Large Currency Transfers TEST

- Rated 'Excellent' on Trustpilot

get a Free quote

Please share details of the transfer you’d like to make.

Please note: we do not support cash transfers.

Get Ready to Experience the Best in Currency Exchange

Register to bid today at Gooding & Company and open your free account with us. We look forward to seeing you there!

AS A PARTNER, BENEFIT FROM:

You will receive commission on all revenue your referrals generate.

We will provide marketing collateral and an interactive FX calculator to get you started.

You will have a dedicated account manager to help you every step of the way.

How we can help

Drive growth opportunities that strongly deliver back into your business. Eliminate penalties from late payments and remove complex reporting and/or execution. Increase your currency management strategies and market insights whilst improving on your business model.

- Reduce reconciliation costs

- Track payment status

- Manage multiple currencies

- Remove manual processes

- Send money overseas to multiple suppliers

What we do

With Currency Solutions, you’ll get:

- Your own dedicated account manager

- Fast, easy and secure cross border payments

- The latest intelligence on currency risk management

- Competitive rates, plus no fees with transfers over £3k

Get your account number and IBAN in minutes

Open your business account today with no credit checks and no fees!

Get approved in minutes and start using your account right away.

Don't let traditional banking requirements hold you back.

Sign up now and experience the convenience of our business account!

- No setup fee

- No account fee's

- No credit checks

Benefits of our online international business account:

- A multi-currency account with 40+ major currencies and FX

- A dedicated Client Manager that understands your business and supports you

- Send & receive high-value business payments around the world

- Local IBANs in the UK, EU and US

All in one place

What we do

With Currency Solutions, you’ll get:

- Your own dedicated account manager

- Fast, easy and secure cross border payments

- The latest intelligence on currency risk management

- Competitive rates, plus no fees with transfers over £3k

How we can help

Open your business account today with no credit checks and no fees!

Get approved in minutes and start using your account right away.

Don't let traditional banking requirements hold you back.

Sign up now and experience the convenience of our business account!

- No setup fee

- No account fee's

- No credit checks

Benefits of a Currency Solutions Business Account

- Your own dedicated Client Manager

- Foreign exchange at competitive rates

- Local UK, EU and US IBANs in your company name

- Access 40+ currencies inc. USD, EUR, CNY & more

- Collect, send and exchange high-value payments in 190+ countries

- Reduced costs

- Track payment status

- Manage multiple currencies

- Automate processes

- Pay multiple suppliers overseas in local currencies instantly

What we do

With Currency Solutions, you’ll get:

- Your own dedicated account manager

- Fast, easy and secure cross border payments

- The latest intelligence on currency risk management

- Competitive rates, plus no fees with transfers over £3k

Get your account number and sort code in minutes

Open your business account today with no credit checks and no fees!

Get approved in minutes and start using your account right away.

Don't let traditional banking requirements hold you back.

Sign up now and experience the convenience of our business account!

- No setup fee

- No account fee's

- No credit checks

Benefits of a Currency Solutions Business Account

- Reduce reconciliation costs

- Track payment status

- Manage multiple currencies

- Automate processes

- Send and receive money overseas to multiple suppliers

What we do

With Currency Solutions, you’ll get:

- Your own dedicated account manager

- Fast, easy and secure cross border payments

- The latest intelligence on currency risk management

- Competitive rates, plus no fees with transfers over £3k

Fast and reliable FX & payment services for luxury purchases

It's no secret that international payments can be complex and expensive, with hidden fees and unexpected delays.

Brought to you in collaboration with Shmee150, Currency Solutions is your ultimate partner for hassle-free FX and payments. We've helped thousands of people buy and sell their dream cars, homes and luxury items internationally.

As a member of the Shmee150 community, you'll get:

- Bank-beating FX rates and preferential fees

- Access to 40+ currencies, including EUR, USD, GBP, INR, AED and more

- Fast and secure same-day international payments

- Superior, personalised service with our dedicated team of FX experts

Work with Shmee150's personal FX broker

Working with Currency Solutions means having your own, dedicated FX broker with proven industry expertise.

Steve Geoghegan is Shmee’s personal FX broker and an automobile expert who has brokered countless luxury car deals, including the coveted Ferrari 250 GTO, worth over £20 million.

