does it work?

Volatile currency markets can have a huge impact on your profits.

Let say that you set a 2021 price for a product, bought in USD including a 5% profit margin, based on the exchange rate when the pound was strongest.

When the pound weakened, your profit margin would soon erode, and leave you with -2.5% profit - based on the same price, from stock bought at the dollar’s peak.

This fluctuation in price could force you to either absorb the loss or increase your prices, with the knock-on effect of untenable prices in your already competitive market.

We are a payment solutions provider with over 20 years’ experience and expertise in foreign exchange payments Our services inlcude but are not limited to:

- Hedging and FX Strategies

- Best rates for Spot trades

- vIBAN set up

- E-commerce solutions

We know that it can be time-consuming and challenging to keep up with the innumerable ongoing events that continuously affect the global market mood.

Click here for an instant quote or contact us for a free foreign exchange health check, guaranteed to save you money.