Reach out to Steve today at s.geoghegan@currencysolutions.com or +447809143016 to discuss how he can support your payment needs.

What we do

With Currency Solutions, you’ll get:

- Your own dedicated account manager

- Fast, easy and secure cross border payments

- The latest intelligence on currency risk management

- Competitive rates, plus no fees with transfers over £3k

How we can help

Time consuming payment processes can hinder operational efficiencies and negatively affect profit margins. Manual implementation also increases human errors and erodes clarity on cash-flows, making it difficult to truly understand how best to manage FX risk to your corporate advantage.

- Outsource FX to a specialist provider

- Cut down on operational and admin costs

- Easily Send/Receive in local currency required

- Set target rate accordingly

- Take advantage of our hedging products

What we do

With Currency Solutions, you’ll get:

- Your own dedicated account manager

- Fast, easy and secure cross border payments

- The latest intelligence on currency risk management

- Competitive rates, plus no fees with transfers over £3k

How we can help

We can help you identify your currency risk and help you manage it with confidence. Allowing you to identify the real impact of FX volatility on your organisation as well as easily track payment status. We can prepare currency reports for you that can easily be shared with your Board.

- Understand more about your specific currency risk

- Learn how to manage currency risk

- Unify cross border workflows

- Access market-watch and insights on a 24/7 basis

What we do

With Currency Solutions, you’ll get:

- Your own dedicated account manager

- Fast, easy and secure cross border payments

- The latest intelligence on currency risk management

- Competitive rates, plus no fees with transfers over £3k

CUSTOMER BENEFIT

With our forward contractand hedging solutions, your customers can save money and mitigate currency volatility.

Our team has over 20 years’ experience in helping customers and providing personalised support.

Get paid locally to the UK, US and Europe with our multicurrency IBANs and easy-to-use online platform.

How we can help

Open your business account today with no credit checks and no fees!

Get approved in minutes and start using your account right away.

Don't let traditional banking requirements hold you back.

Sign up now and experience the convenience of our business account!

- No setup fee

- No account fee's

- No credit checks

Benefits of a Currency Solutions Business Account

- Reduce reconciliation costs

- Track payment status

- Manage multiple currencies

- Automate processes

- Send and receive money overseas to multiple suppliers

What we do

With Currency Solutions, you’ll get:

- Your own dedicated account manager

- Fast, easy and secure cross border payments

- The latest intelligence on currency risk management

- Competitive rates, plus no fees with transfers over £3k

JOIN OUR STRATEGIC PROGRAM

JOIN OUR AFFILIATE PROGRAM

WHAT CAN YOU PROMOTE?

Save on exchange rates in 40+ currencies by using Currency Solutions.

Lock in exchange rates for over 60 days as a risk mitigation strategy.

Get local IBANs in the UK, US and Europe to save money and time on international transactions.

PARTNER BENEFITS

Get paid for referring customers to Currency Solutions.

Help your customers save money on their foreign exchange and international transactions by using Currency Solution products.

As an approved Currency Solutions partner, we will treat your customers with care and priority.

As part of our collaboration, we’ll organise events, marketing collateral and campaigns to promote your brand.

HOW TO GET STARTED

Fill in our partner enquiry form to get started

Finalise your agreement with our dedicated partnerships team

Recommend us to your audience. We will provide all marketing materials

Receive competitive commission for the revenue your referral generates.

CUSTOMER FEEDBACK

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

We work with a leading steel broker to help them combat currency volatility. This recently resulted in a saving of $550k after our hedging solution helped them avoid a market fluctuation of 2.8%.

Help your audience access competitive foreign exchange rates and better, personalised service. If you have a blog, comparison or e-commerce site, we’ll offer commission payments for promoting Currency Solutions and give you all the marketing tools you’ll need to succeed.

Add value to your network or customer base by helping them save on foreign exchange and international payments. From forward contracts, to multicurrency accounts we`ve got them covered.

What we do

With Currency Solutions, you’ll get:

- Your own dedicated account manager

- Fast, easy and secure cross border payments

- The latest intelligence on currency risk management

- Competitive rates, plus no fees with transfers over £3k

We offer a range of FX products including spot contracts, market orders and forwards.

Our specialists will help you create a unique risk management strategy for your business.

Your payments will be fast and frictionless, and managed by a personal broker.

All major currencies are available via our online trading platform, and we offer UK, EU and US international business accounts

Simply register online here. Registration is easy and will take you less than two minutes.

Alternatively, give us a call on +44 (0)20 7740 0000 and we’ll be more than happy to help.

We support over 30 currencies including EUR, USD, GBP, AED. Our full list of supported currencies can be found here.

We accept payment by Visa and Mastercard debit cards, as well as bank transfer.

Payment limits may apply depending on your bank and payment method.

Unfortunately, we do not accept cash or cheques.

We will assign a dealer to you once you have registered, and they will be available to support with anything you need.

There is a £10 charge for all transfers under £3,000. All transfers over £3,000 are completely fee free.

We offer a range of products, not just transfers, such as forward contracts and risk management.

Opening an account with Currency Solutions is completely free, and you can contact us at any time to see how we might be able to help.

As soon as you open your account with Currency Solutions, you’ll be assigned your own personal account manager.

Working closely with your business, they will be able to advise the optimal time to make your transfer.

Our bank accounts charge no fees, and have no setup fees or credit checks.

A Currency Solutions bank account will also allow you to automate processes, manage multiple currencies at once, and easily send and receive money overseas.

We offer two convenient ways to make transfers, catering to all your needs:

1. Call us directly: No limits!

• Transfer any amount, no upper limit

• Personalised service for all transaction sizes

• Ideal for large or complex transfers

2. Use our online platform

• Business accounts: Up to £50,000 per transaction

• Personal accounts: Up to £20,000 per transaction

• Daily limit: Three transfers

Whether you prefer the convenience of our online system or need to move larger sums, we've got you covered. For any transfer amount beyond the online limits or for multiple daily transactions, our expert team is just a phone call away, ready to assist with unlimited transfer capabilities.

Give us a call on +44 (0)20 7740 0000.

Absolutely. Once you have opened your account, please contact your personal account manager, and they will walk you through the process.

We’ve been serving our clients since 2003, send over £1bn of payments every year, and have consistently maintained an ‘Excellent’ Trustpilot rating.

Our methods are simple – find solutions to the complex challenges our customers are facing, while making sure they’re getting the most out of their money.

You can find out more on our About page.

Open an account today

1

Register online

Opening your account takes minutes and is completely free.

2

Get a quote

Tell us which currency you’ve got and which currency you need.

3

Make a transfer

You can make a transfer over the phone or online. There will be no hidden fees, just competitive exchange rates.

Why Currency Solutions?

Streamline

Our systems streamline inefficient workflows and remove manual processes.

Open an account

Cut costs

Operational and admin costs can be expensive, as well as prone to error. We save you time and money.

Open an account

Stabilise

Currency management can be confusing – we make it simple and provide clear solutions to any kind of FX volatility.

Open an account

Our products

Spot contracts

Competitive FX rates with no hidden charges.

Forward contracts

Lock in fixed rates for the future to mitigate your risk.

Market orders

Target your preferred upper and lower rates and let us do the work.

Business options

Trusted, tailor-made solutions to protect your business.

CURRENCY EXCHANGE BUILT FOR YOU

- Over £1 billion in money transfers in 2023

- Free online trading platform and dedicated dealer

- Fast, easy and secure

- Excellent rates, and no fees with transfers over £3k

Our account managers put you at the heart of everything we do. Taking time to understand your needs, they watch the markets for you, offering guidance on fast, frictionless transfers

Our secure trading platform and global reach mean your payments are fast, accurate and frictionless. We take the worry out of Money transfers abroad

We transferred over a £billion in currency services in 2023. Our trading platform is fast easy and secure and we offer excellent rates and no transfer fees above £3K

Don’t just take our word for it, Our customers are very happy with our service and we have a 4.9 star trustpilot rating to reflect this

I understand the below will show the interbank rate

Help FAQs

Our story has been featured in

BENEFIT FROM GREATER FX SAVINGS, TODAY

Founded in 2003, we're experts at high-value, competitive currency exchange.

What our customers say

Send and receive same-day international payments

With our international payments network, you can send, receive and exchange money globally, faster. We process £1bn of payments every year.

Access 30+ currencies at competitive rates

Our easy-to-use online platform gives you access to 30+ currencies including GBP, USD, EUR, AED and more, all at competitive prices.

Experience personalised client service

Our mission is simple: we facilitate high-value transactions by giving you the award-winning service, rates and FX expertise you deserve.

ENJOY AWARD-WINNING SERVICE

Get started in three simple steps

1

Register online

Opening your account takes minutes and is completely free.

2

Get a quote

Tell us which currency you’ve got and which currency you need.

3

Make a transfer

You can make a transfer over the phone or online. There will be no hidden fees, just competitive exchange rates.

Supported payment methods

Visa Debit

MasterCard Debit

Bank Transfer

Convert money from one currency to another

We support SMEs of all structures and sizes, wherever in the world they do business.

Access 30+ currencies at competitive rates

Our easy-to-use online platform gives you access to 30+ currencies including GBP, USD, EUR, AED and more, all at competitive prices.

View and manage open and historical transactions

With a dedicated Client Manager and dedicated tech support team, help is never far away.

Save money and scale your business

Better service

Benefit from your own, dedicated Client Manager with proven FX expertise

Better Cost

We believe in highly competitive prices without compromising on service

Secure Payments

We’re FCA-regulated and process over £1bn a year for our clients

Personal transfers EEA

Buying a property or emigrating abroad? Need to send a large amount of money overseas? With Currency Solutions award-winning service you can:

- Over a £Billion in money transfers in 2023

- Free online trading platform and dedicated dealer

- Fast, easy and secure

- Excellent rates

Business transfers EEA

Overseas suppliers to pay? Earnings to transfer home? Import/export payments to manage? Our dedicated account managers can help you mitigate risk and protect your profit. We can offer:

- Your own dedicated portfolio manager

- Fast, easy and secure cross border payments

- Latest intelligence on currency risk management

- Excellent rates

OUR CUSTOMER SUCCESS STORIES

“We receive a first-class service. The Currency Solutions team have become an extension of our finance team.”

Lee, Founder at Poole Lighting Ltd.

How we can help

Medical procedures are nerve wracking, even more so when you are away from home. But you are not alone. According to government figures, the number of British patients having operations abroad increased from 48,000 in 2014 to 144,000 in 2017. Treatments range from dentistry and cosmetic surgery to large operations like hip replacements.

Our experience shows how important it is you do your research — from finding a healthcare provider to making suitable travel and accommodation arrangements.

We want our customers to feel in control of life’s big events. Our experienced team can find you the right international payment option and send your money safely, leaving you to focus on getting well.

Products and services customers found useful

Lock an exchange rate

With a forward contract (fixed or flexible) that you can use when and how you need it.

Send an international payment

Our easy 24/7 online trading platform will send your money securely.

CURRENCY EXCHANGE BUILT FOR YOU

- Over £1 billion in money transfers in 2023

- Free online trading platform and dedicated dealer

- Fast, easy and secure

- Excellent rates, and no fees with transfers over £3k

How we can help

Exciting times ahead but first the move. With a lot of moving parts, people and payments to organise, Currency Solutions wants to help you maximise your budget, especially when sending money overseas.

From our experience, most people are unaware of the impact currency fluctuations can have on their budget.

We can help. Not packing the boxes, unfortunately. But our specialist area can find you the best option when making an international currency transfer.

Products and services customers found useful

Lock an exchange rate

A forward contract (fixed or flexible) can give you confidence, assurance and stability.

Multiple and regular payments

Make multiple international payments easily and quickly with our online trading platform.

CURRENCY EXCHANGE BUILT FOR YOU

- Over £1 billion in money transfers in 2023

- Free online trading platform and dedicated dealer

- Fast, easy and secure

- Excellent rates, and no fees with transfers over £3k

How we can help

Buying goods from overseas has never been easier. What isn’t easy is constant currency fluctuations. Don’t worry. We are here to help.

Whether you’re buying a yacht, vintage wine or a piece of jewellery we can guide you on the right time to make your currency exchange, send your international payment, and hopefully save you some money in the process. Perhaps for that next luxury item?

Start by opening a Currency Solutions account and your dedicated broker will help you pick the right option.

Products and services customers found useful

Fast payment

We quickly get your money to its destination using Faster Payments, SEPA (Europe only) or SWIFT.

Lock an exchange rate

A forward contract (fixed or flexible) can give you confidence, assurance and stability.

CURRENCY EXCHANGE BUILT FOR YOU

- Over £1 billion in money transfers in 2023

- Free online trading platform and dedicated dealer

- Fast, easy and secure

- Excellent rates, and no fees with transfers over £3k

How we can help

Currency Solutions wants to help you maximise your hard earned cash when sending money back home to friends and loved ones. We handle all major currencies and send money to 38 countries.

Most people are unaware or have the insider knowledge on how to manage the impact currency fluctuations can have on their money. We are here to help.

Speak to one of our specialists who will help you find the right option for your international payment.

Products and services customers find useful

Lock an exchange rate

A forward contract (fixed or flexible) can give you confidence, assurance and stability.

Multiple and regular payments

Make multiple international payments easily and quickly with our online trading platform.

CURRENCY EXCHANGE BUILT FOR YOU

- Over £1 billion in money transfers in 2023

- Free online trading platform and dedicated dealer

- Fast, easy and secure

- Excellent rates, and no fees with transfers over £3k

How we can help

Many of our customers use us for regular international payments. Ideal for overseas mortgage payments, pensions or general living expenses. A regular payment plan locks in a rate you like and reduces admin by making sure international payments are sent fast and securely.

Plans can be fixed for up to 24 months. It’s easy to do. And it will help you budget more effectively — as you won’t need to continuously monitor the exchange rate. The amount you receive will be fixed.

Speak to one of our dedicated dealers who can help you set up the right plan.

Products and services customers found useful

Regular payments

Secure a rate you like with a forward contract (Fixed or Flexible) that you can use when and how you need too.

Online Trading platform

Our easy 24/7 online trading platform will send your money securely.

CURRENCY EXCHANGE BUILT FOR YOU

- Over £1 billion in money transfers in 2023

- Free online trading platform and dedicated dealer

- Fast, easy and secure

- Excellent rates, and no fees with transfers over £3k

How we can help

There’s a lot to consider when buying property overseas. When you find the perfect home you need to handle solicitors, new rules and institutions — and very often in a different language. Stressful.

Important piece of advice: most people are unaware of the impact currency fluctuations can have on their budget.

Our mission is to put people ahead by helping our customers maximise their budget.

So while we can’t pack the boxes, our specialist team can support your international currency transfer, putting you in control.

Products and services customers found useful

Large currency transfers

We can help you fix a rate to take away the stresses of currency rate movements and we will send your money securely.

Multiple and regular payments

Make multiple international payments easily and quickly with our online trading platform for all those tricky day to day reoccurring payments.

CURRENCY EXCHANGE BUILT FOR YOU

- Over £1 billion in money transfers in 2023

- Free online trading platform and dedicated dealer

- Fast, easy and secure

- Excellent rates, and no fees with transfers over £3k

GBP TO NZD CURRENCY CONVERTER TOOL

The rate on this form is not available to individuals or business customers. This converter is based on the Interbank rate - this is used by banks to sell currency to each other and can indicate how the market is currently performing.

I understand the below will show the interbank rate

USD United States Dollar

GBP Great British Pound

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

USD United States Dollar

EUR Euro

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

GBP TO SOUTH AFRICAN RAND CURRENCY CONVERTER TOOL

The rate on this form is not available to individuals or business customers. This converter is based on the Interbank rate - this is used by banks to sell currency to each other and can indicate how the market is currently performing.

I understand the below will show the interbank rate

USD United States Dollar

GBP Great British Pound

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

USD United States Dollar

EUR Euro

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

USD TO EUR CURRENCY CONVERTER TOOL

The rate on this form is not available to individuals or business customers. This converter is based on the Interbank rate - this is used by banks to sell currency to each other and can indicate how the market is currently performing.

I understand the below will show the interbank rate

USD United States Dollar

GBP Great British Pound

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

USD United States Dollar

EUR Euro

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

GBP TO AUD CURRENCY CONVERTER TOOL

The rate on this form is not available to individuals or business customers. This converter is based on the Interbank rate - this is used by banks to sell currency to each other and can indicate how the market is currently performing.

I understand the below will show the interbank rate

USD United States Dollar

GBP Great British Pound

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

USD United States Dollar

EUR Euro

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

USD TO GBP CURRENCY CONVERTER TOOL

The rate on this form is not available to individuals or business customers. This converter is based on the Interbank rate - this is used by banks to sell currency to each other and can indicate how the market is currently performing.

I understand the below will show the interbank rate

USD United States Dollar

GBP Great British Pound

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

USD United States Dollar

EUR Euro

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

GBP TO USD CURRENCY CONVERTER TOOL

The rate on this form is not available to individuals or business customers. This converter is based on the Interbank rate - this is used by banks to sell currency to each other and can indicate how the market is currently performing.

I understand the below will show the interbank rate

USD United States Dollar

GBP Great British Pound

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

USD United States Dollar

EUR Euro

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

EUR TO GBP CURRENCY CONVERTER TOOL

The rate on this form is not available to individuals or business customers. This converter is based on the Interbank rate - this is used by banks to sell currency to each other and can indicate how the market is currently performing.

I understand the below will show the interbank rate

USD United States Dollar

GBP Great British Pound

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

USD United States Dollar

EUR Euro

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

Get Started

Opening an account with Currency Solutions is completely free and you’ll be able to make currency transfers anytime at our excellent exchange rates.

We appreciate that navigating the currency market can be daunting! So, a dedicated account manager will always be on hand to offer guidance.

GBP TO EUR CURRENCY CONVERTER TOOL

The rate on this form is not available to individuals or business customers. This converter is based on the Interbank rate - this is used by banks to sell currency to each other and can indicate how the market is currently performing.

I understand the below will show the interbank rate

USD United States Dollar

GBP Great British Pound

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

USD United States Dollar

EUR Euro

JPY Japanese Yen

AUD Australian Dollar

CAD Canadian Dollar

BHD Bahraini Dinar

BBD Barbadian Dollar

BGN Bulgarian Lev

CNY Chinese Yuan

HRK Croatian Kuna

DKK Danish Krone

HKD Hong Kong Dollar

HUF Hungarian Forint

ILS Israeli Shekel

KWD Kuwaiti Dinar

MXN Mexican Peso

MAD Moroccan Dirham

NZD New Zealand Dollar

NOK Norwegian Krone

OMR Omani Rial

PLN Polish Zloty

QAR Qatari Riyal

RON Romanian Leu

SAR Saudi Riyal

SGD Singapore Dollar

ZAR South African Rand

SEK Swedish Krona

CHF Swiss Franc

THB Thai Baht

TND Tunisian Dinar

AED United Arab Emirates Dirham

Why Currency Solutions?

Our bank accounts charge no fees, and have no setup fees or credit checks.

A Currency Solutions bank account will also allow you to automate processes, manage multiple currencies at once, and easily send and receive money overseas.

There is a £10 charge for all transfers under £3,000. All transfers over £3,000 are completely fee free.

We offer a range of products, not just transfers, such as forward contracts and risk management.

Opening an account with Currency Solutions is completely free, and you can contact us at any time to see how we might be able to help.

As soon as you open your account with Currency Solutions, you’ll be assigned your own personal account manager.

Working closely with your business, they will be able to advise the optimal time to make your transfer.

We offer two convenient ways to make transfers, catering to all your needs:

1. Call us directly: No limits!

• Transfer any amount, no upper limit

• Personalised service for all transaction sizes

• Ideal for large or complex transfers

2. Use our online platform

• Business accounts: Up to £50,000 per transaction

• Personal accounts: Up to £20,000 per transaction

• Daily limit: Three transfers

Whether you prefer the convenience of our online system or need to move larger sums, we've got you covered. For any transfer amount beyond the online limits or for multiple daily transactions, our expert team is just a phone call away, ready to assist with unlimited transfer capabilities.

Give us a call on +44 (0)20 7740 0000.

Simply register online here. Registration is easy and will take you less than two minutes.

Alternatively, give us a call on +44 (0)20 7740 0000 and we’ll be more than happy to help.

We accept payment by Visa and Mastercard debit cards, as well as bank transfer.

Payment limits may apply depending on your bank and payment method.

Unfortunately, we do not accept cash or cheques.

We charge a £10 fee for all transfers under £3,000. Any transfer over £3,000 has no fees.

We support over 30 currencies including EUR, USD, GBP, AED. Our full list of supported currencies can be found here.

Product features

Currency services

We handled over £1 billion of transfers in the last 2 years

Competitive rates

Bank-beating* exchange rates and no fees on transfers over £3,000

Dedicated dealer

Transfer over the phone with a dedicated currency expert

Secure service

Access your account any time with our secure online platform

Personal transfers

Buying a property or emigrating abroad? Need to send a large amount of money overseas? With Currency Solutions award-winning service you can:

- Over a £Billion in money transfers in 2023

- Free online trading platform and dedicated dealer

- Fast, easy and secure

- Excellent rates, and no fees with transfers over £3k

Business transfers

Overseas suppliers to pay? Earnings to transfer home? Import/export payments to manage? Our dedicated account managers can help you mitigate risk and protect your profit. We can offer:

- Your own dedicated portfolio manager

- Fast, easy and secure cross border payments

- Latest intelligence on currency risk management

- Excellent rates, and no fees with transfers over £3k

A SERVICE THAT’S BUILT AROUND YOU

- Your own dedicated partnership manager

- Excellent rates, and no fees with transfers over £3k

- The latest insight on how to respond to currency fluctuations

- Sector specialism: Real estate, Law firms, Accountants, Pet migration, Repatriation

You will be able to offer a comprehensive range of FX products such as spots and forward contracts to your clients. In some cases, we’ve found savings of up to 4%.

Our 24/7 secure online trading platform puts you and your clients in control of their currency transfers and ensures payments are fast and frictionless.

No business is the same. That’s why your dedicated partnership manager takes the time to set you up correctly and provide ongoing mentorship so you get the maximum benefit.

We are known for our excellent customer service — phone and online. We can support any sale and provide marketing collateral to give clients reassurance. It’s easy to track your referrals and you get paid each time a trade is made.

Payment methods

Visa Debit

MasterCard Debit

Bank Transfer

Checklist for Sending Money to Spain

- Name of the recipient

- Recipient’s IBAN, and their BIC or SWIFT code

- Transfer amount and the currency the money should be received in

- Reason for the transfer

Checklist for Sending Money to Australia

- Name of the recipient

- Recipient’s IBAN, and their BIC or SWIFT code

- Transfer amount and the currency the money should be received in

- Reason for the transfer

Checklist for Sending Money to France

- Name of the recipient

- Recipient’s IBAN, and their BIC or SWIFT code

- Transfer amount and the currency the money should be received in

- Reason for the transfer

Checklist for Sending Money to Ireland

- Name of the recipient

- Recipient’s IBAN, and their BIC or SWIFT code

- Transfer amount and the currency the money should be received in

- Reason for the transfer

Checklist for Sending Money to New Zealand

- Name of the recipient

- Recipient’s bank account number, BIC or SWIFT code

- Transfer amount and the currency the money should be received in

- Reason for the transfer

Checklist for Sending Money to the USA

- Name of the recipient

- Recipient’s bank account number, and their BIC or SWIFT code

- Transfer amount and the currency the money should be received in

- Reason for the transfer

Checklist for sending money to South Africa

- Name of the recipient

- Recipient’s bank account number, and their BIC or SWIFT code

- Transfer amount and the currency the money should be received in

- Reason for the transfer

Checklist for sending money to Poland

- Name of the recipient

- Recipient’s IBAN, and their BIC or SWIFT code

- Transfer amount and the currency the money should be received in

- Reason for the transfer

International Currency Transfers explained

- Register online It’s free to open an account. No strings attached.

- Get approved We might ask you for proof of identification.

- Receive a quote Enter a few details for an instant quote.

- Book your transfer No hidden fees and free transfers above £3k.

- Settle up Add your beneficiary details and send us your funds. Job done.

Need To Send Money Overseas?

Making an international mortgage payment? Or exchanging your pension from Pounds to Euros or Dollars?

Currency Solutions is a leading UK money transfer company. We specialise in finding an FX solution with the compelling combination of a free online trading platform and a dedicated account manager.

Let our experts do the hard work for you.

Fast, easy & secure currency transfers

Making any currency transfer, such as receiving or sending money abroad, can be daunting. At Currency Solutions, you will have a dedicated personal broker to support you throughout the process.

We want our customers to have complete peace of mind that their currency transfer is delivered quickly and securely.

We are authorised and regulated by the Financial Conduct Authority (FCA).

Manage your money transfers

We’ll keep you updated on your money transfers, you’ll get an email when:

- You've booked your transfer

- You add a beneficiary

- We receive your funds

- We send the money to the beneficiary

You can manage your transfer through our online platform, or you can speak with an account manager.

Simple Process With Real People On Call

Making international money transfers can be daunting and time-consuming.

Start by getting a free quote and one of our brokers will contact you to find a bespoke foreign exchange solution.

Opening your personal account normally takes less than 2 minutes from start to finish and our team are at hand to answer any questions you may have.

Our experienced money transfer broker will find you a great rate and support you at every stage making the whole process stress-free.

Success Is Happy Customers

“Thank you for making it an easy process!! CS. Given that transferring large amounts of money isn't something that the average householder does on a daily basis, you need to have confidence and trust in the people you are dealing with from the very start. The staff from receptionist, dealers and the accounts etc. immediately give you that feeling of trust and that must be one of the most important aspects when dealing with money matters. Well done to all concerned at Currency Solutions!! ” -- Happy Customer Since 2008

Rated 4.9 on trustpilot

Need to make large currency transfers?

Buying a property abroad? Or need to send a large amount of money overseas? Don't get hit with high rates or hidden fees; make your time and money count. For foreign exchange transfers, it's crucial to find a reliable service.

Currency Solutions, a currency transfer expert, specialising in forex money transfers. We don't believe in a one-size-fits-all approach. That's why customers are assigned an experienced foreign currency broker to deliver the right currency solutions for them.

A service that’s built around you

undefined

Solutions designed to deliver real value to your business

undefined

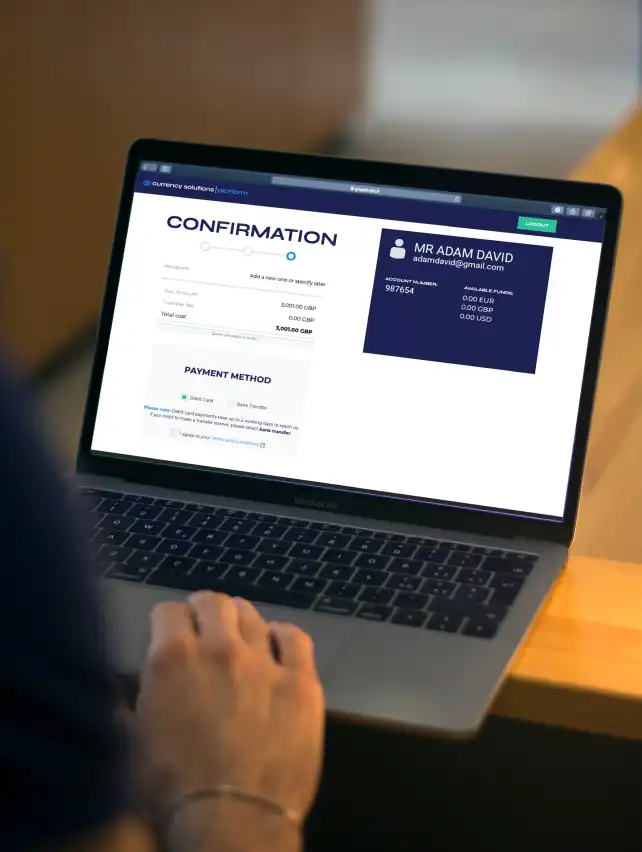

Making your transfer with Currency Solutions

At Currency Solutions, we know that your investments matter. That’s why we’re here to support you in all aspects of foreign currency exchange, whether you’re buying property, or investing abroad.

Whatever your situation, we will support you through the complex currency markets to ensure that you are maximizing your investments.

We understand that these are big decisions - so with us, you can always speak to someone.

With our award winning service, you can be secure in knowing that you’ll get the most out of your hard earned savings.